CA Mayur J Sondagar | Jul 26, 2021 |

GST QRMP vs Non-QRMP Brief Analysis

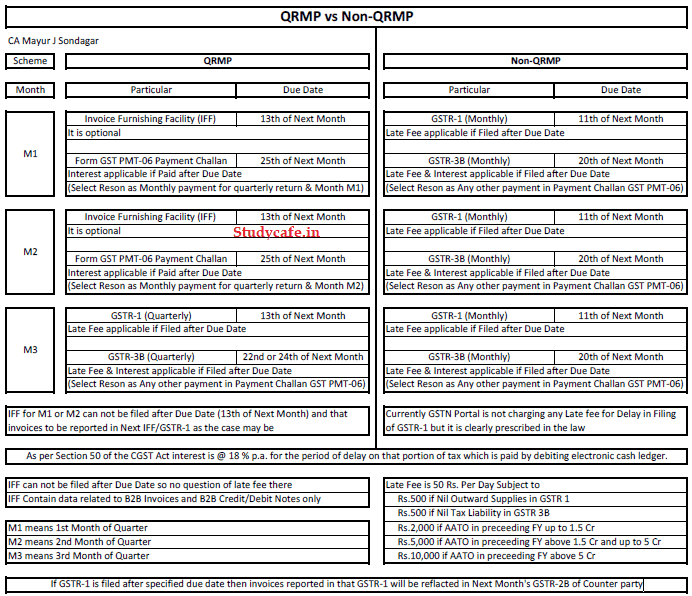

Below is the crisp analysis between Quarterly Return Monthly Payment [QRMP] Scheme and Regular GSTR-3B Filing Scheme which will help you in deciding while choosing b/w QRMP or Non-QRMP Scheme.

| QRMP vs Non-QRMP | ||||

| Scheme | QRMP | Non-QRMP | ||

| Month | Particular | Due Date | Particular | Due Date |

| M1 | Invoice Furnishing Facility (IFF)- Optional | 13th of Next Month | GSTR-1 (Monthly)- Late Fee applicable if Filed after Due Date | 11th of Next Month |

| Form GST PMT-06 Payment Challan | 25th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Interest applicable if Paid after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Monthly payment for quarterly return & Month M1) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

| M2 | Invoice Furnishing Facility (IFF) | 13th of Next Month | GSTR-1 (Monthly) | 11th of Next Month |

| It is optional | Late Fee applicable if Filed after Due Date | |||

| Form GST PMT-06 Payment Challan | 25th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Interest applicable if Paid after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Monthly payment for quarterly return & Month M2) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

| M3 | Invoice Furnishing Facility (IFF) | 13th of Next Month | GSTR-1 (Monthly) | 11th of Next Month |

| It is optional | Late Fee applicable if Filed after Due Date | |||

| GSTR-3B (Monthly) | 22nd or 24th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Late Fee & Interest applicable if Filed after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Any other payment in Payment Challan GST PMT-06) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

GST QRMP vs Non-QRMP Brief Analysis

Notes:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"