Many taxpayers have received Intimations from Tax Department for non-disclosure of income from VDA. Here is what you can do.

Nidhi | Jun 9, 2025 |

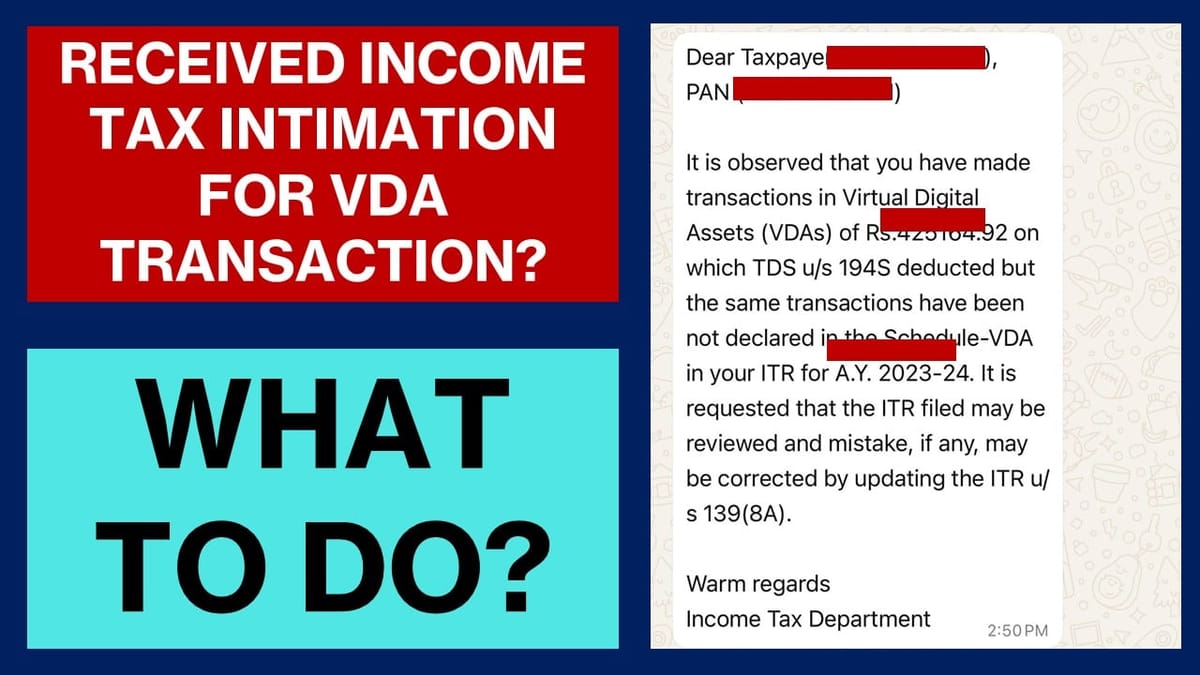

Income Tax Department Sending Bulk Notices for Crypto Transactions

The Income Tax Department, after tightening scrutiny on political donations & House Rent Allowance (HRA) claims is now issuing bulk Income Tax Intimations for non-disclosure of income from Virtual Digital Assets (VDA).

Received Income Tax Intimation for Crypto Transactions, What can you do?

The Income Tax Department can send you notices in the following situations:

Here are the different types of income tax notices under various sections that the income tax department may issue you:

Here is what you should do when you receive an income tax notice.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"