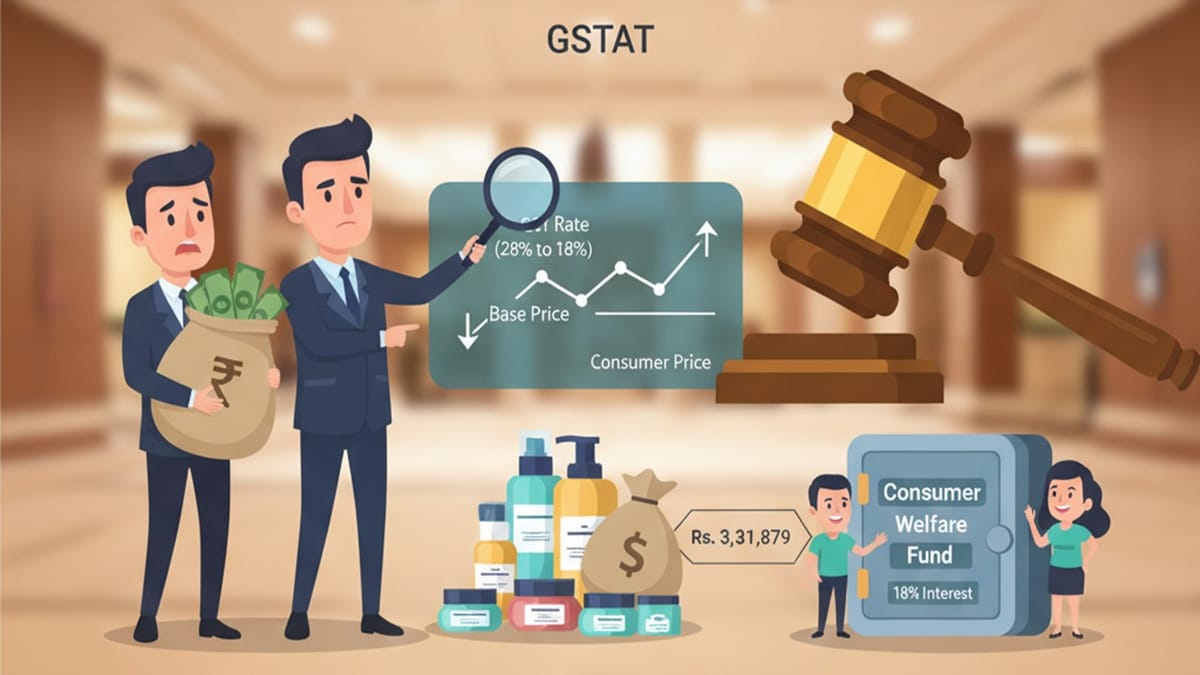

GSTAT confirms anti-profiteering finding against Assessee Company for failing to pass on the 28% to 18% GST rate benefit, directing deposit of Rs. 3,31,879/- plus 18% interest into CWF.

Meetu Kumari | Oct 22, 2025 |

GSTAT: Distributor Profiteered Rs. 3.31 Lakh by Increasing Base Price Post-GST Cut

The Respondent, a distributor of M/s. L’Oréal India Pvt. Ltd. was subjected to anti-profiteering proceedings under Section 171 of the Central Goods and Services Tax Act, 2017 (CGST Act). The investigation stemmed from the reduction in the rate of GST on Cosmetics Products from 28% to 18% with effect from November 15, 2017, via Notification No. 41/2017. The erstwhile National Anti-Profiteering Authority (NAA) had already passed Order No. 25/2018 on December 27, 2018, determining an amount of Rs. 3,43,109/- as profiteered for the period 15.11.2017 to 31.03.2018, which the Respondent accepted and deposited.

The current investigation, initiated following a direction from the erstwhile NAA, covered the subsequent period from April 1, 2018, to December 31, 2018. The Director General of Anti-Profiteering (DGAP) reported that the Respondent failed to pass on the benefit to consumers by increasing the base price of the products, which resulted in the cum-tax price remaining unchanged despite the tax rate reduction.

Main Issue: Whether the Respondent profited an amount of Rs. 3,31,879/- by not passing the benefit of the reduction in the Rate of GST (from 28% to 18% w.e.f. 15.11.2017) to consumers for the period 01.04.2018 to 31.12.2018.

Tribunal’s Decision: The Goods and Service Tax Appellate Authority (GSTAT), Principal Bench, confirmed the order under appeal. The Authority noted that there was no dispute that the GST rate was reduced and that the unit sale prices of various products remained unchanged. It was established that the GST rate of 18% was charged on an increased base price, which meant the cum-tax price paid by consumers was not reduced commensurately.

Therefore, the GSTAT directed the Respondent to deposit a sum of Rs. 3,31,879/- along with interest of 18% P.A. from the date of collection of the higher amount (01.04.2018 to 31.12.2018) into the Consumer Welfare Fund (CWF) created by the Centre and State under the CGST Act, within a period of three months.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"