CBIC has imposed AIDC on entries falling under 7112, 7113 and 7118 i.e. Spent Catalyst or Ash Containing Precious Metals, Gold or Silver Findings and Coins of precious metals via issuing Notification.

Reetu | Jan 23, 2024 |

CBIC imposes AIDC on entities like Precious Metals, Gold and Silver

The Central Board of Indirect Taxes and Custom (CBIC) has imposed Additional Duty on Customs (AIDC) on entries falling under 7112, 7113 and 7118 i.e. Spent Catalyst or Ash Containing Precious Metals, Gold or Silver Findings and Coins of precious metals via issuing Notification.

The Notification Read as Follows:

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), read with section 124 of the Finance Act, 2021 (13 of 2021), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 11/2021 – Customs, dated the 1st February 2021, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 69(E), dated the 1st February 2021.

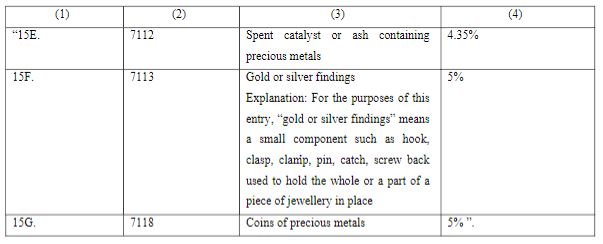

In the said notification, in the Table, after Sl. No. 15D and the entries relating thereto, the following Sl. Nos. and entries shall be inserted, namely:-

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"