Reetu | Feb 27, 2024 |

CA Exam May/June 2024: Applicable BOS Publication for New Scheme

The Institute of Chartered Accountants of India (ICAI) developed the New Scheme of Education and Training in accordance with International Education Standards and the National Education Policy, 2020 (NEP), after taking into account feedback from various stakeholders.

The New Scheme of Education and Training was notified in the Gazette of India on June 22, 2023, and took effect on July 1, 2023.

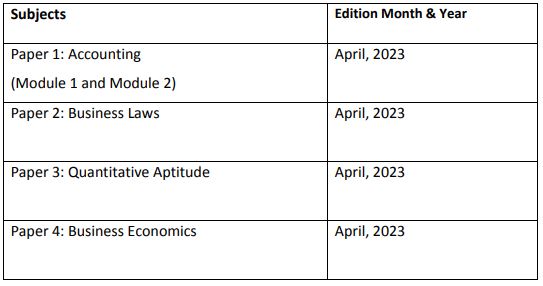

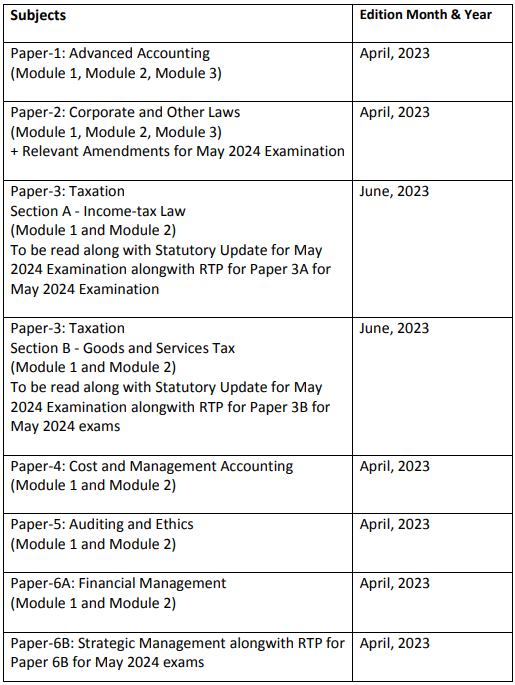

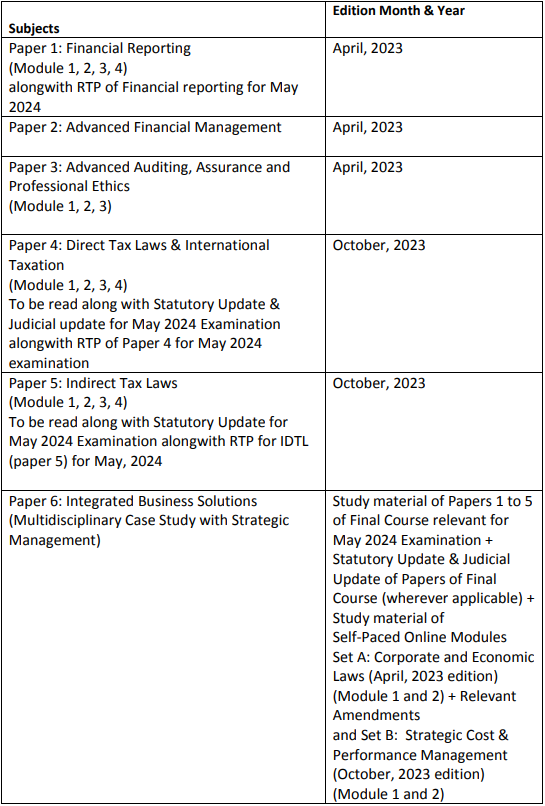

ICAI has released the applicable BoS Publication for the CA Foundation, Intermediate and Final Course May/ June 2024 Examination (New Scheme).

The Details of Applicable BoS Publication are as follows:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"