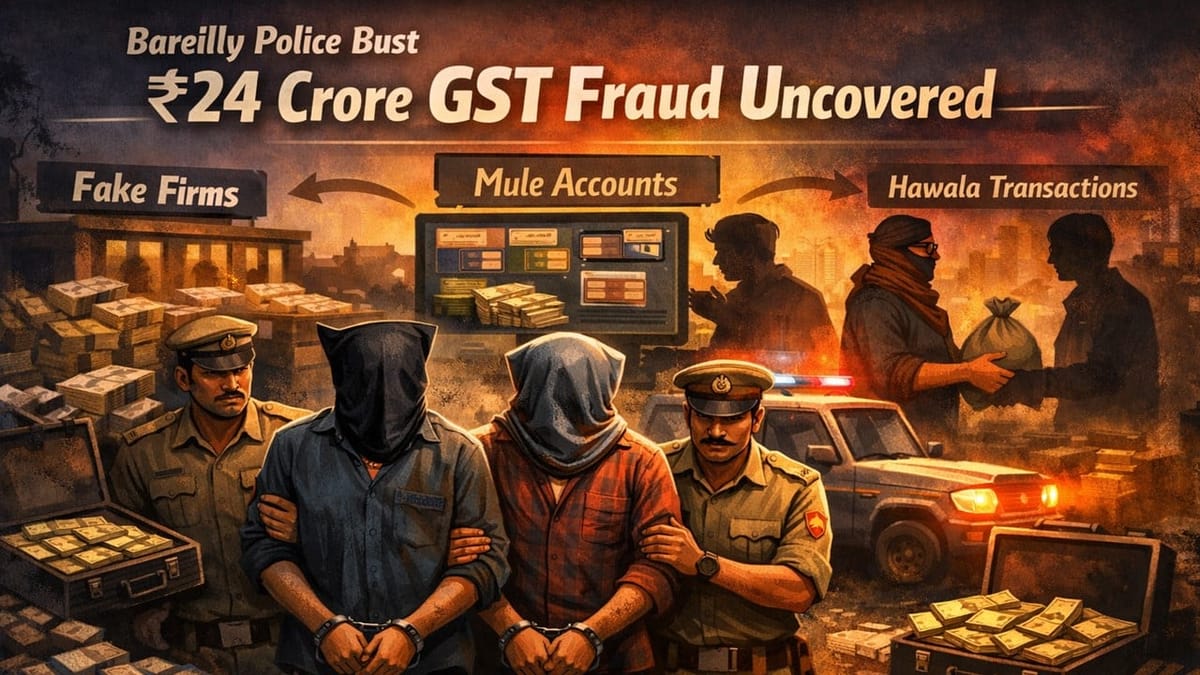

Bareilly Police uncovered a Rs. 24 crore GST fraud involving fake firms, mule accounts and suspected hawala transactions, leading to the arrest of two key accused.

Saloni Kumari | Jan 6, 2026 |

Bareilly Police Unearths Massive Rs. 24 Crore GST Fraud Linked to Hawala Network; Two Key Accused Arrested

The Uttar Pradesh, Bareilly Police has exposed a massive hawala and GST fraud network worth approximately Rs. 24 crore. The scam involved the use of illegal financial transactions.

As of now, the police have arrested two individuals named Shahid Ahmed and Amit Gupta in relation to the case. These individuals are alleged to have used bogus firms and so-called “mule accounts” to move money, officials said on Tuesday.

Bareilly Superintendent of Police Anshika Verma stated on Monday that the racket was exposed following an income tax notice received by a small zari artisan, raising a demand amounting to Rs. 1.5 crore on grounds that he was not aware of.

Under the said racket, small traders and daily wage workers were targeted. They were convinced to enter the export market and expand their businesses.

The accused allegedly convinced these targeters to give their identity proofs, such as Aadhaar and PAN cards, and thereafter used these documents to open bogus bank accounts in their names and to form shell firms. The accused used these shell companies to make large-scale unauthorised transactions.

The Bareilly Superintendent of Police Anshika Verma stated, “At first glance, it appears to be a GST fraud, but the movement of funds suggests the possible involvement of a hawala network.” Also said, “About ₹24 crore in suspicious transactions were routed through this firm within a year.”

The investigation further revealed that there were several companies named Mahavir Trading Company, Mahakal Traders and Sumit Traders, which only existed on paper. The accused used these fake firms to generate fake bills and invoices to evade GST (Goods and Services Tax). An individual belonging to a neighbouring Shahjahanpur district is also under investigation by the police in connection with the case. Police recovered several mobile phones and cash during the investigation.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"