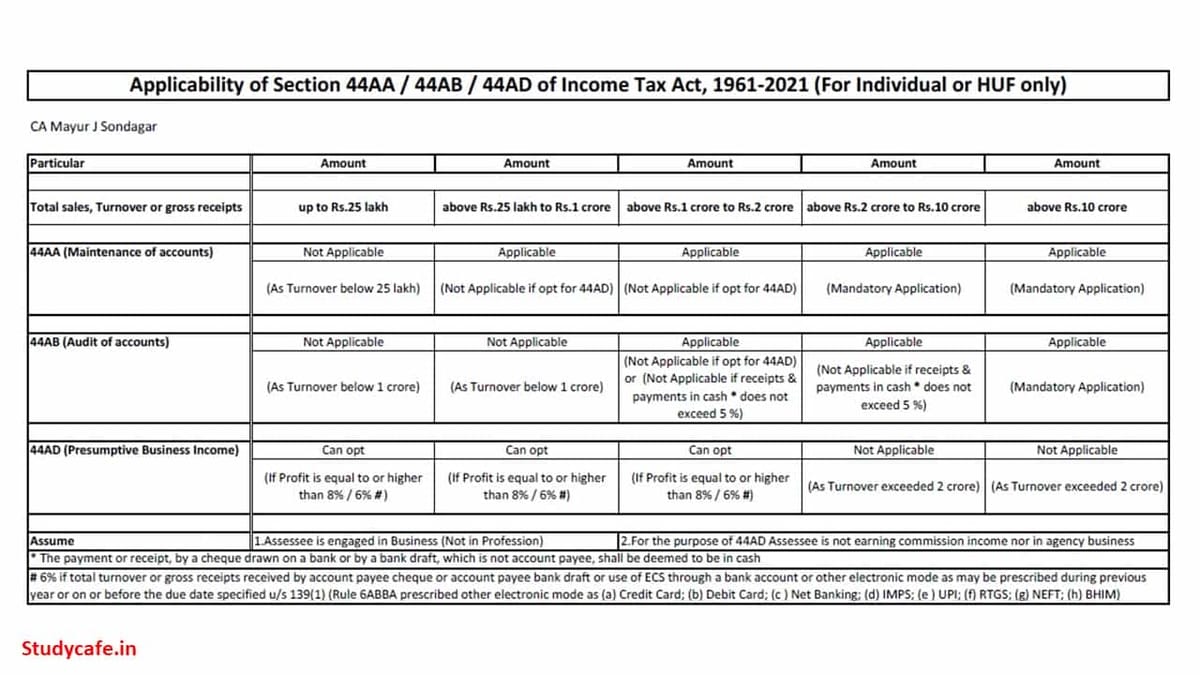

Applicability of Section 44AA/44AB/44AD of Income Tax Act, 1961-2021

CA Mayur J Sondagar | Aug 9, 2021 |

Applicability of Section 44AA/44AB/44AD of Income Tax Act, 1961-2021

| Particular | Amount | Amount | Amount | Amount | Amount |

| Total sales, Turnover or gross receipts | up to Rs.25 lakh | above Rs.25 lakh to Rs.1 crore | above Rs.1 crore to Rs.2 crore | above Rs.2 crore to Rs.10 crore | above Rs.10 crore |

| 44AA (Maintenance of accounts) | Not Applicable | Applicable | Applicable | Applicable | Applicable |

| (As Turnover below 25 lakh) | (Not Applicable if opt for 44AD) | (Not Applicable if opt for 44AD) | (Mandatory Application) | (Mandatory Application) | |

| 44AB (Audit of accounts) | Not Applicable | Not Applicable | Applicable | Applicable | Applicable |

| (As Turnover below 1 crore) | (As Turnover below 1 crore) | (Not Applicable if opt for 44AD) or (Not Applicable if receipts & payments in cash * does not exceed 5 %) | (Not Applicable if receipts & payments in cash * does not exceed 5 %) | (Mandatory Application) | |

| 44AD (Presumptive Business Income) | Can opt | Can opt | Can opt | Not Applicable | Not Applicable |

| (If Profit is equal to or higher than 8% / 6% #) | (If Profit is equal to or higher than 8% / 6% #) | (If Profit is equal to or higher than 8% / 6% #) | (As Turnover exceeded 2 crore) | (As Turnover exceeded 2 crore) | |

| Assume | 1.Assessee is engaged in Business (Not in Profession) | 2.For the purpose of 44AD Assessee is not earning commission income nor in agency business | |||

* The payment or receipt, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be in cash

# 6% if total turnover or gross receipts received by account payee cheque or account payee bank draft or use of ECS through a bank account or other electronic mode as may be prescribed during previous year or on or before the due date specified u/s 139(1) (Rule 6ABBA prescribed other electronic mode as (a) Credit Card; (b) Debit Card; (c ) Net Banking; (d) IMPS; (e ) UPI; (f) RTGS; (g) NEFT; (h) BHIM)

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"