Vanshika verma | Feb 2, 2026 |

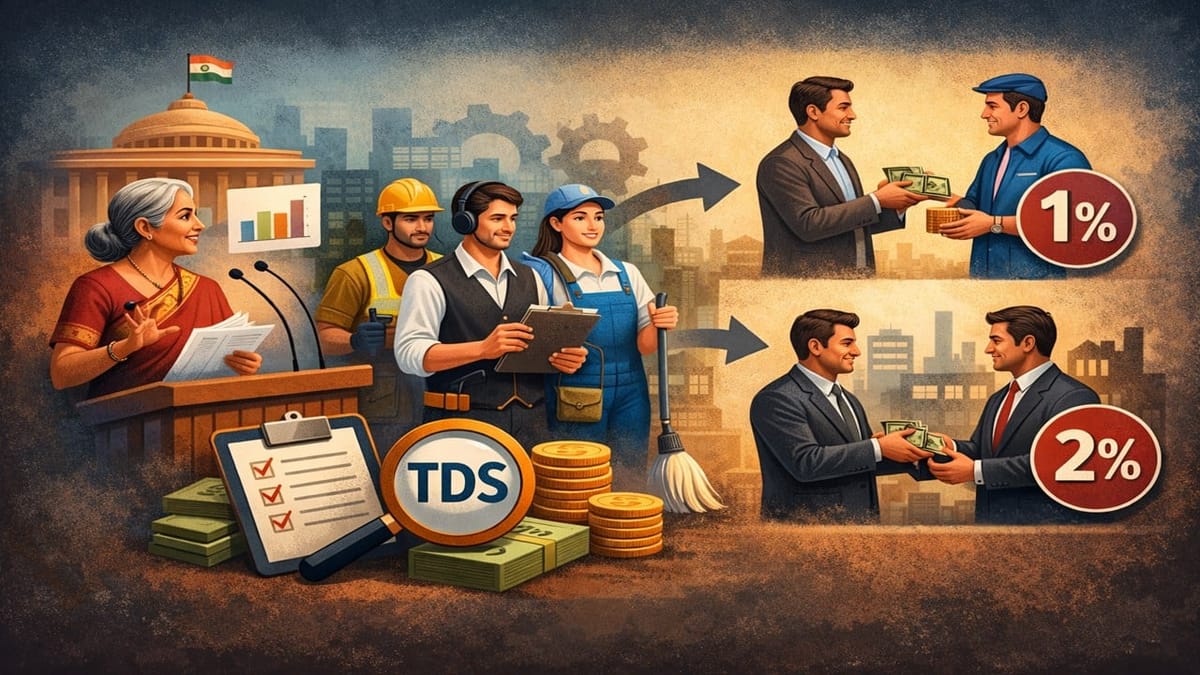

Budget 2026: Manpower Supply Now Treated as ‘Contractual Work’ for TDS Purposes

In Budget 2026, Finance Minister Nirmala Sitharaman made some changes to make Tax Deducted at Source simpler and easier. She clarified when and how Tax Deducted at Source (TDS) should be applied to different types of payments.

Under Section 393(1) of the Income Tax Act, 2025, which comes into effect from April 1, 2026, anyone making certain types of payments to a resident is required to deduct tax at source (TDS). Regarding the supply of manpower, the rules for TDS will apply as follows:

1. Section 393(1) requires that when a payment is made to a contractor for carrying out any work, the person making the payment must deduct TDS before paying the contractor. The rate of deduction is 1% if the payment is made to an individual or a Hindu Undivided Family (HUF), and 2% in all other cases, such as companies or firms.

2. Section 393(1) deals with tax deduction at source (TDS) on payments for professional or technical services. If you pay fees for technical services, royalties for the sale, distribution, or exhibition of cinematographic films, or to a business operating a call centre, the payer must deduct tax at 2%. For all other professional or technical services, the TDS rate is 10%.

3. Section 393(1) requires individuals and Hindu Undivided Families (HUFs) to deduct tax at source (TDS) when making certain payments. This includes payments to contractors for work (not covered under section 393(1)), payments by way of commission or brokerage, or for professional services (not covered under section 393(1)). The tax must be deducted at a rate of 2%.

There is some confusion about which TDS (Tax Deducted at Source) rate should be applied to payments for manpower supply. It is unclear whether the rate mentioned in Section 193(1), Table Sl. No. 6(i) or (ii) should be used, or the rate given in Table Sl. No. 6(iii). To make it clear how tax should be deducted at source when manpower is supplied, it is proposed that supplying manpower be treated as “work” under section 402(47). This means the rules for tax deduction at source under Section 393(1) [Table: Sl. No. 6(i)] will apply to such cases.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"