CA Pratibha Goyal | Jan 8, 2025 |

GST Penalty of 20K even if Tax Payable is Zero: Know the whole Story

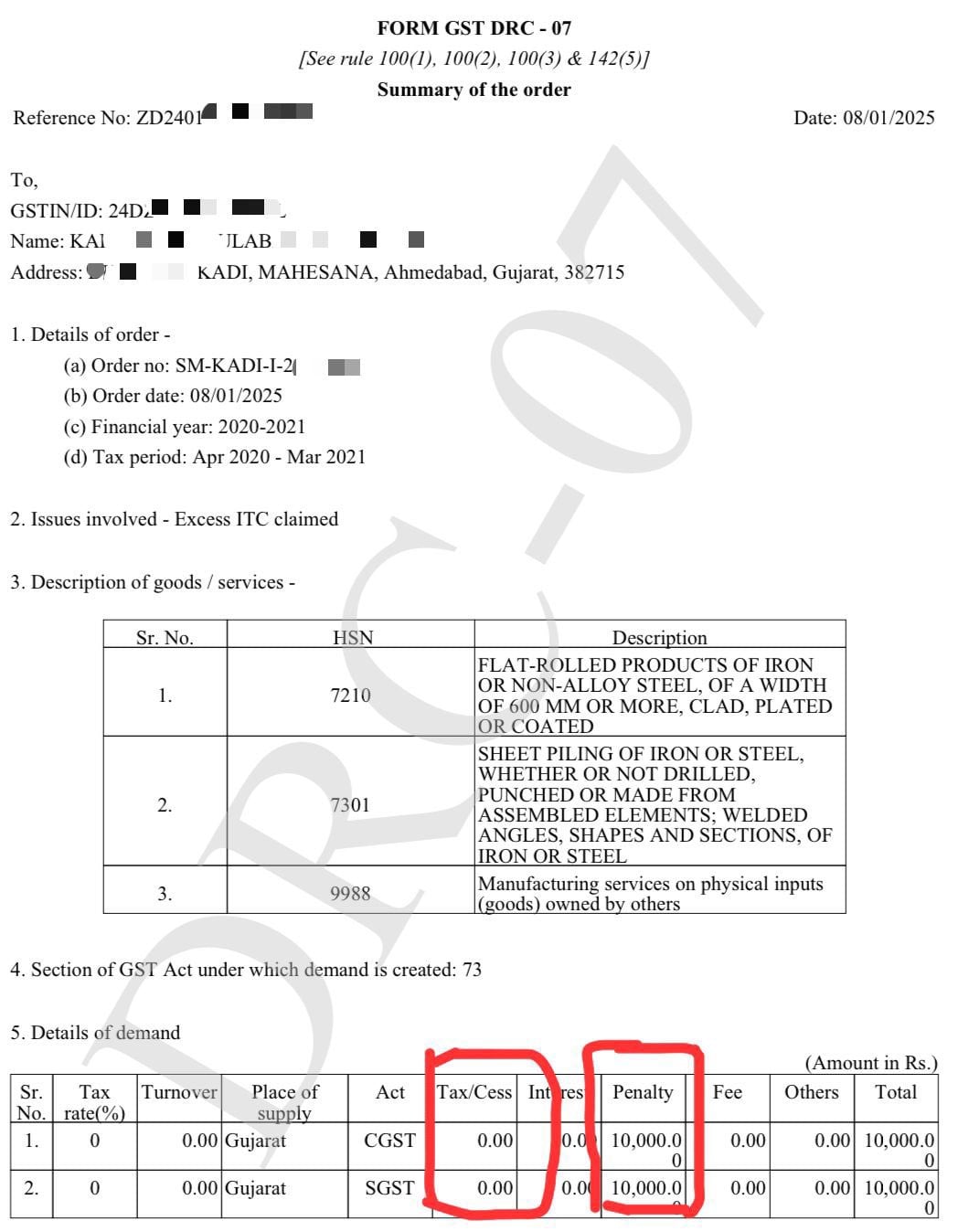

One trader in Ahmedabad has received a GST Notice for a Penalty of Rs. 20,000 even when Tax and Interest Payable is Zero. The Notice is issued under section 73 and reason for issuance of Notice is Excess ITC claimed.

The copy of Notice is given below:

Can GST Officer Levy such penalty?

As per Section 73 of the CGST Act, The proper officer can levy a penalty equivalent to 10% of tax or ten thousand rupees, whichever is higher. This means The Act gives power to GST Officer to levy a minimum penalty of Rs. 10,000 under the CGST Act. The same amount of penalty will be levied in respective SGST Act as well.

Section 73 deals with the Determination of tax [pertaining to the period up to Financial Year 2023-24] not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason other than fraud or any willful-misstatement or suppression of facts.

From Financial Year 2024-25, Section 74A will be the section for the Determination of Tax Demands. This section also advocates a minimum penalty of ten thousand rupees even if tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised for any reason, other than the reason of fraud or any wilful-misstatement or suppression of facts to evade tax.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"