Various Examples Discussing Income Tax Audit Applicability

CA Mayur J Sondagar | Aug 12, 2021 |

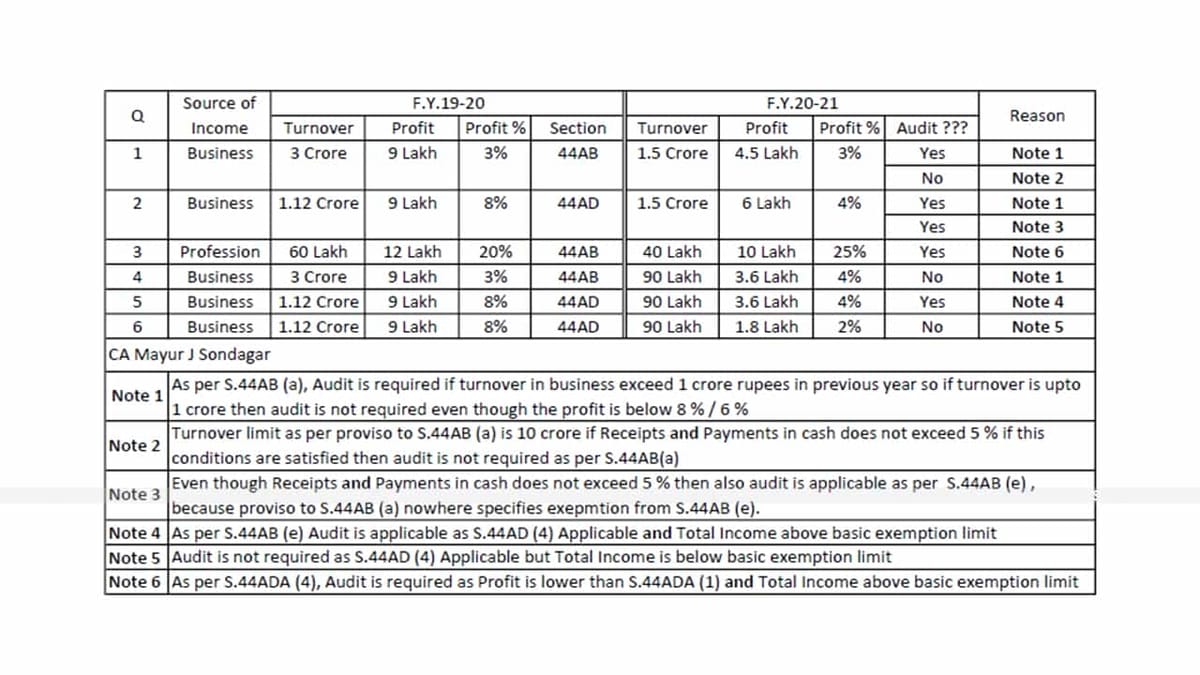

Various Examples Discussing Income Tax Audit Applicability

| Q | Source of Income | F.Y.19-20 | F.Y.20-21 | Reason | ||||||

| Turnover | Profit | Profit % | Section | Turnover | Profit | Profit % | Audit ??? | |||

| 1 | Business | 3 Crore | 9 Lakh | 3% | 44AB | 1.5 Crore | 4.5 Lakh | 3% | Yes | Note 1 |

| No | Note 2 | |||||||||

| 2 | Business | 1.12 Crore | 9 Lakh | 8% | 44AD | 1.5 Crore | 6 Lakh | 4% | Yes | Note 1 |

| Yes | Note 3 | |||||||||

| 3 | Profession | 60 Lakh | 12 Lakh | 20% | 44AB | 40 Lakh | 10 Lakh | 25% | Yes | Note 6 |

| 4 | Business | 3 Crore | 9 Lakh | 3% | 44AB | 90 Lakh | 3.6 Lakh | 4% | No | Note 1 |

| 5 | Business | 1.12 Crore | 9 Lakh | 8% | 44AD | 90 Lakh | 3.6 Lakh | 4% | Yes | Note 4 |

| 6 | Business | 1.12 Crore | 9 Lakh | 8% | 44AD | 90 Lakh | 1.8 Lakh | 2% | No | Note 5 |

Note 1 As per S. 44AB (a), Audit is required if turnover in business exceeds 1 crore rupees in the previous year so if turnover is up to 1 crore then an audit is not required even though the profit is below 8 % / 6 %

Note 2 Turnover limit as per proviso to S.44AB (a) is 10 crore if Receipts and Payments in cash does not exceed 5 % if these conditions are satisfied then an audit is not required as per S.44AB(a)

Note 3 Even though Receipts and Payments in cash does not exceed 5 % then also audit is applicable as per S.44AB (e), because proviso to S.44AB (a) nowhere specifies exemption from S.44AB (e).

Note 4 As per S.44AB (e) Audit is applicable as S.44AD (4) Applicable and Total Income above the basic exemption limit

Note 5 Audit is not required as S.44AD (4) Applicable but Total Income is below the basic exemption limit

Note 6 As per S.44ADA (4), Audit is required as Profit is lower than S.44ADA (1) and Total Income above the basic exemption limit

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"