Vanshika verma | Feb 3, 2026 |

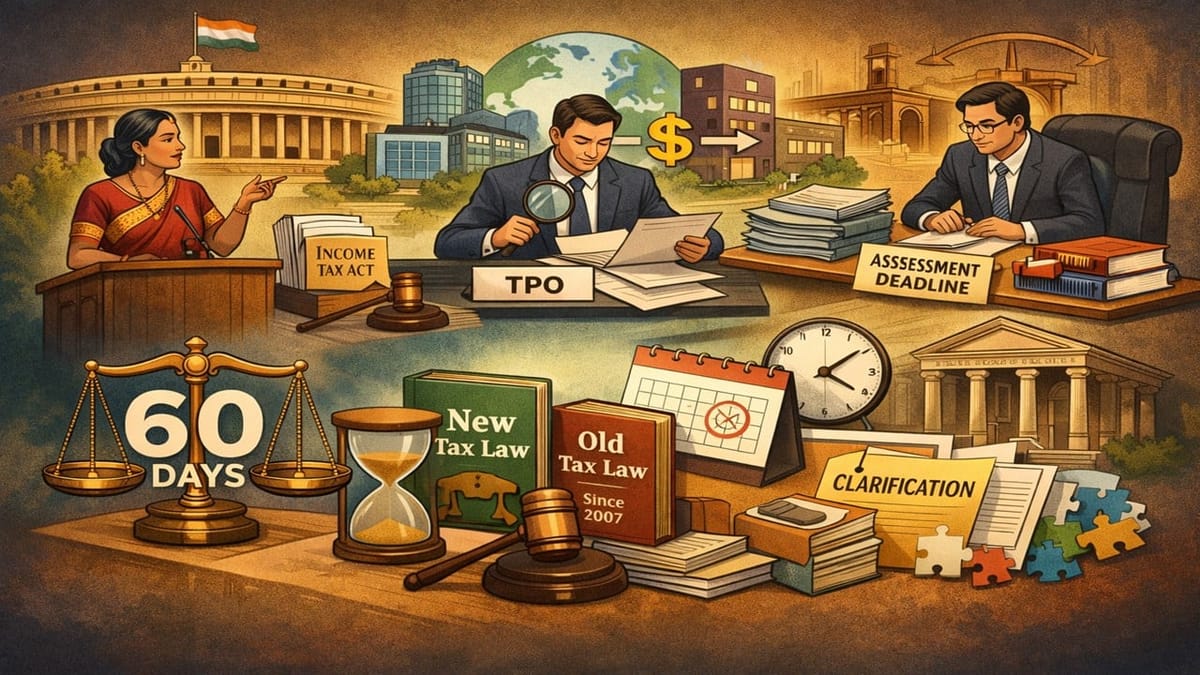

Budget 2026: Clarification on Computation of Sixty-Day Period under Section 92CA(3A)

Finance Minister Nirmala Sitharaman, during the 2026 budget, proposed to clarify the computation of sixty days for passing the order by the Transfer Pricing Officer.

Section 92CA of the Income-tax Act, 1961 says that when an assessee enters into an international transaction or a specified domestic transaction, the Assessing Officer (AO) can send the case to a Transfer Pricing Officer (TPO) to check whether the price charged in that transaction is fair and as per market value (arm’s length price). The TPO then examines the transaction and determines the correct price. Based on this, the AO can make changes in the assessee’s income, if needed, to ensure that taxes are properly calculated.

According to Section 92CA(3A), the Transfer Pricing Officer (TPO) may complete and pass an order at least 60 days before the last date on which the Assessing Officer is allowed to finish the assessment, reassessment, or fresh assessment under Section 153 or 153B.

There has been significant litigation in courts regarding how the sixty-day period mentioned in Section 92CA(3A) should be calculated. The legislature always intended that the last date of limitation should be included while computing these sixty days. However, courts have cancelled many assessments by holding that the date of limitation should not be included. As a result, even assessments lawfully made by the Transfer Pricing Officer, where sixty days were clearly available for completing the final assessment under Sections 153 or 153B, have been set aside.

The government said that there is an urgent requirement to clarify the position of the law. The Income-tax Act, 2025, will come into force from April 1, 2026. The main aim of this new law is to make tax rules easier to understand. It uses simple and clear language so that people do not get confused while reading it. This will help reduce different interpretations of the law and prevent unnecessary legal disputes.

It is proposed to clarify in Section 92CA(3A) as how the period of sixty days should be calculated, regardless of anything stated in any judgement. Necessary changes are also proposed to be made in the Income-tax Act, 2025, to ensure the law is interpreted correctly. This will help reduce legal disputes and bring more certainty and clarity in its application.

This clarification will apply retrospectively from June 1, 2007, in the old Income-tax Act, 1961 and from April 1, 2026, in the new Income-tax Act, 2025.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"