Reetu | Sep 4, 2024 |

AU Small Finance Bank submits Application for Universal Banking License to RBI

AU Small Finance Bank (AUSFB) submitted an application to the RBI for a universal bank license on Tuesday. In April, the RBI requested proposals from small finance banks that met specified criteria, including a minimum net worth of Rs.1,000 crore, to become regular or universal banks.

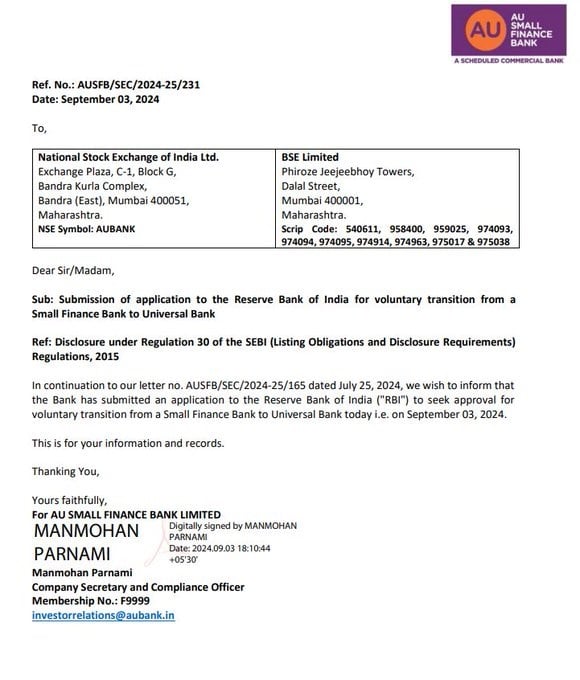

AUSFB filed an application with the central bank on September 3, 2024, asking for approval for a voluntary change from a small finance bank to a universal bank, according to a BSE filing.

In November 2014, the RBI announced guidelines for licensing small finance banks (SFBs) in the private sector.

According to the RBI’s April guidelines, an SFB intending to become a universal bank must have a minimum net value of Rs.1,000 crore at the end of the previous quarter and its shares must be listed on a recognised stock exchange.

It should also have a net profit in the last two years, as well as gross and net NPAs of less than or equal to 3% and 1%, respectively, in the last two years.

The Jaipur-based AUSFB bought Fincare Small Finance Bank, and the merger went into effect on April 1 of this year. The amalgamated entity’s overall business mix now exceeds Rs.1.8 lakh crore.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"