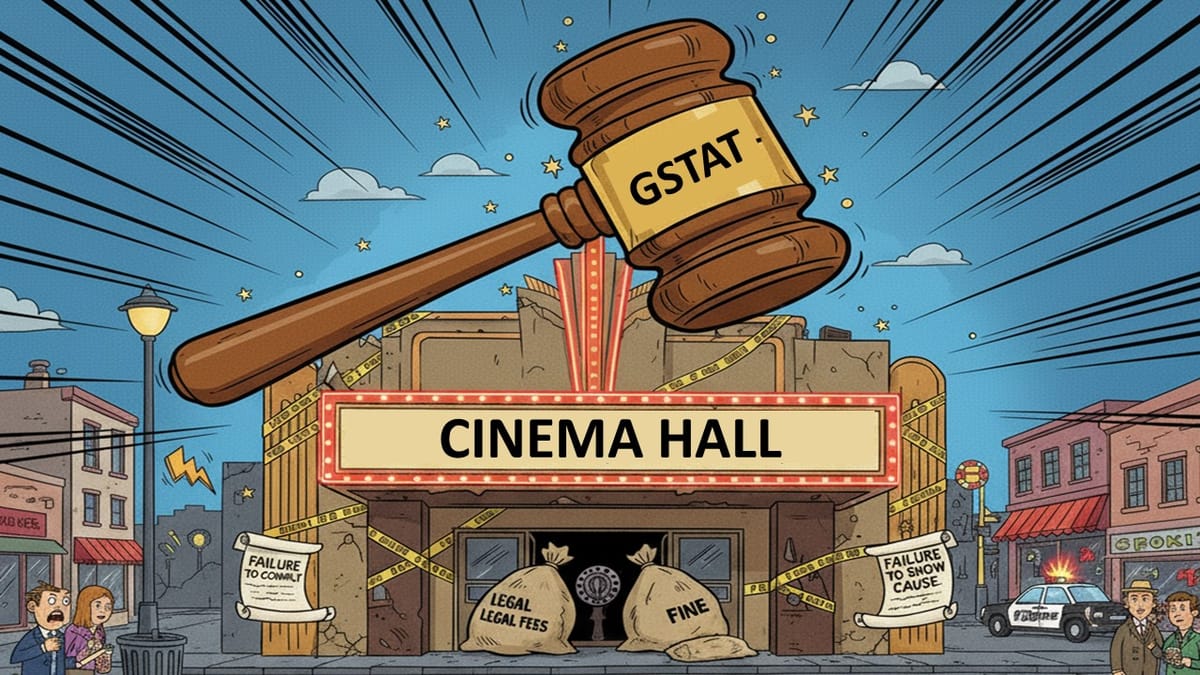

GSTAT holds theatre guilty of profiteering by not reducing ticket prices after GST rate cut on cinema tickets; directs deposit of amount with limited interest for three days only

Meetu Kumari | Oct 10, 2025 |

GSTAT: Cinema Hall Directed to Deposit Rs. 16.50 Lakh Profiteered by Not Passing GST Rate Cut

In a recent case, profiteering by a theatre owner who failed to pass on the benefit of the GST rate reduction on cinema tickets from 28% to 18% and from 18% to 12% effective 1 January 2019. The Directorate General of Anti-Profiteering (DGAP) found that during January-June 2019, the theatre continued charging higher ticket prices without corresponding reduction, resulting in a net profiteering of Rs. 16,50,166.

a The respondent argued that ticket rates were fixed under the Telangana Cinemas (Regulation) Act, 1955, and subsequent Government Orders, and that the High Court of Telangana had allowed theatres to set ticket prices within notified limits. It was also claimed that ticket prices already included Rs. 3 per ticket as tax-free maintenance charges, and that market dynamics and rising costs justified the pricing.

Main Issue: Whether the respondent profiteered by not reducing ticket prices after the GST rate cut and whether interest @18% under Rule 133(3)(c) applies retrospectively or prospectively.

GSTAT’s Ruling: The tribunal held that the theatre had indeed profiteered Rs. 16.50 lakh by not passing on the tax benefit to consumers. However, following the principles laid down in CIT v. Vatika Township Pvt. Ltd. and its own earlier ruling in DGAP v. Procter & Gamble Group (2025), it concluded that the power to impose 18% interest under Rule 133(3)(c) was introduced only prospectively from 28 June 2019.

Therefore, interest was limited to the three days (28-30 June 2019). The respondent was directed to deposit Rs. 16.50 lakh, along with Rs. 27,350 as interest, in equal proportion into the Central and State Consumer Welfare Funds within one month. The concerned Commissioner was instructed to ensure compliance within four months. Appeal partly allowed; interest restricted to three days post amendment.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"