The Goods and Services Tax Network (GSTN) has now enabled the filing of Letter of Undertaking (LUT) on the GST Portal for the Financial Year 2026-27.

Saloni Kumari | Feb 9, 2026 |

GSTN Update: LUT Filing for FY 2026-27 Now Live on GST Portal; Check Details and Step-by-Step Guide

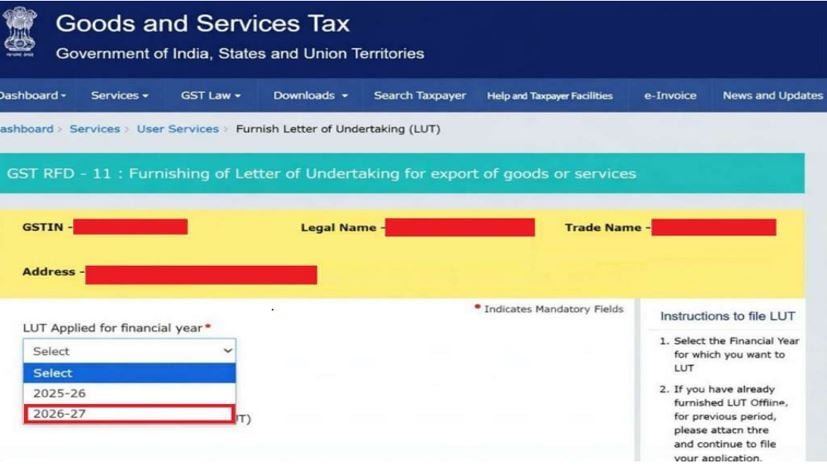

The Goods and Services Tax Network (GSTN) has now enabled the filing of Letter of Undertaking (LUT) on the GST Portal for the Financial Year 2026-27 (Assessment Year 2027-28). The GST Department has added the option to select the relevant financial year, including 2025-26 and 2026-27, on the GST portal.

Taxpayers generating zero-rated supplies without payment of integrated tax are now eligible to furnish LUT by filling in Form GST RFD-11 for the upcoming financial year.

The GSTN has suggested all registered and eligible taxpayers finish filing LUT (Letter of Undertaking) for the Financial Year 2026-27 well in advance in order to avoid last-minute hustle and inconvenience.

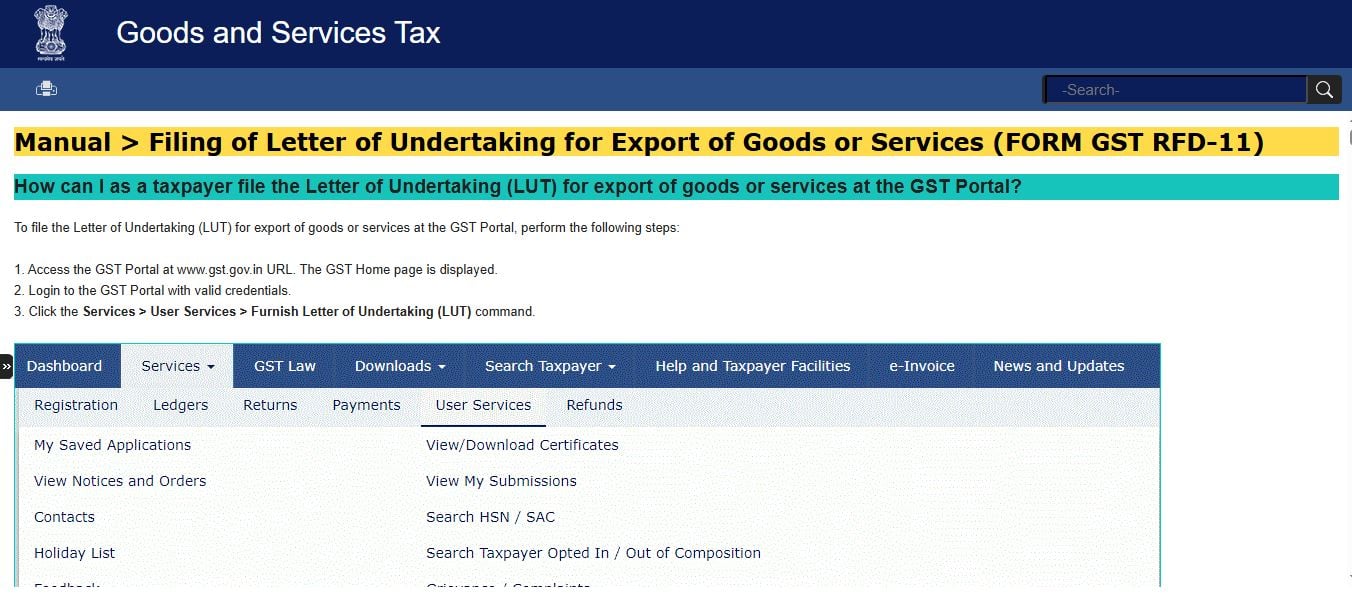

Here are the simple steps following which taxpayers can file a Letter of Undertaking (LUT) for export of goods or services at the GST Portal:

For detailed steps, taxpayers can visit the link – Click Here

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"