CA Pratibha Goyal | Jun 25, 2022 |

Breaking: GST Compensation Cess period extended till 31.03.2026

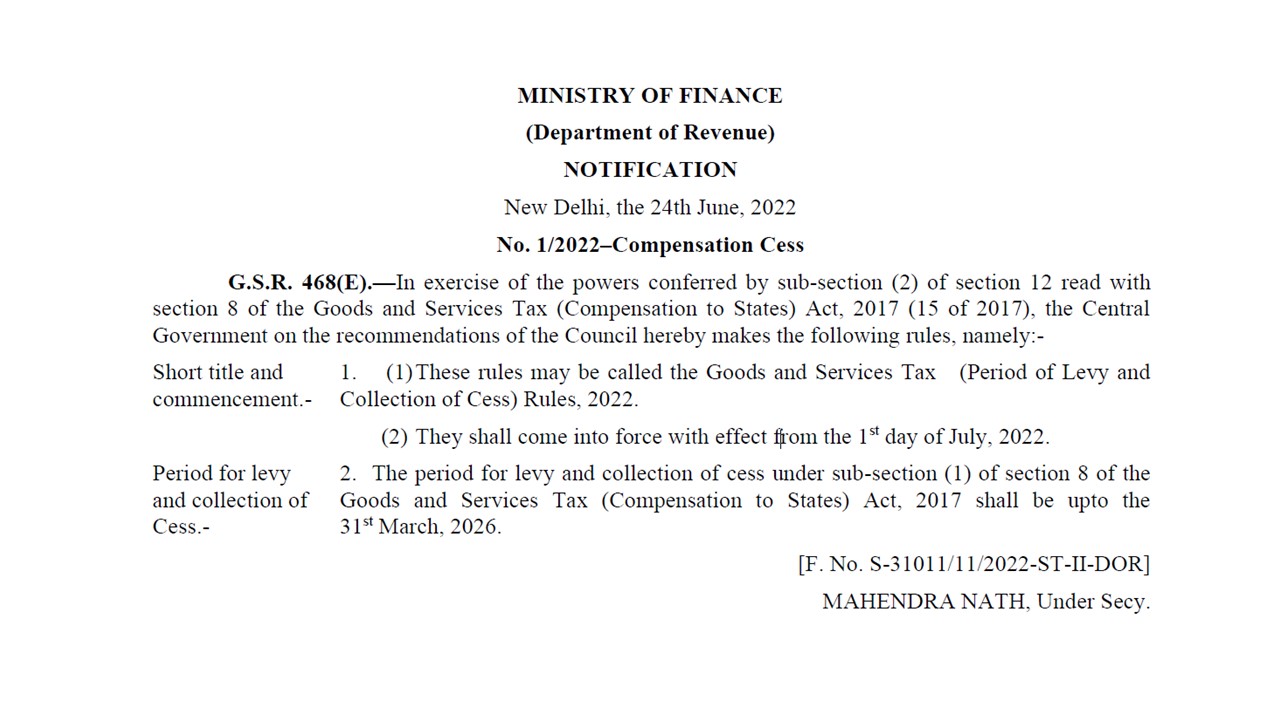

Ministry of Finance vide Notification No. 1/2022 – Compensation Cess dated 24th June 2022 has extended the Period of Levy and Collection of GST Compensation Cess up to 31st March 2026.

Notification is given below for reference:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"