Vanshika verma | Feb 19, 2026 |

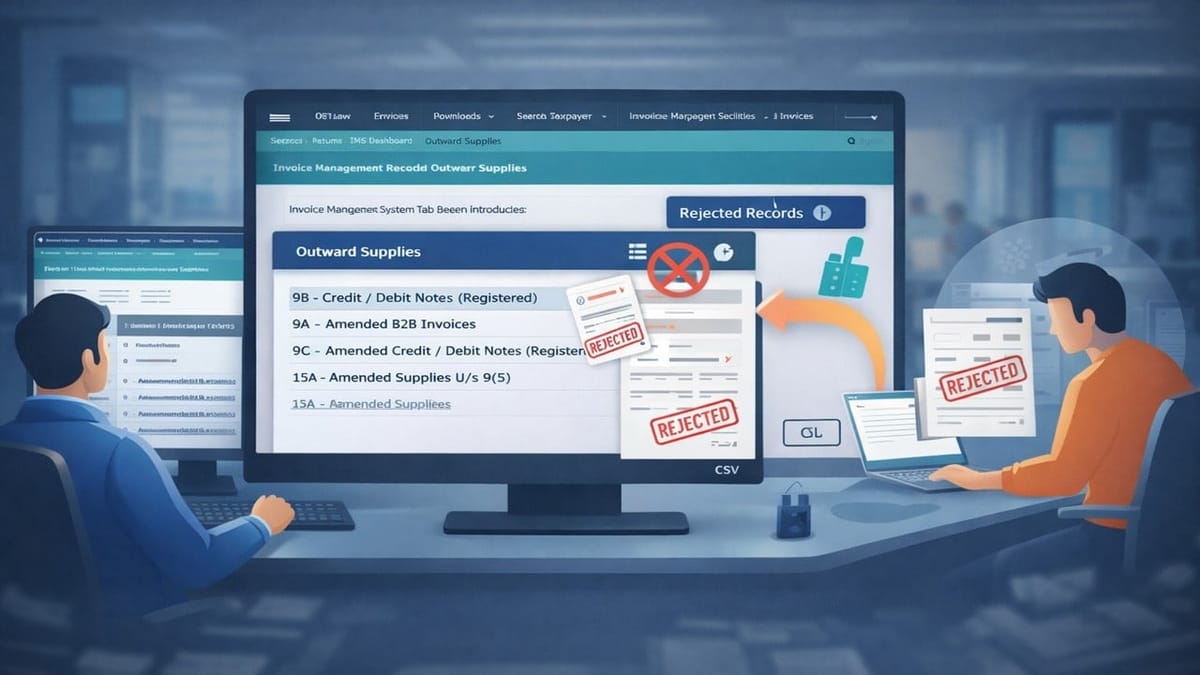

GST Update: Separate Tab for Rejected Credit Notes Provided in Outward Invoice Management System

The GSTN introduced a dedicated “Rejected Records” tab in the Outward Supplies section of the Invoice Management System (IMS) on 18th February 2026.

With this update, taxpayers can more efficiently identify cases where the tax liability needs to be added back in GSTR-3B. This new feature is designed to display rejected Credit Notes and similar documents in a separate and easily identifiable manner.

This new update mainly helps suppliers when a buyer rejects a document, such as a Credit Note or Debit Note. The following are the key points:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"