CA Pratibha Goyal | Mar 25, 2023 |

Audit Trail from 1st April: Are you ready for the change? How to get Audit Trail in Tally

As per the MCA notification dated 31st March 2022, the requirement for accounting software that has an audit trail is applicable with effect from 1st April 2023.

Now this change was originally notified with effect from 1st April 2021, first differed to 1st April 2022, and then to 1st April 2023. Since it has already been deferred 2 times, there is high chance that it won’t be deferred now.

This big question is, “Are you ready for the change?”

Now Most of the Business use Tally to do their Accounting, this comes as a surprising fact that Tally provides the feature of Audit Trail.

You need to have TallyPrime 2.1 and the feature of Audit Trail is available in this version.

Already have the Company’s data on Tally

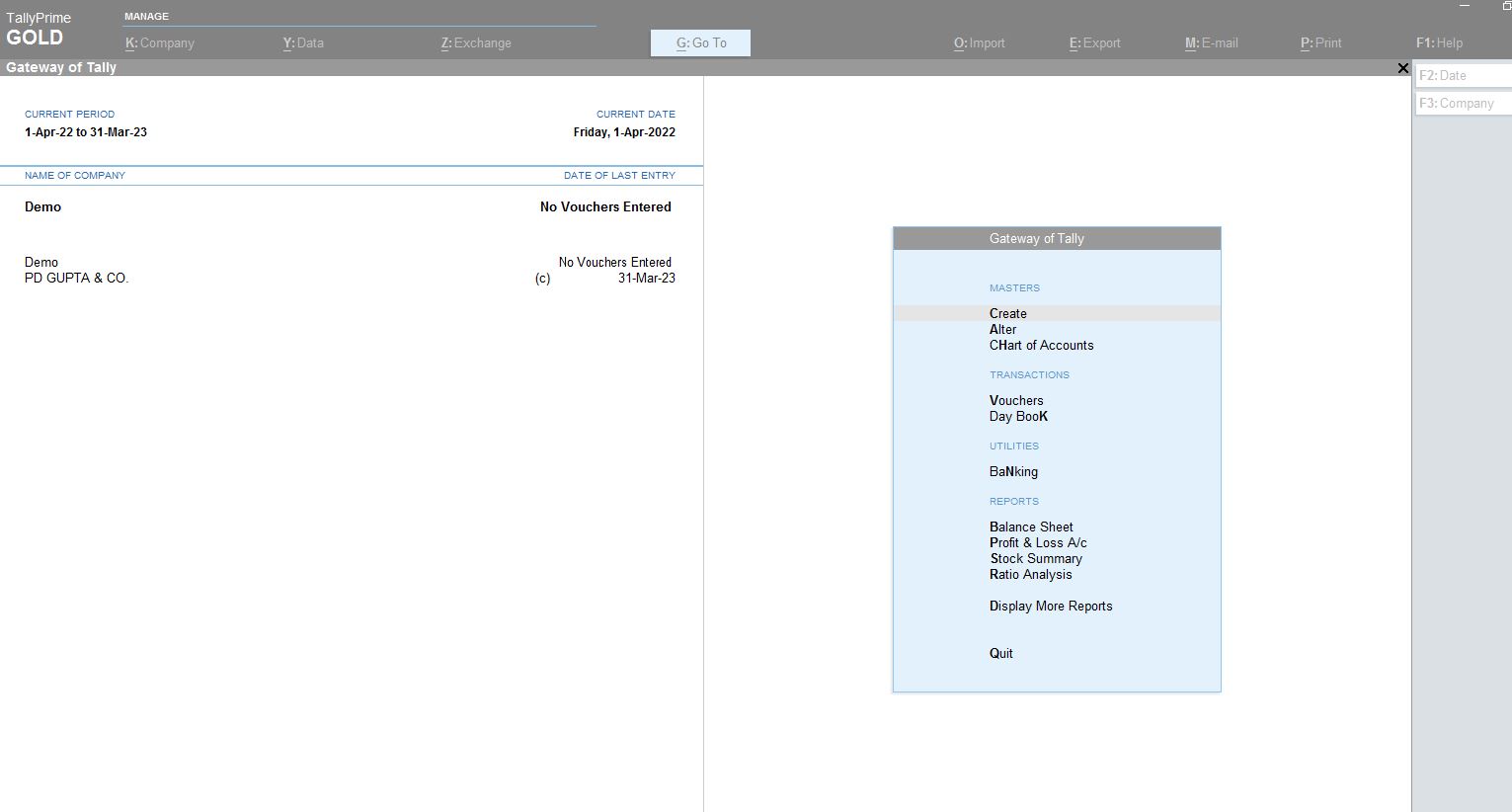

Load the Data of the Company

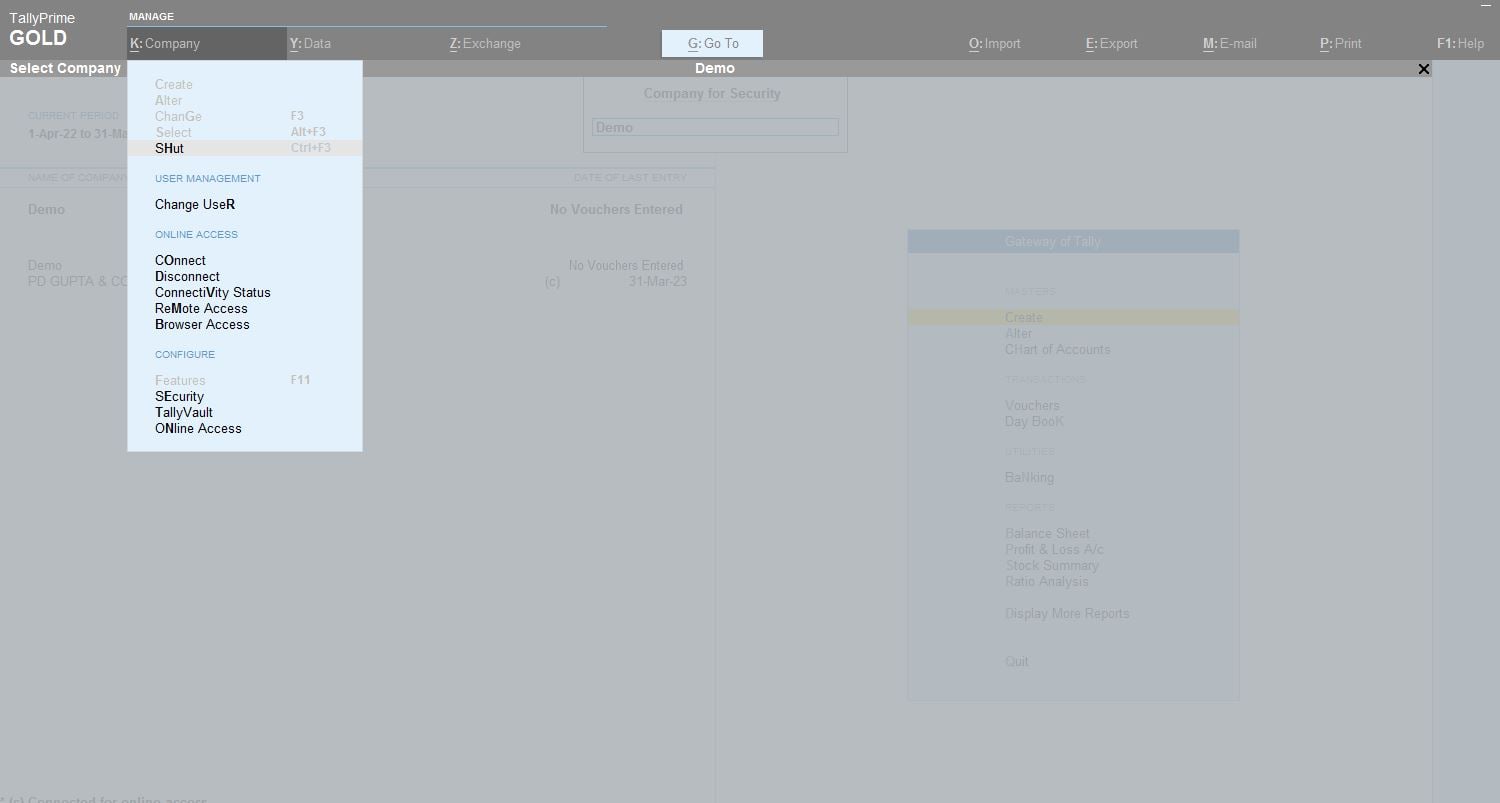

Press Alt+K to Alter the Company’s Menu. First, you need to enable security features.

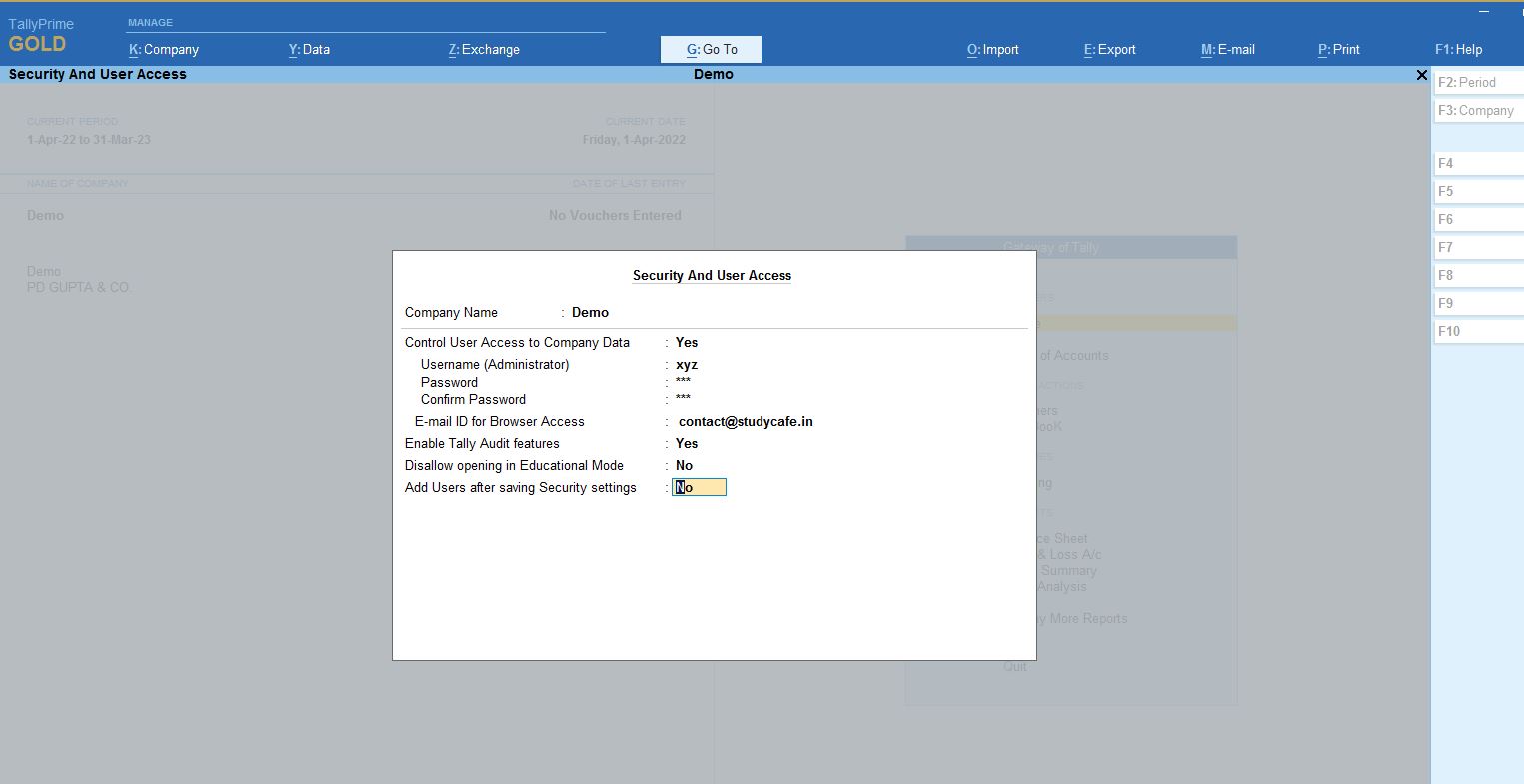

First, you need to enable security features. Need to provide Username and Password.

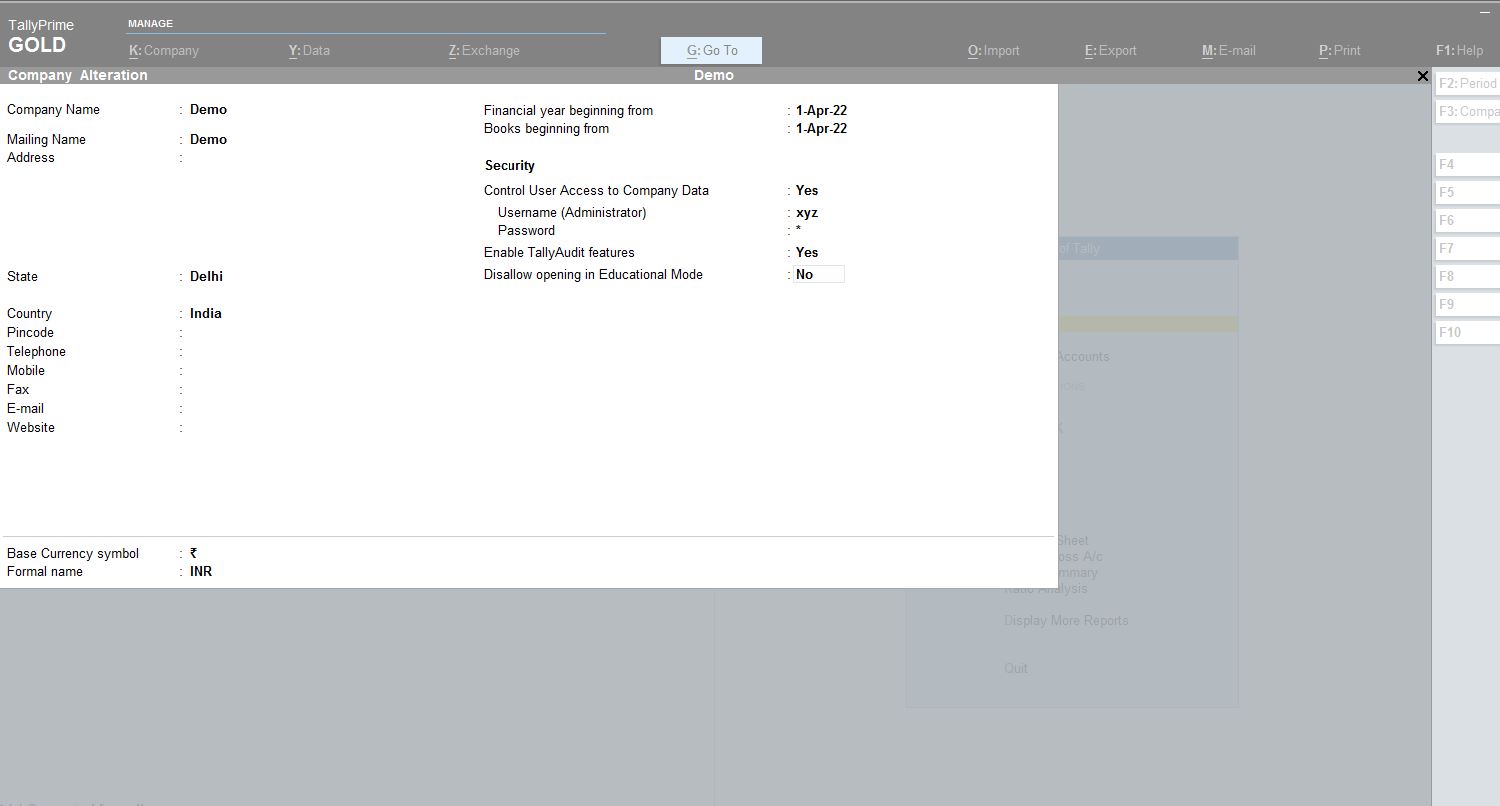

Now you need to Alter the features of the company. Here check yes on Security and Enable Tally Audit Features.

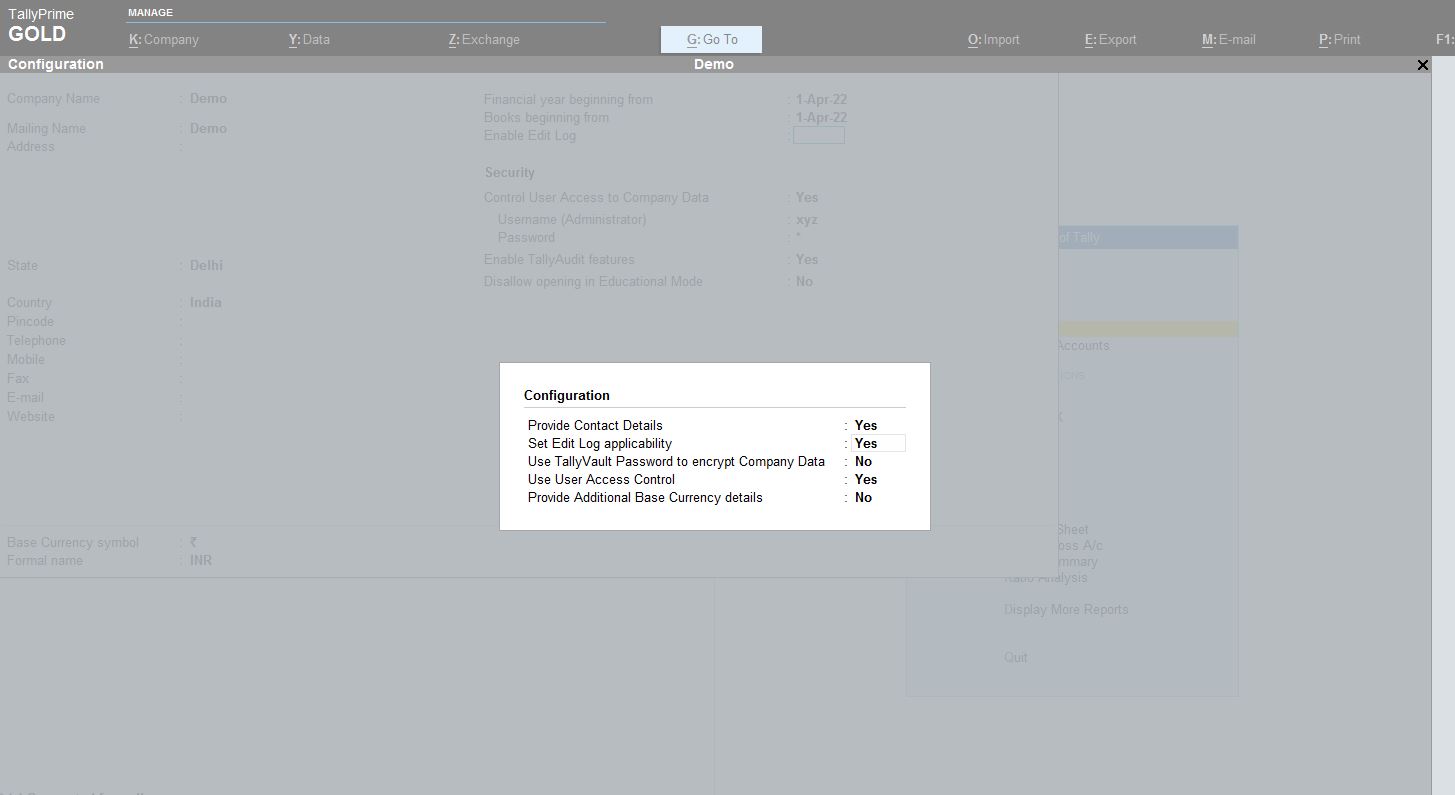

If the Security and Enable Tally Audit Features is not available, Press F12 for ‘Configure and Enable ‘Set Edit Log Applicability’ Next, Set ‘Enable Edit Log’ to ‘Yes’ in the company alteration screen.

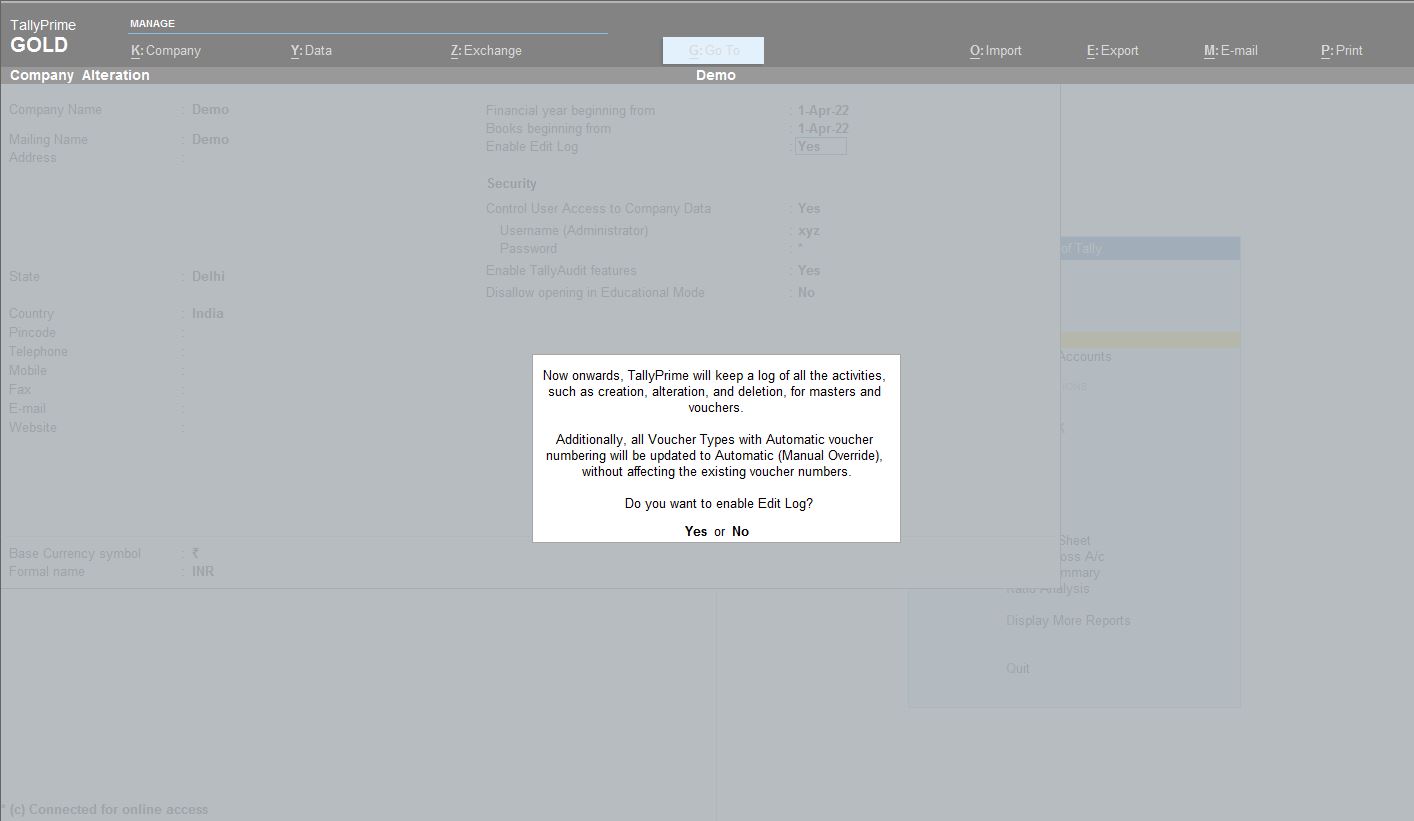

Once Security and Enable Tally Audit Features are enabled, it gives a warning message that all the voucher numbering will be Automatic now on.

If you are a new Company

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"