Section 134 of the Companies Act, 2013 mandates the preparation and approval of the Board’s Report, inclusion of disclosures as prescribed in Rules, authentication by directors, and filing in Form AOC-4.

shashank kothiyal | Aug 26, 2025 |

Extract of Board’s Report: Comprehensive Format, Mandatory Disclosures & MCA Compliance

1. Introduction

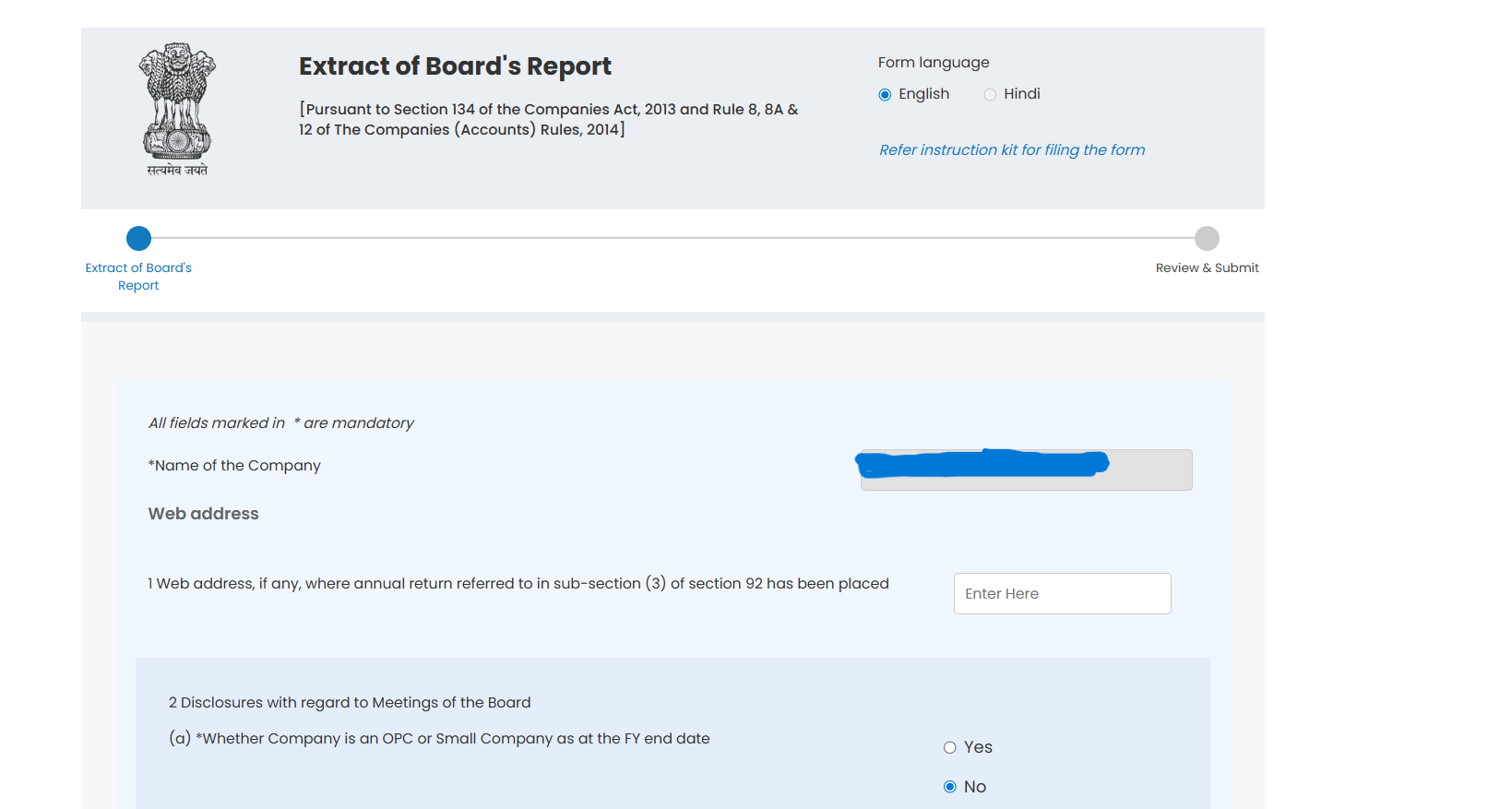

With the Ministry of Corporate Affairs (MCA) moving toward structured digital filings, companies are now required to furnish structured extracts of the Board’s Report in Form AOC-4. This extract is not just a summary, but a digitised and compliance-sensitive filing format aligned with Section 134 of the Companies Act, 2013, and Rules 8, 8A, and 12 of the Companies (Accounts) Rules, 2014.

Under MCA V3, these disclosures are tagged and standardised, and interlink seamlessly with the Director’s Report section in Form AOC-4 (and AOC-4 XBRL wherever applicable).

2. Legal Framework

Section 134 of the Companies Act, 2013 mandates the preparation and approval of the Board’s Report, inclusion of disclosures as prescribed in Rules, authentication by directors, and filing in Form AOC-4.

3. Interlinking with AOC-4: e-Director’s Report Format

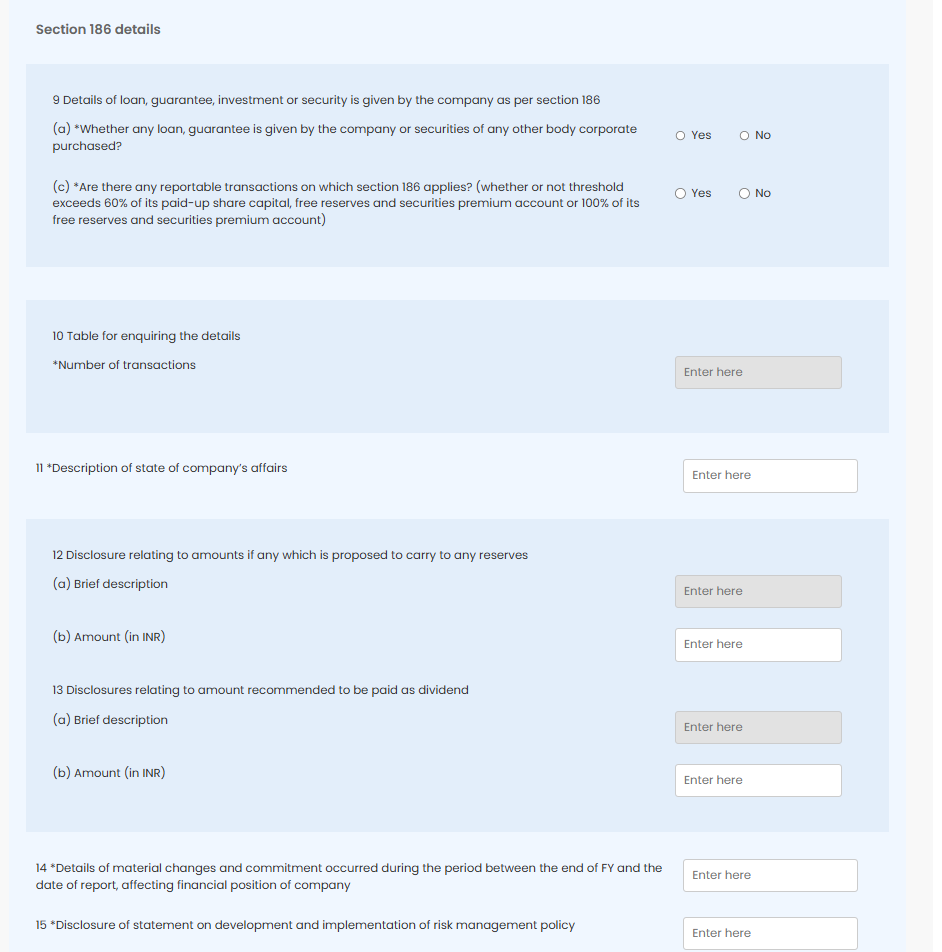

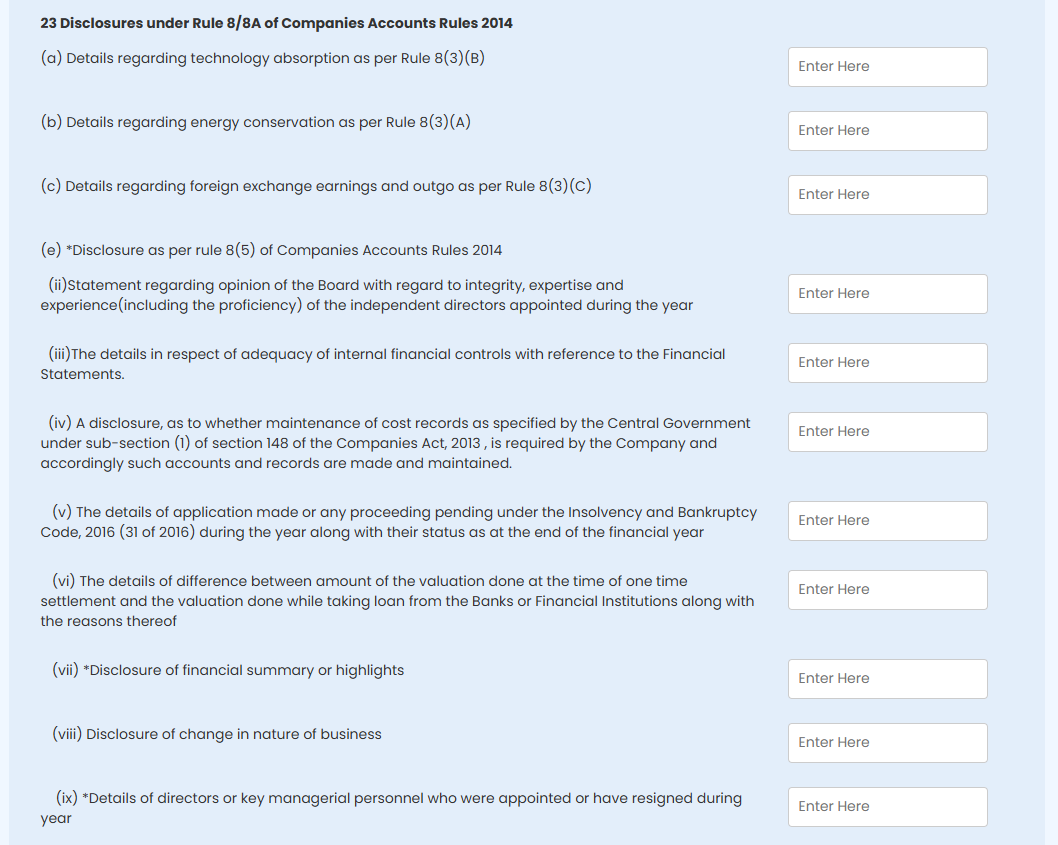

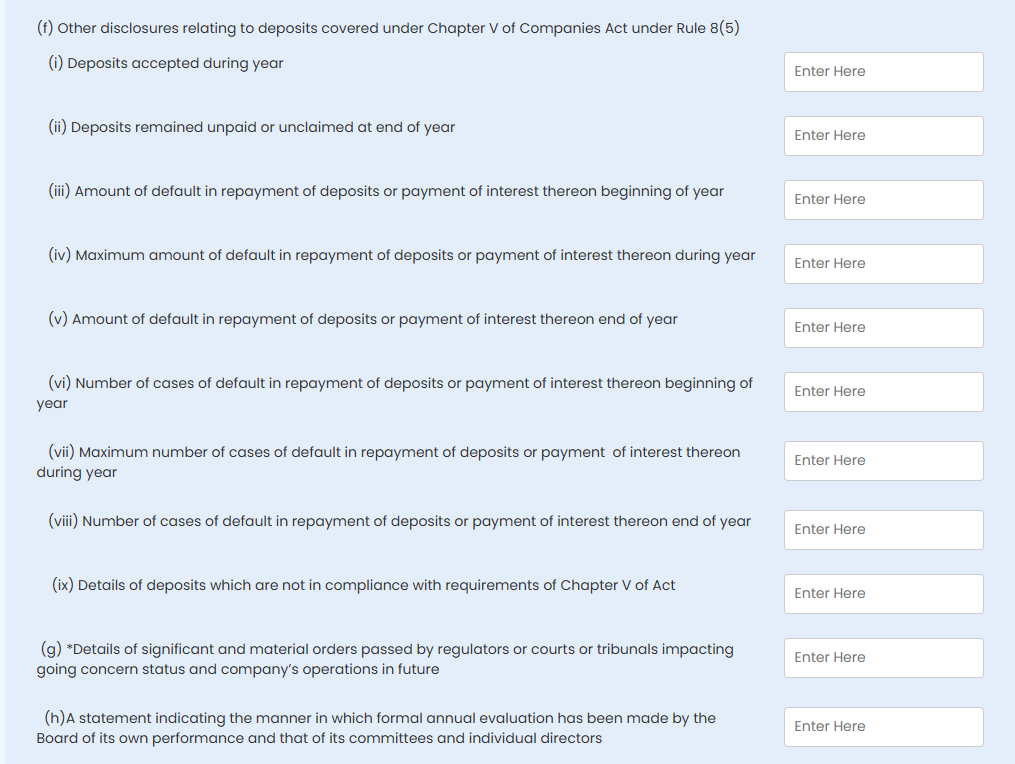

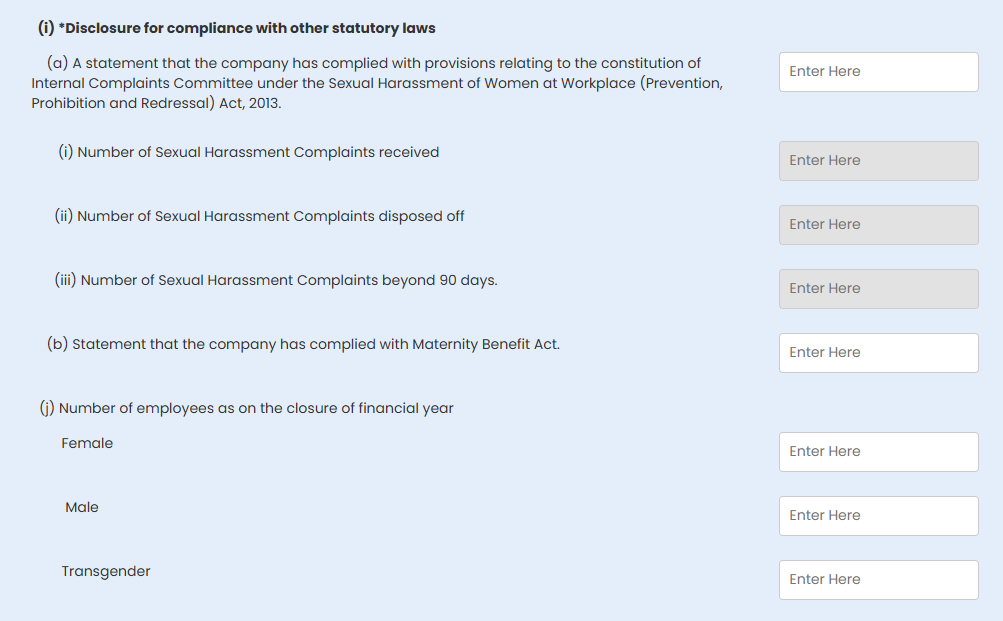

MCA’s e-filing portal now requires companies to fill specific fields for “Extract of Board’s Report” when submitting Form AOC-4. These fields are standardised, follow a point-based system as per MCA’s schema, and require structured input to ensure consistency.

4. Detailed Clauses of Extract of Board’s Report (As per MCA Format)

S.No. | Disclosure Point | Mapped in AOC-4 (e-Director’s Report) |

1 | Financial Summary | Point 23(e)(viii) |

| 2 | State of Affairs / Highlights | Point 11, 23(e)(viii), 23(e)(xxi) |

3 | Web Link of Annual Return | Point 1 |

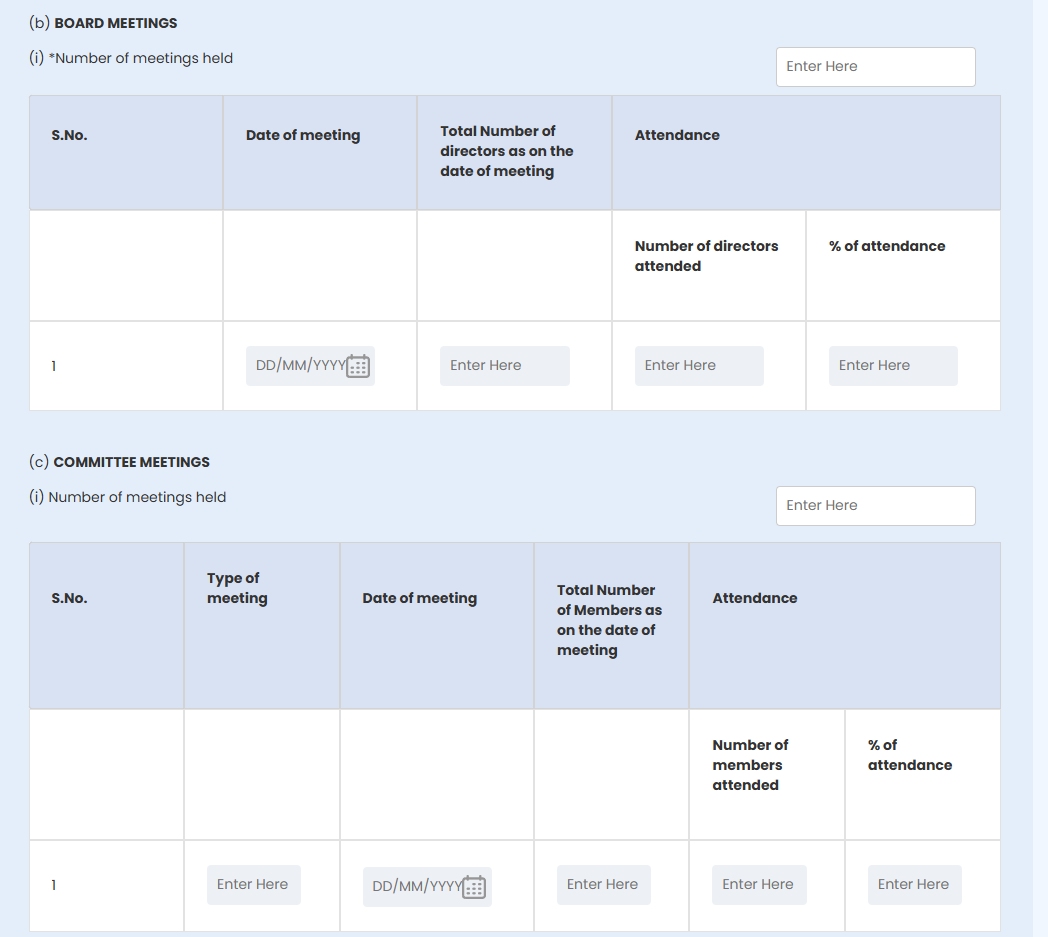

| 4 | Meetings of Board of Directors | Point 2 |

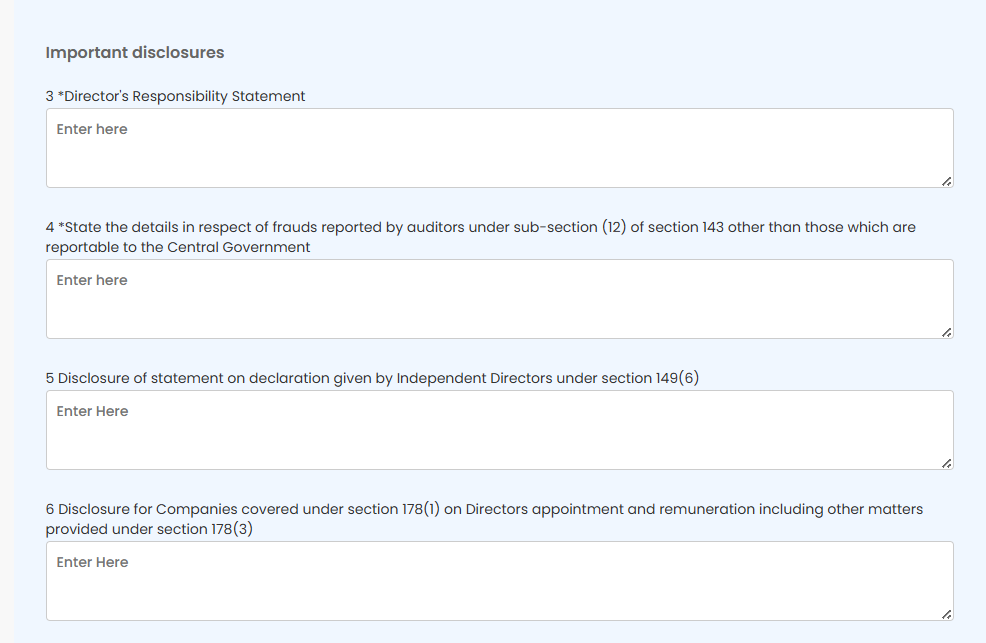

5 | Fraud Reporting | Point 4 |

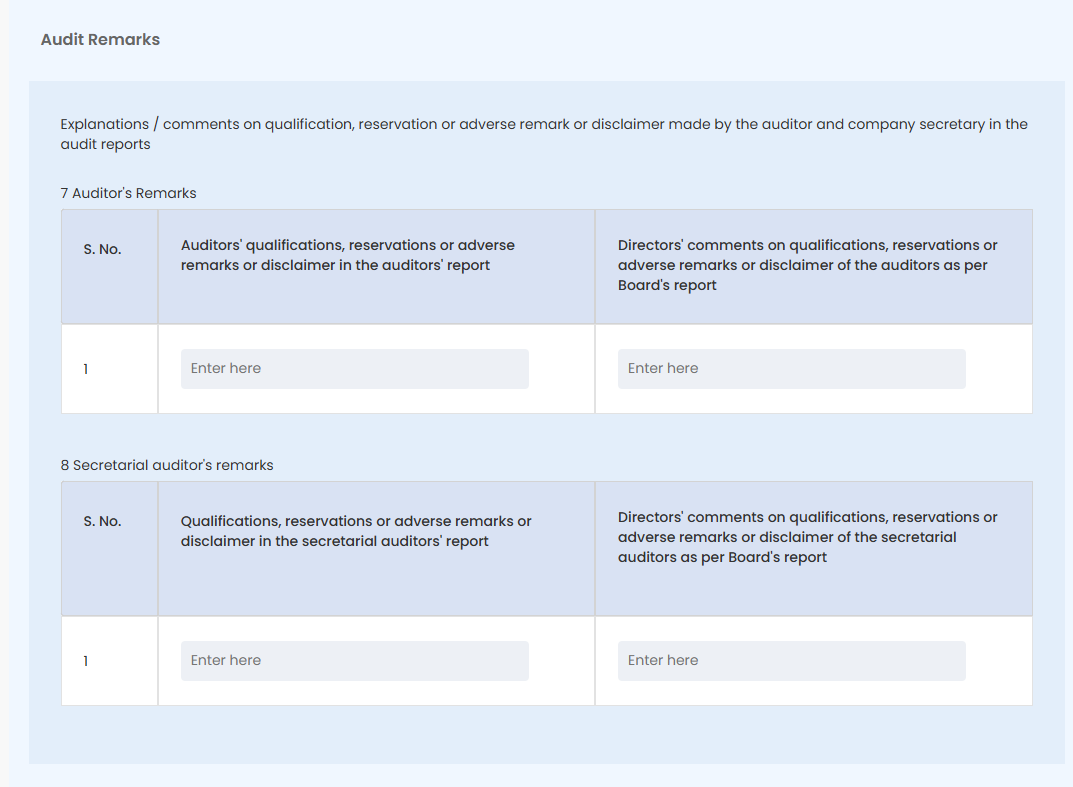

6 | Board’s Comment on Auditors’ Report | Point 7, 8 |

| 7 | Material Changes and Commitments | Point 14 |

8 | Change in Directorship | Point 23(e)(ix) |

| 9 | Orders by Regulators/Courts | Point 23(g) |

10 | Related Party Transactions | Clause 24 |

| 11 | Compliance with Secretarial Standards | Clause 24 |

12 | Loans, Guarantees, Investments | Point 9 & 10 |

| 13 | Auditor Details | Clause 24 |

14 | Director’s Responsibility Statement | Point 3 |

| 15 | Deposits | Point 23(f) |

16 | POSH Compliance | Point 23(i) |

| 17 | Reserves Disclosure | Clause 12 |

18 | Dividend Disclosure | Clause 13 |

| 19 | Conservation of Energy/Technology | Point 23(a) and (b) |

20 | Foreign Exchange Earnings/Outgo | Point 23(c) |

| 21 | Risk Management Policy | Point 15 |

22 | Subsidiary, JV, Associate Co. Details | Point 23(d), e(i) |

| 23 | Internal Financial Control | Point 23(e)(iii) |

24 | CSR | Clause 16 to 22 |

| 25 | Cost Records | Point 23(e)(iv) |

26 | Independent Director Declaration | Point 5, 23(e)(ii) |

| 27 | Vigil Mechanism | Clause 24 |

28 | Particulars of Employees / KMP | Point 6 |

| 29 | Management Discussion & Analysis | Clause 24 |

30 | Corporate Governance | Clause 24 |

| 31 | Board/Director Evaluation | Point 23(h) |

32 | Insolvency Proceedings | Point 23(e)(v) |

| 33 | Difference in Valuation (OTS) | Point 23(e)(vi) |

34 | Maternity Benefit | — |

| 35 | Director Appointment & Remuneration (Sec 178) | Clause 6 |

36 | Independent Director Declaration (Sec 149(6)) | Clause 5 |

| 37 | Risk Management Policy (Detailed) | Clause 15 |

38 | CSR (Additional Reference) | Clauses 16 to 22 |

| 39 | Not Applicable to Private Companies, Small Companies, and OPC | Private Companies, Small Companies and OPC can write not applicable on the said clause. |

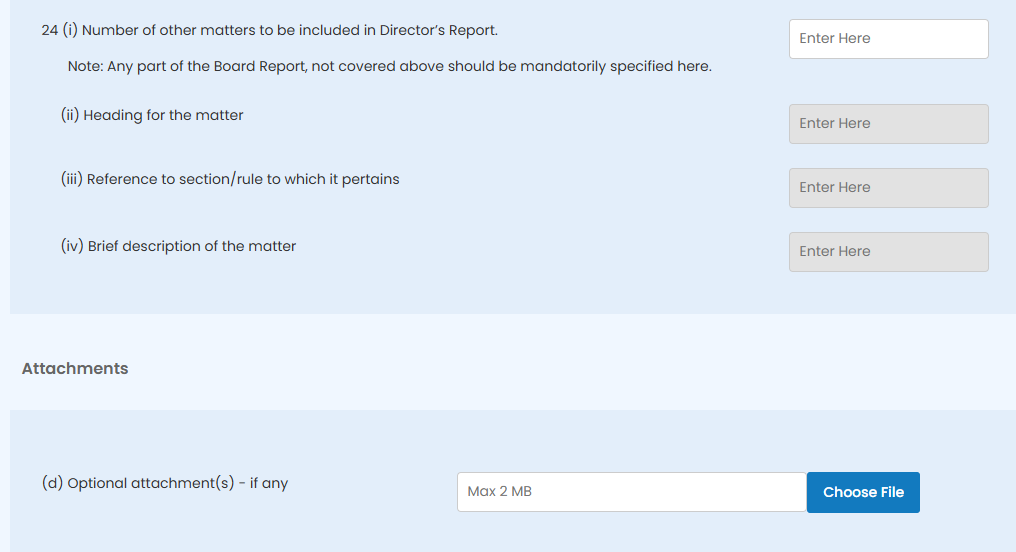

Screenshots of the Extract of the Board Report:

5. Filing Flow & Practical Compliance

When Filing AOC-4:

6. Key Benefits of the Extract Format

7. Conclusion

The Extract of Board’s Report is a pivotal part of today’s digitised company compliance. It ensures standardised reporting as per the MCA schema and helps companies maintain legal integrity. A mapped and clause-wise approach, as outlined above, will streamline compliance and reduce resubmission or rejection risks.

Disclaimer: –

The information provided is for educational purposes and should not be considered as professional advice. The author shall not be liable for any direct, indirect, special, or incidental damage resulting from, arising out of, or in connection with the use of the information.

This Article is shared by CS Shashank Kothiyal

He can be contacted at Cell: +91-7838165739 | [email protected]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"