CA Pratibha Goyal | Jan 8, 2025 |

GST Department files for Review Petition before the Hon’ble Supreme Court in matter of Safari Retreats

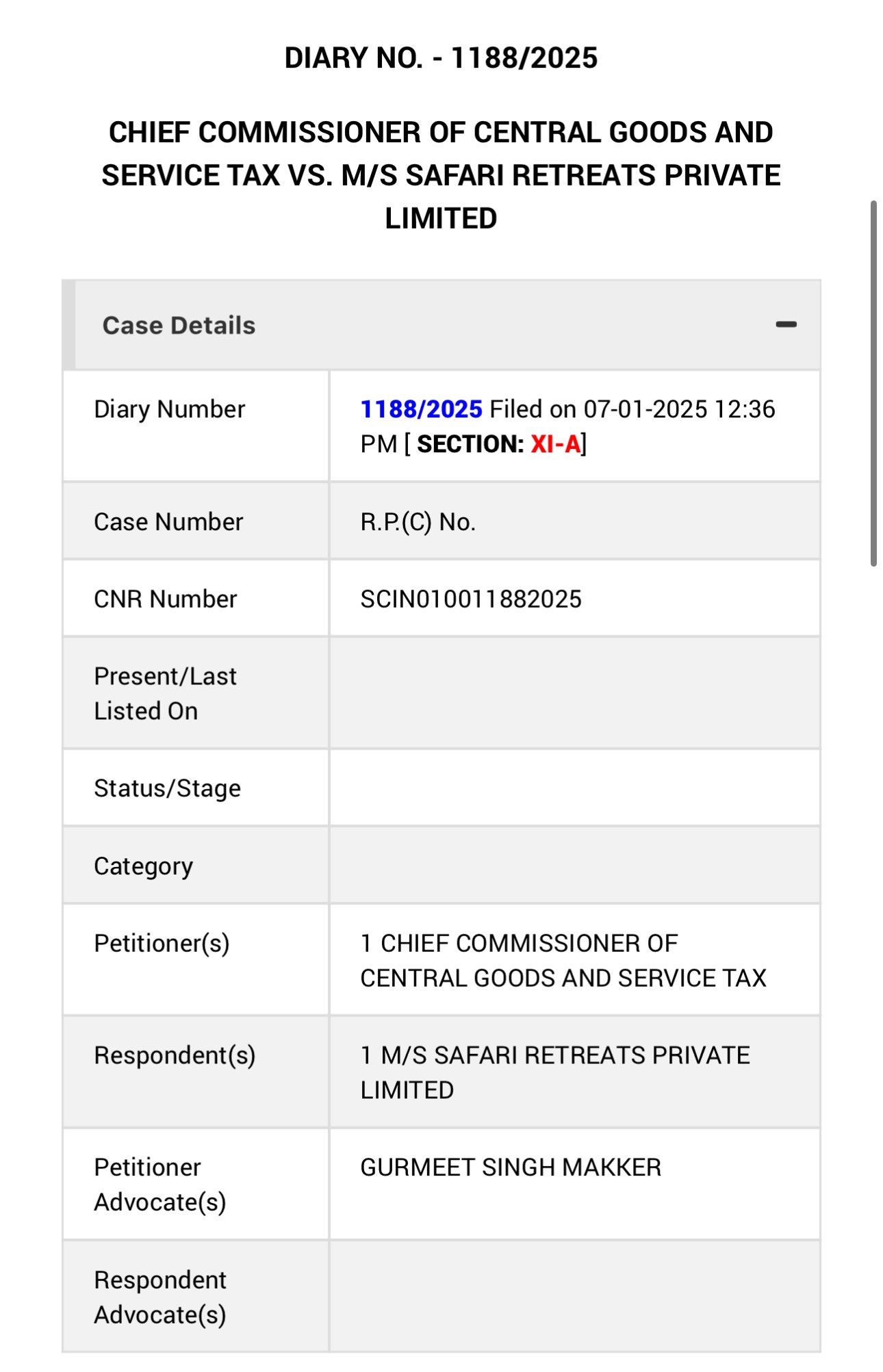

In the matter of Chief Commissioner of Central Goods and Service Tax vs. M/s Safari Retreats Private Limited, the revenue department has filed a Review Petition before the Hon’ble Supreme Court.

The Hon’ble Supreme Court in the matter of Central Goods and Service Tax vs. M/s Safari Retreats Private Limited, gave a landmark ruling by permitting input tax credit (ITC) on construction expenses for buildings meant to be leased/rented.

Retrospective Amendment:

GST Council in 55th GST Meeting, recommended to align the provisions of section 17(5)(d) of CGST Act, 2017 with the intent of the said section. The Council has recommended amending section 17(5)(d) of CGST Act, 2017, to replace the phrase “plant or machinery” with “plant and machinery”, retrospectively, with effect from 01.07.2017, so that the said phrase may be interpreted as per the Explanation at the end of section 17 of CGST Act, 2017.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"