ITR-5 Excel Utility for AY 2025-26 is now live, enabling LLPs, firms, societies, and other eligible entities to file their income tax returns.

Saloni Kumari | Aug 11, 2025 |

ITR-5 Excel Utility for AY 2025-26 Released: LLPs, Firms, and Societies Can Now File Returns

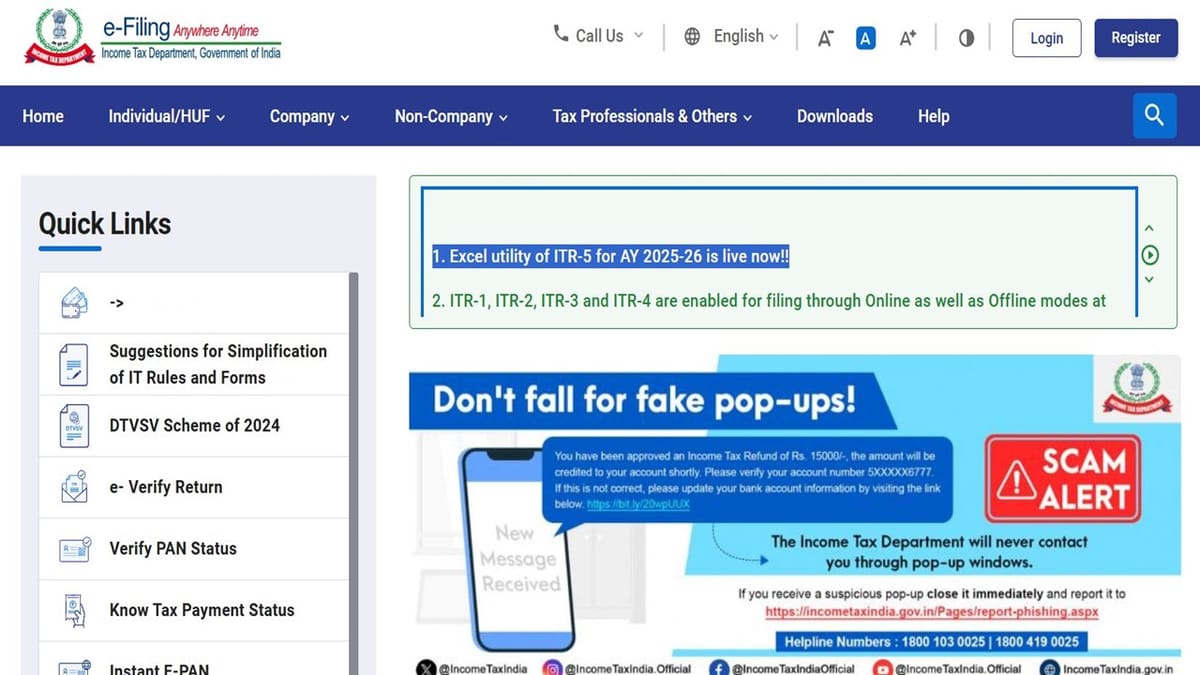

The Income Tax Department has released the Excel utility for Income Tax Return (ITR)-5 for the assessment year 2024-25. Partnership firms, Limited Liability Partnerships (LLPs), and cooperative societies can use this Excel utility to file their annual returns.

These ITR-5 Excel Utilities were released on August 09, 2025. The Income Tax Department also made the announcement officially on the platform ‘X’, “Kind Attention Taxpayers! The Excel Utility of ITR-5 is live now and is available for filing.”

Kind Attention Taxpayers!

Excel Utility of ITR-5 is live now and is available for filing.visit: https://t.co/uv6KQUbpQX pic.twitter.com/gNUbDDUlea

— Income Tax India (@IncomeTaxIndia) August 9, 2025

The ITR-5 form is a specific form used by firms, Limited Liability Partnerships (LLPs), Associations of Persons (AOPs), Bodies of Individuals (BOIs), and even Artificial Judicial Persons (AJP) to file their income tax return (ITR). ITR-5 is the Income Tax Return form used in India by specific entities not eligible to file ITR-7 and not filing ITR-1 to ITR-4.

The following categories are eligible to file ITR-5:

The Income Tax Department has already released Excel utilities for ITR-1, ITR-2, ITR-3 and ITR-4 for AY 2025-26 (FY 2024-25). Excel utilities for ITR‑1 (Sahaj) and ITR‑4 (Sugam) were released on May 30, 2025, with the latest update on July 02, 2025, and those for ITR‑2 and ITR‑3 on July 11, 2025.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"