shashank kothiyal | Jul 29, 2019 |

FILING PROCESS OF CMP-08

All the registered taxpayers paying tax under the provisions of section 10 of CGST Act 2017 or availing benefits of Notification No. 2/2019-Central Tax (Rate) dated 07th March 2019 have been categorized under special category of persons by the CBDT. A special procedure has been laid out by the CBDT via Notification no. 21/2019 Central Tax dated 23rd April 2019 for such persons to file their tax returns, registered under the composition scheme.

Such specified persons are required to furnish their return statement with the help of Form GST CMP-08 on a quarterly basis (on or before the 18th of the month following the quarter of any given financial year). GST CMP 08 form extended due date is 31st July for the quarter of April 2019 to June 2019.

Currently the extended due date for filing CMP-08 is 31st August,2019.

1. What is Form CMP-08

Ans. A composition dealer will use the Form CMP-08, which is a special statement-cum-challan to declare the details or summary of his/her self-assessed tax payable for a given quarter. It also acts as a challan for making payment of tax. A composition dealer is a dealer who has been registered under the composition scheme of GST.

In addition to Form CMP-08, a composition dealer will also need to file his/her annual return via the revised format of Form GSTR-4 by 30 April following the end of a specific financial year.

2. Who should file CMP-08

Ans. A taxpayer who has opted for the composition scheme has to CMP-08 in order to deposit payments every quarter. There are two kinds of taxpayers registered using CMP-02 (Opt into Composition scheme) :

A. The supplier of goods being manufacturers, retailers having an annual aggregate turnover of up to Rs 1.5 crore in the previous financial year, except :

B. The supplier of services who fulfil the conditions mentioned under the Notification Number 2/2019 Central Tax (Rate) dated 7 March 2019 having the aggregate annual turnover up to Rs 50 lakh in the previous financial year.

3. What is the due date for filing the form CMP-08

Ans. Form CMP-08 must be filed on a quarterly basis, on or before the 18th of the month succeeding the quarter of any specific financial year.

Revised due date is 31st August,2019.7.28

4. What is the penalty for not filing CMP-08 within the due date

Ans. In case a taxpayer fails to furnish his/her return on or before the due date, he or she will be liable to pay a late fee of Rs 200 per day for every day of delay. i.e. Rs 100 per day under CGST and Rs 100 per day under SGST. IGST Act prescribes an amount equal to the late fees for CGST and SGST Act i.e Rs 200 per day of delay.

Late fee charges will be subject to a maximum of Rs 5,000 from the start of the due date to the actual return filing date of the taxpayer.

We can file CMP-08 in two ways :

1. Nil Return

2. Not a Nil Return

Lets discuss the following topics in detail :

The taxpayer can file the nil return, if taxpayer not perform the below mentioned activities :

The filing process for Nil CMP-08 are :

I. Log in at GST Portal.

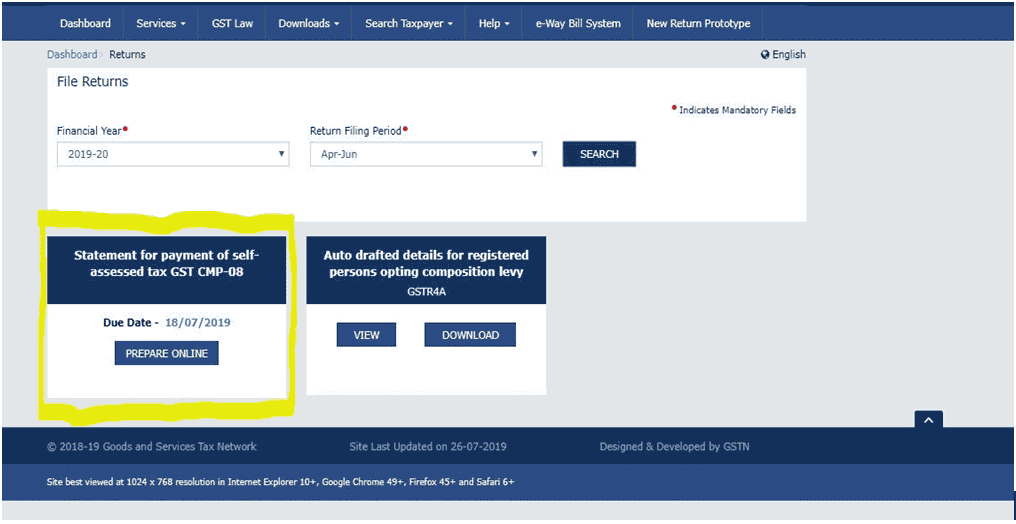

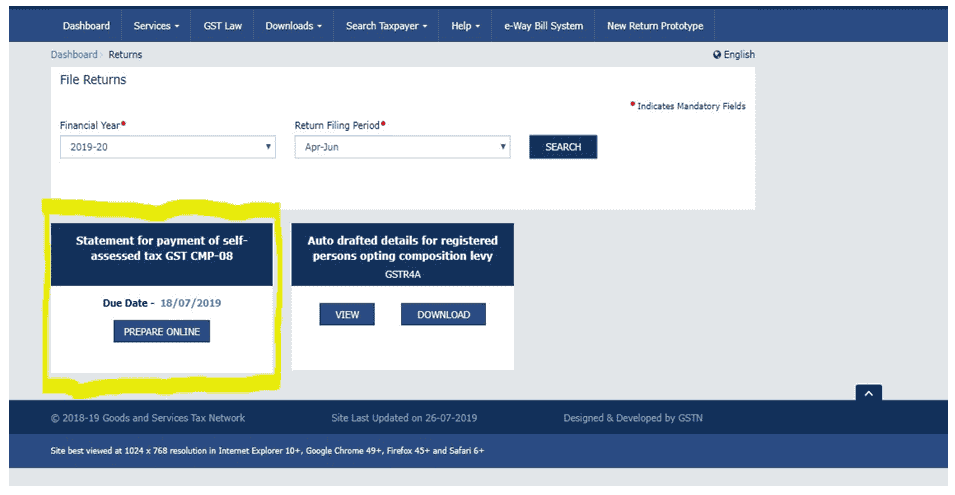

II. Click on Services > Return Dashboard > Select Return Filing Period and Financial Year.

III. Click on CMP-08 then following window will get displayed :

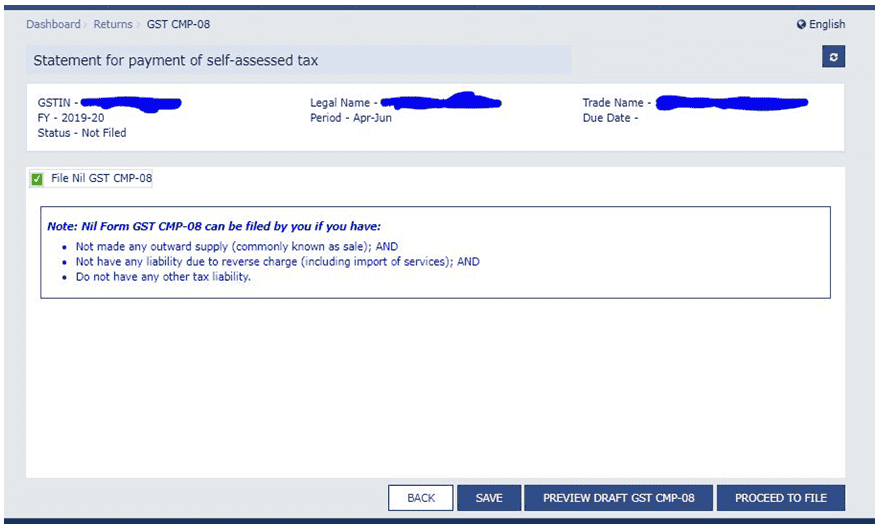

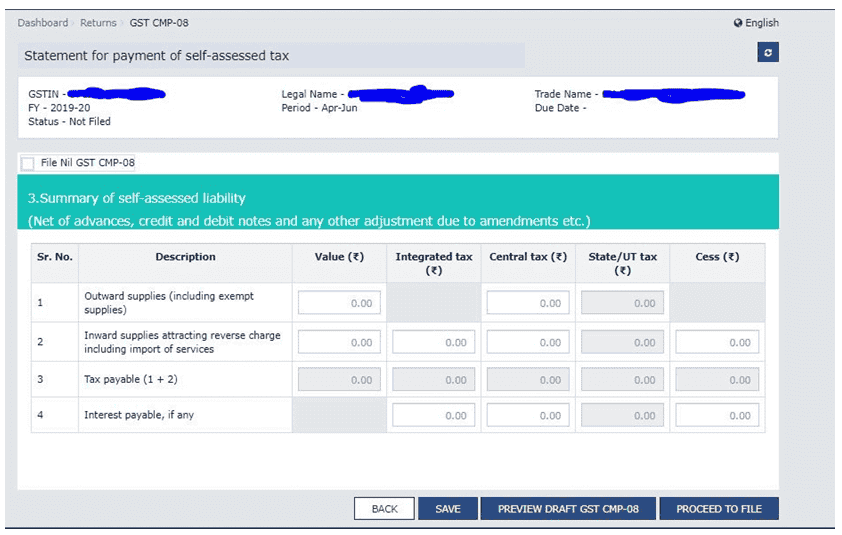

IV. Click on File Nil GST CMP-08 to file Nil CMP-08.

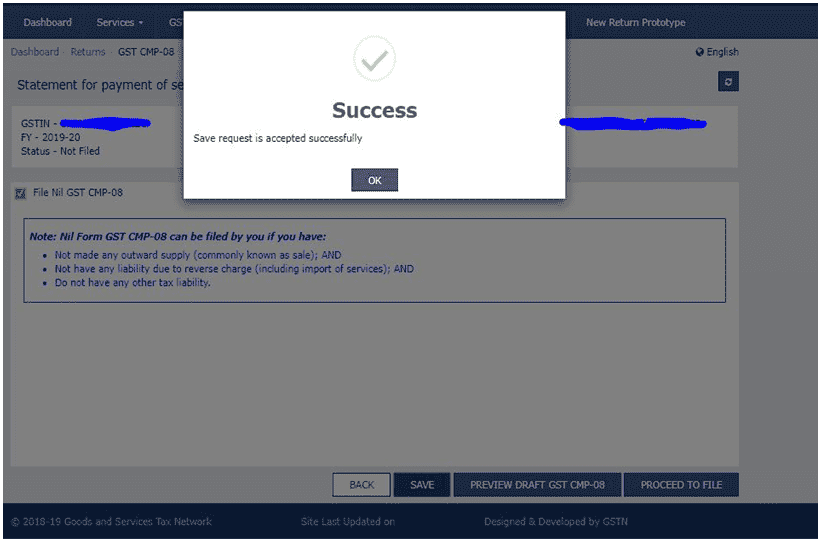

V. Then click on Save Tab.

VI. After Clicking on Save then click on Preview Draft GST CMP-08.

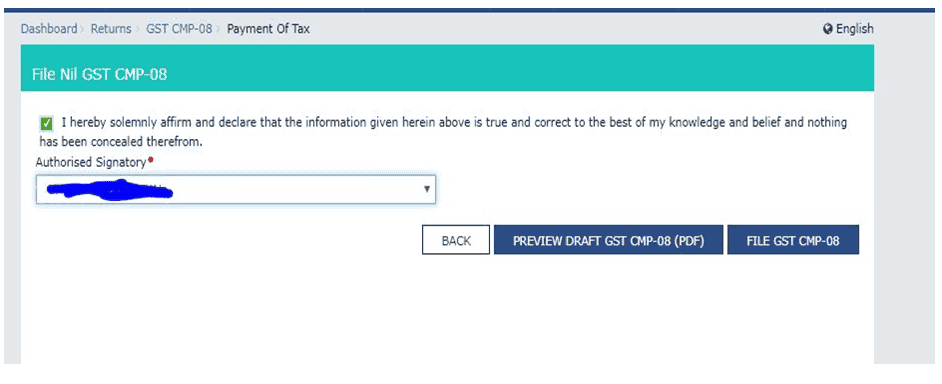

VII. After clicking on Preview Draft GST CMP-08 then click on File GST CMP-08 to file the form, Taxpayer can file the form as per applicability (EVC or DSC).

VIII. After Form CMP-08 is filed :

The taxpayer needs to file taxable CMP-08, if taxpayer perform the below mentioned activities :

The filing process for Nil CMP-08 are :

I. Log in at GST Portal.

II. Click on Services > Return Dashboard > Select Return Filing Period and Financial Year.

III. Click on CMP-08 then following window will get displayed :

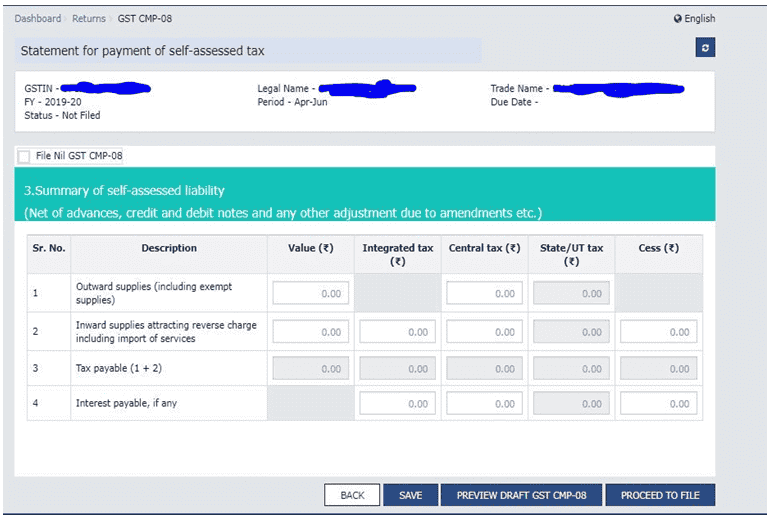

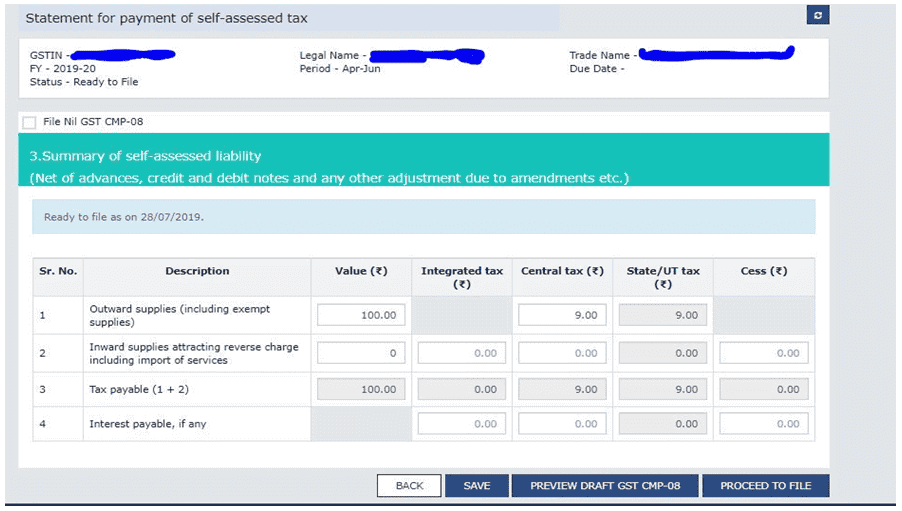

IV. The taxpayer needs to enter the details related to the below mentioned details :

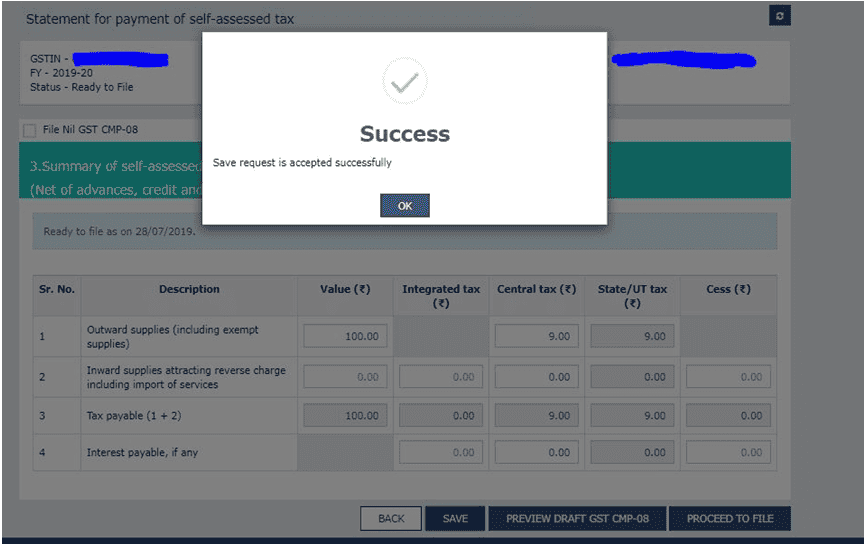

V. After entering the details taxpayer needs to click on Save button.

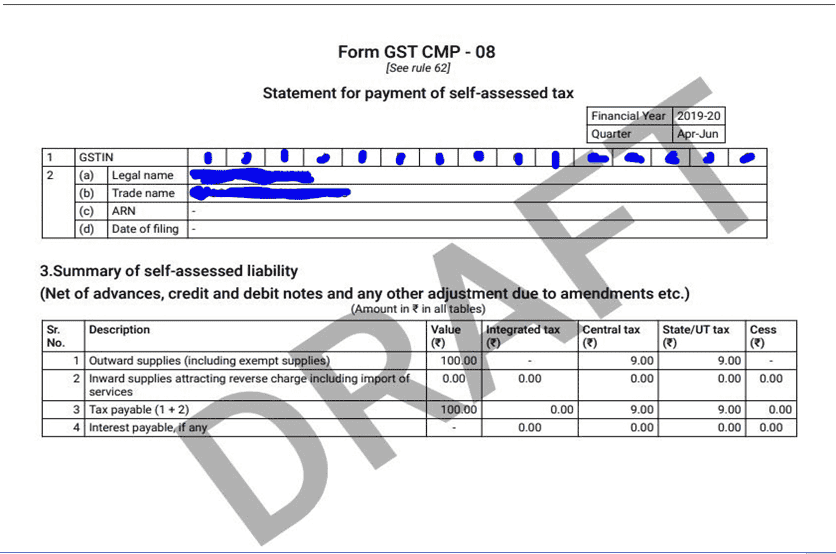

VI. After Clicking on Save then click on Preview Draft GST CMP-08.

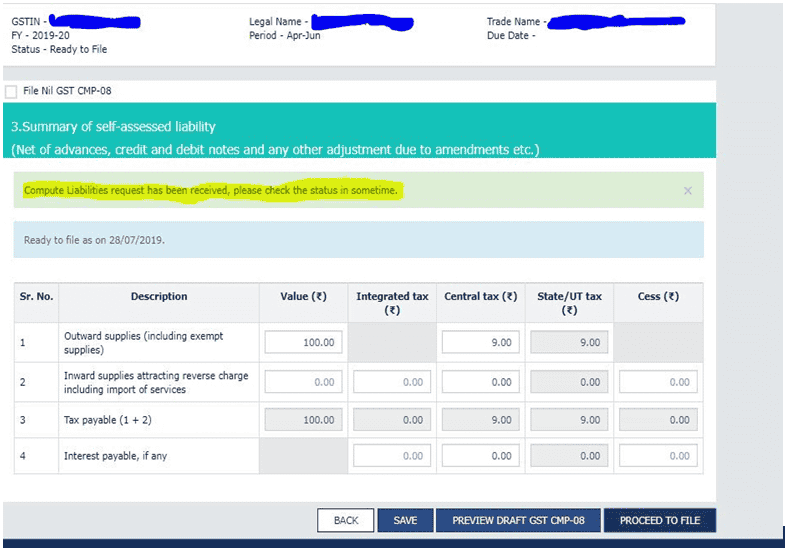

VII. After clicking on Preview Draft GST CMP-08 then click on Proceed to File tab.

When taxpayer clicks on Proceed to File tab then status shows Ready to File and message shows Compute Liabilities request has been received,please check the status in sometime.

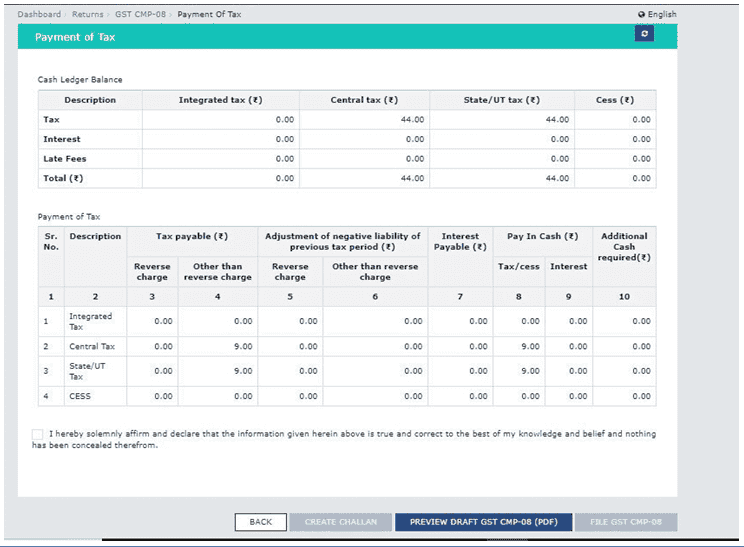

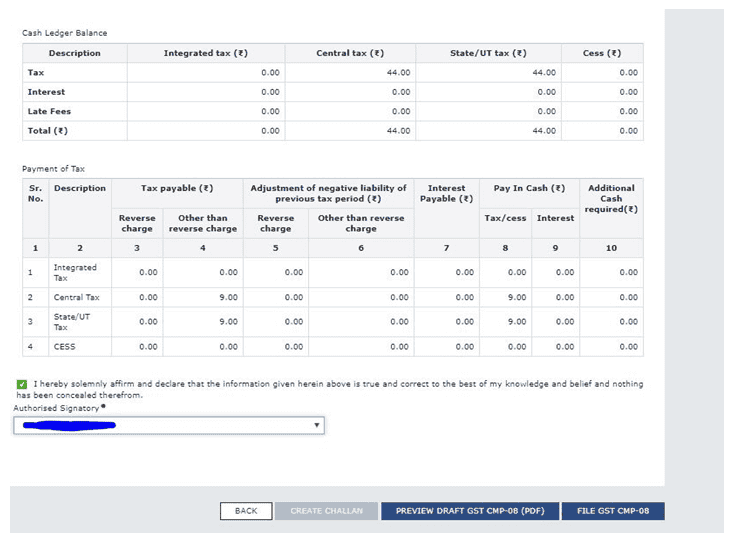

VIII. After clicking on Proceed to File tab following window will get displayed, where taxpayer view the reported liabilities and balance available in cash ledger.

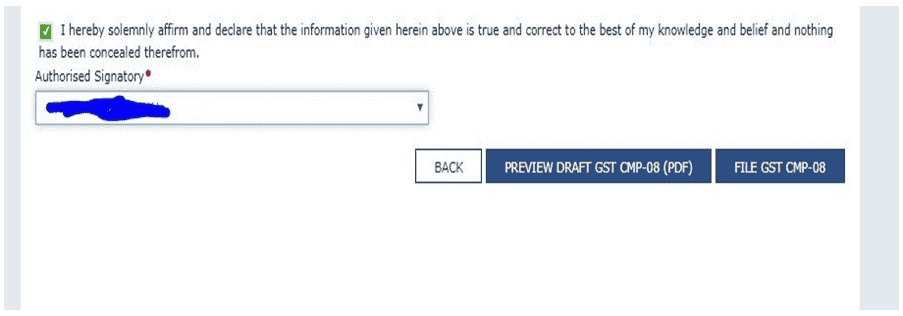

IX. If sufficient balance is available in cash ledger then click on File GST CMP-08, if not then click on Create Challan and paid the tax liabilities accordingly.

X. After clicking on File GST CMP-08 to file the form, Taxpayer can file the form as per applicability (EVC or DSC).

XI. After Form CMP-08 is filed :

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"