Meetu Kumari | Feb 16, 2026 |

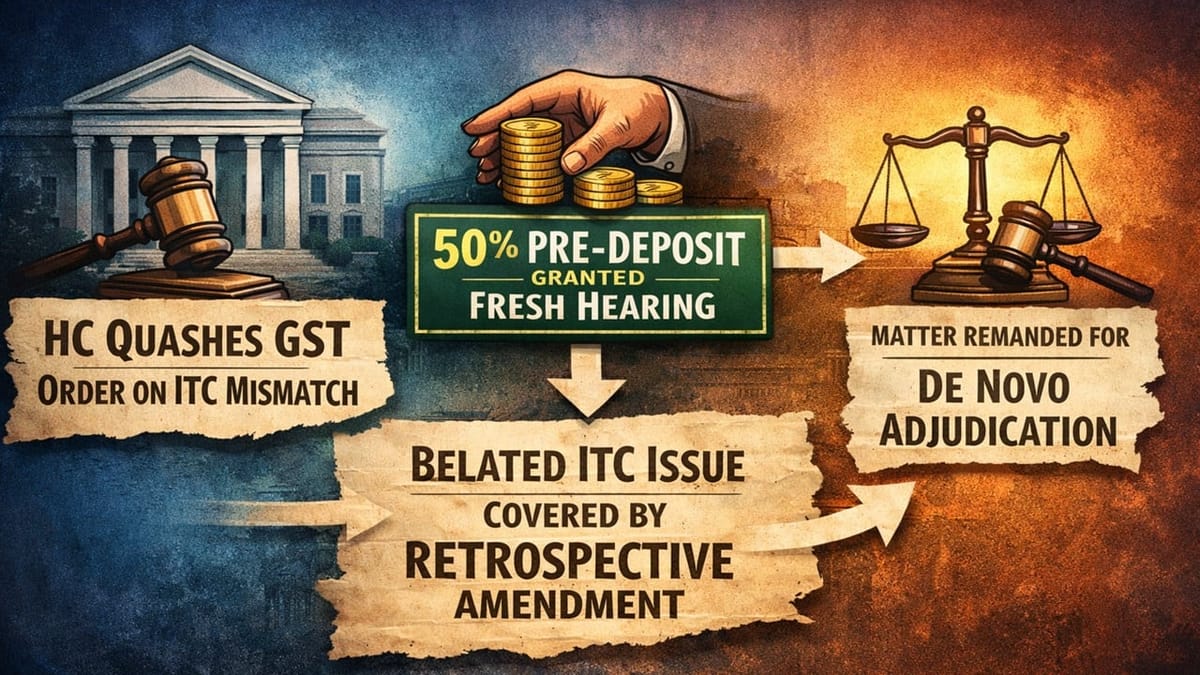

HC Quashes GST Order on ITC Mismatch; Grants Fresh Hearing on 50% Pre-Deposit

Tvl. Cauvery Enterprises challenged an assessment order dated 28.08.2024 issued in Form GST DRC-07 for the tax period 2019-20, confirming demand on two grounds; mismatch between GSTR-3B and GSTR-1 leading to alleged excess ITC claim and belated availment of ITC under Section 16(4).

Though the limitation period for filing appeal under Section 107 had expired, the petitioner approached the High Court and expressed willingness to deposit 50% of the disputed tax relating to the mismatch for fresh adjudication.

Main Issue: Whether the High Court should interfere in writ jurisdiction despite expiry of the statutory appeal period.

HC’s Decision: The High Court noted that the belated ITC issue stood covered in favour of the petitioner due to the retrospective amendment. The Court observed that in similar cases, matters had been remanded subject to reasonable pre-deposit, particularly where delay in filing an appeal was explained.

The Court quashed the assessment order and remitted the matter for fresh adjudication, subject to the deposit of Rs. 3,98,132 within 30 days and the submission of a detailed reply with supporting documents. The respondent was directed to pass a fresh order within three months and lift the bank attachment; failing which, the department could proceed with recovery in accordance with law.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"