Nidhi | Jun 13, 2025 |

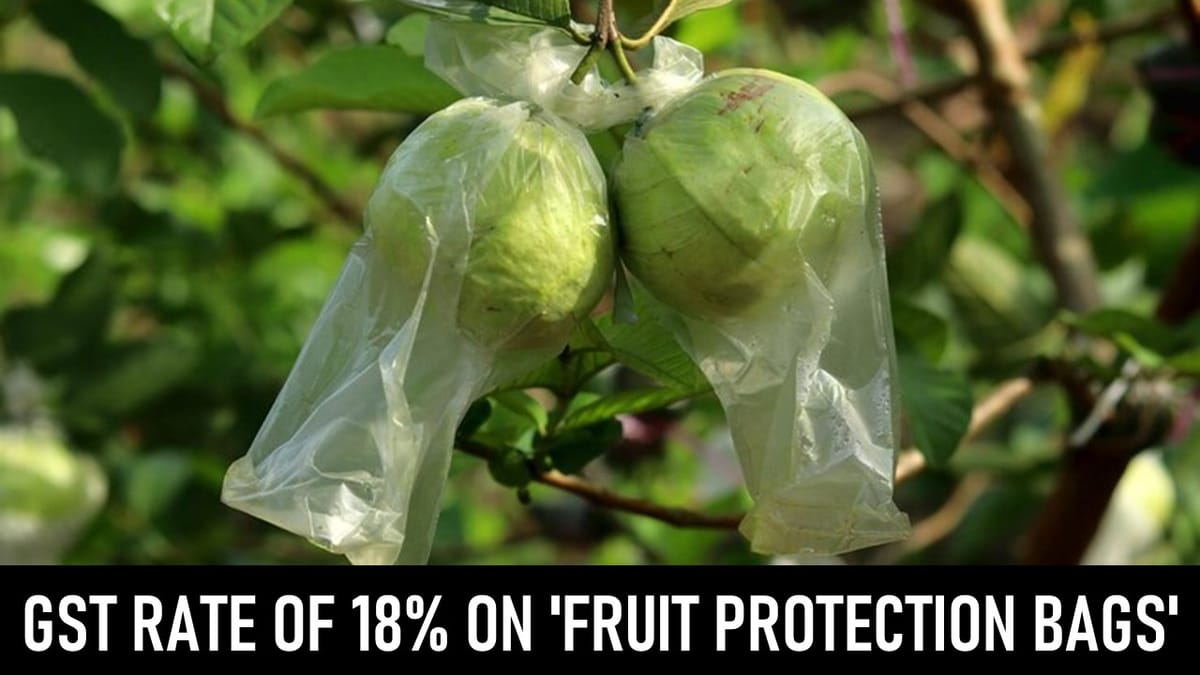

GST Rate of 18% on ‘Fruit Protection Bags’ Made From Kraft Paper: AAR

M/S K R Innovation, the applicant, is a partnership firm that manufactures and sells ‘Fruit Protection Bags‘. This product is made of kraft paper, white or coloured MG poster paper. These bags are made out of Coated paper, glued with synthetic adhesive and Galvanised MS wire is also attached for fastening. The product is primarily used as a protective covering for fruits before harvest.

The applicant submitted an application under section 97 of the CGST Act, 2017, and the Maharashtra Goods and Services Tax Act, 2017, to seek an advance ruling regarding the following questions:

“1. What shall be the classification of the product based on its HSN?

2. What shall be the tax rate to be levied on the product?”

As per the Maharashtra Authority for Advance Ruling (MAAR)

1. The product ‘Fruit Protection Bags‘ would be categorised under 48194000.

2. The GST rate applicable on this product would be 18% (9% CGST + 9% SGST).

For More information, refer to the Advance Ruling.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"