Alert: Beware of Fake ITR due date extension message floating on Social Media

CA Pratibha Goyal | Jul 30, 2022 |

Alert: Beware of Fake ITR due date extension message floating on Social Media

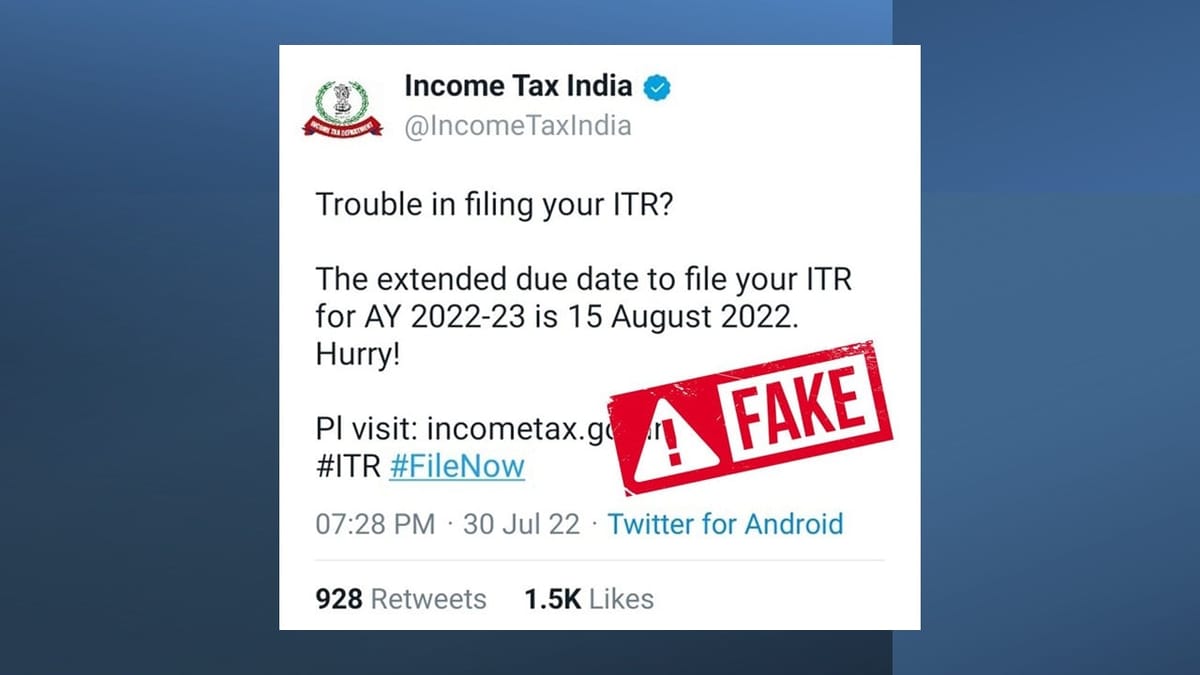

Taxpayers are requested to be stay alerted of Fake Income Tax Return (ITR) due date extension messages floating on Social Media.

Please note that ITR Filing due date for the Financial Year 2021-22 (AY 2022–2023) for a Non-Audit case is July 31, 2022. The Income Tax Department notified on Saturday that approx. 26 lakhs have been filed till 4 p.m and 3.97 lakhs between 5 p.m to 6 p.m and 4.48 lakhs from 6 to 7 p.m.

Lots of rage showed on social media to extend the deadline of ITR Filing for FY 2021-22, and various representations were also submitted before the Hon’ble Finance Minister.

But, Union Revenue Secretary Tarun Bajaj had made it clear that the government does not have any plan to extend the deadline. “So far, there is no thinking of extending the last date of filing,” Mr. Bajaj wrote at his Twitter handle.

As the Government is not planning for an extension of deadlines. To prevent any fines, penalties, and legal repercussions, taxpayers must electronically submit their ITR for the financial year 2021–2022 prior to the deadline.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"