CA Pratibha Goyal | Dec 28, 2023 |

![[Breaking] Due Date for passing GST Order u/s 73(10) extended to 30th April 2024](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2023/12/Time-Limit-for-issuing-SCN-us-73-and-Sec-74-1.jpg)

[Breaking] Due Date for passing GST Order u/s 73 extended to 30th April 2024

The Central Board of Direct Taxes and Customs have extended due date for passing GST Assessment Order u/s 73(10) from 31st March 2024 to 30th April 2023 for FY 2018-19. This also means that the due date for issuance of Show Cause Notice u/s 73 has been extended from 31st December 2023 to 31st January 2024.

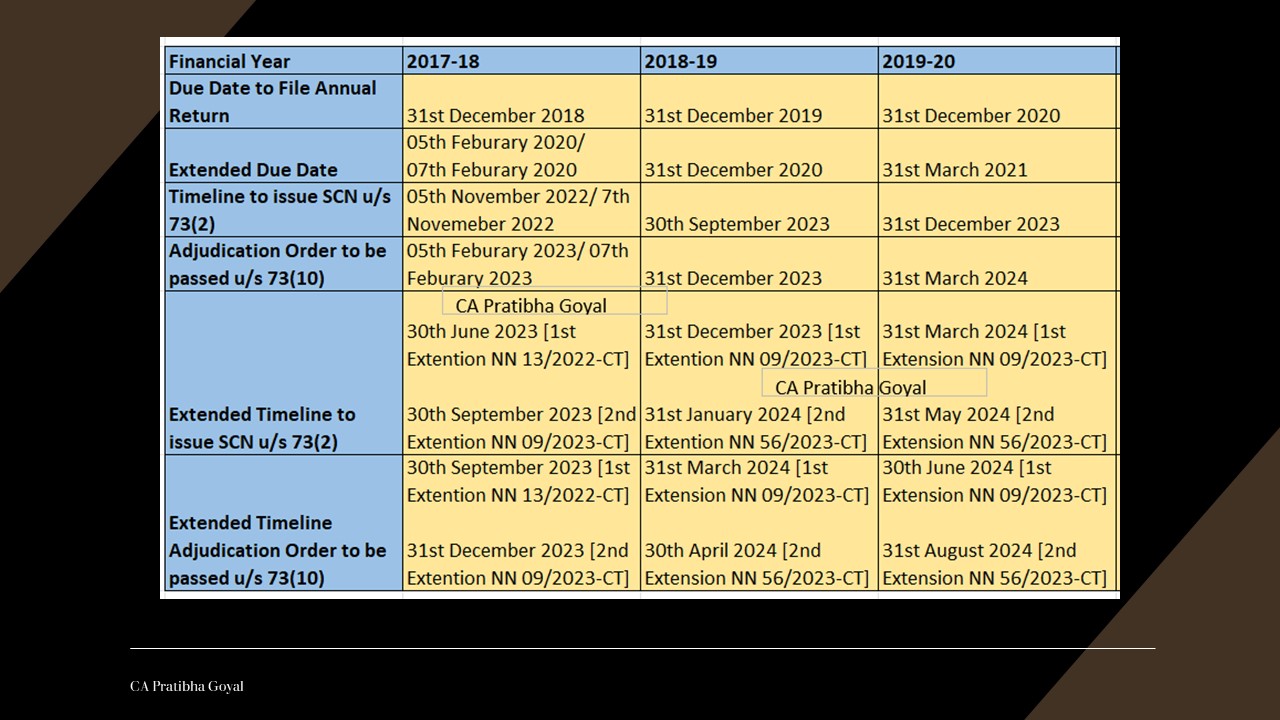

Time Limit for issuing SCN

The time limit for making order u/s 73 [When there is no fraud] is 3 years from the due date of filing the annual return for the year to which the demand relates or date of refund.

The time limit for SCN 3 months before the expiry of 3 years.

Summary of Extended Notifications:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"