Vanshika verma | Feb 16, 2026 |

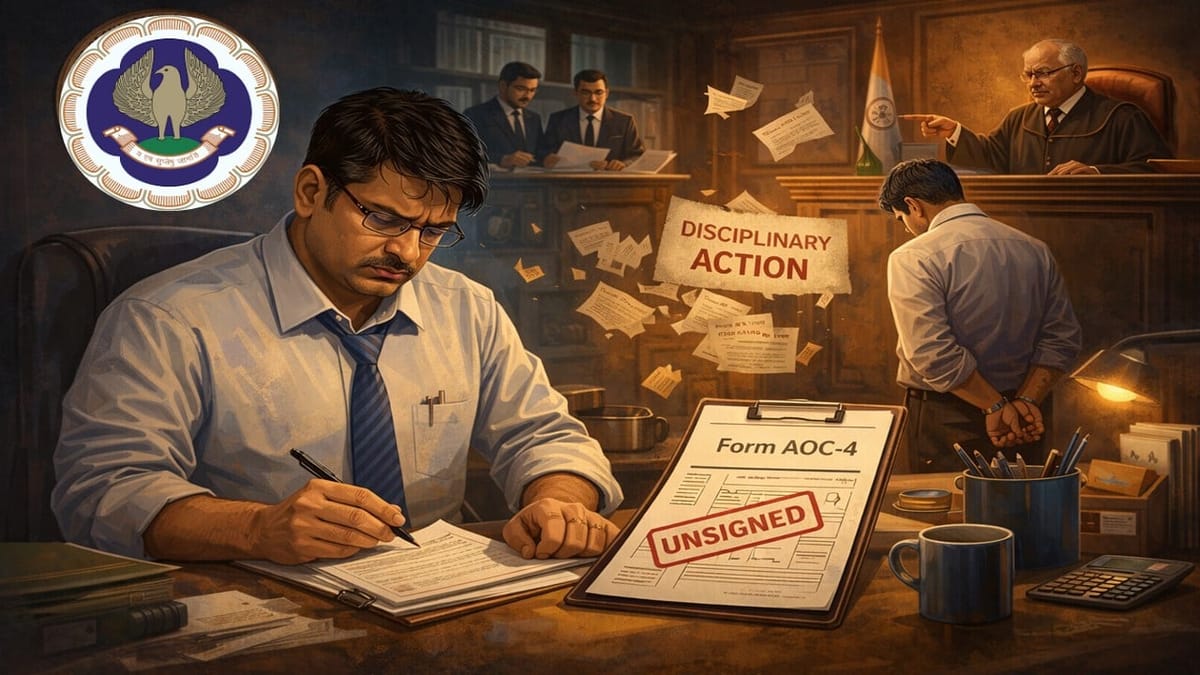

ICAI takes Disciplinary Action Against CA for Certifying AOC-4 with Unsigned Financial Statements

A disciplinary action was taken by the Institute of Chartered Accountants of India (ICAI) against CA Rakesh Kant Khandelwal for failing to ensure that the financial statements and audit reports attached to Form AOC-4 were properly signed before certification and filing.

The complaint was filed by Vijayasimha Reddy after an inspection of a company called Anchor Alloys Private Limited. The issue concerned the financial statements and audit reports for the financial years 2014-15 and 2015-16.

The complainant said that during inspection, it was found that the audit report and balance sheet attached to the Form AOC-4 did not contain the original signatures of the directors of the company, i.e., Mr Amarjeet Singh Chawla and Mr Paramjeet Singh Chawla. Instead, only “SD/-” (signed copy notation) was mentioned. However, according to Section 134(1) of the Companies Act, 2013, documents filed electronically must be scanned copies of the original documents bearing actual signatures.

The disciplinary authorities noted that the Chartered Accountant himself had certified Form AOC-4, which includes a declaration that he had verified the documents from original records and confirmed that they were properly signed and complete. Because of this certification, it was his professional responsibility to ensure that all attachments were correct and duly signed before submission.

Later in the hearing, the CA admitted that the documents were filed without signatures. He said that there was no clear instruction in the filing kit requiring signatures and that the mistake happened due to oversight by his staff. He also requested the committee to take a lenient view. However, the committee rejected his explanation and said that the requirement to file signed documents is clearly mentioned in law, and professionals are expected to know and follow such statutory provisions.

After considering all the facts, the committee held that the CA has failed to exercise due diligence in performing his professional duties. Therefore, he was held guilty of professional misconduct under Clause (7) of Part I of the Second Schedule of the Chartered Accountants Act, 1949.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"