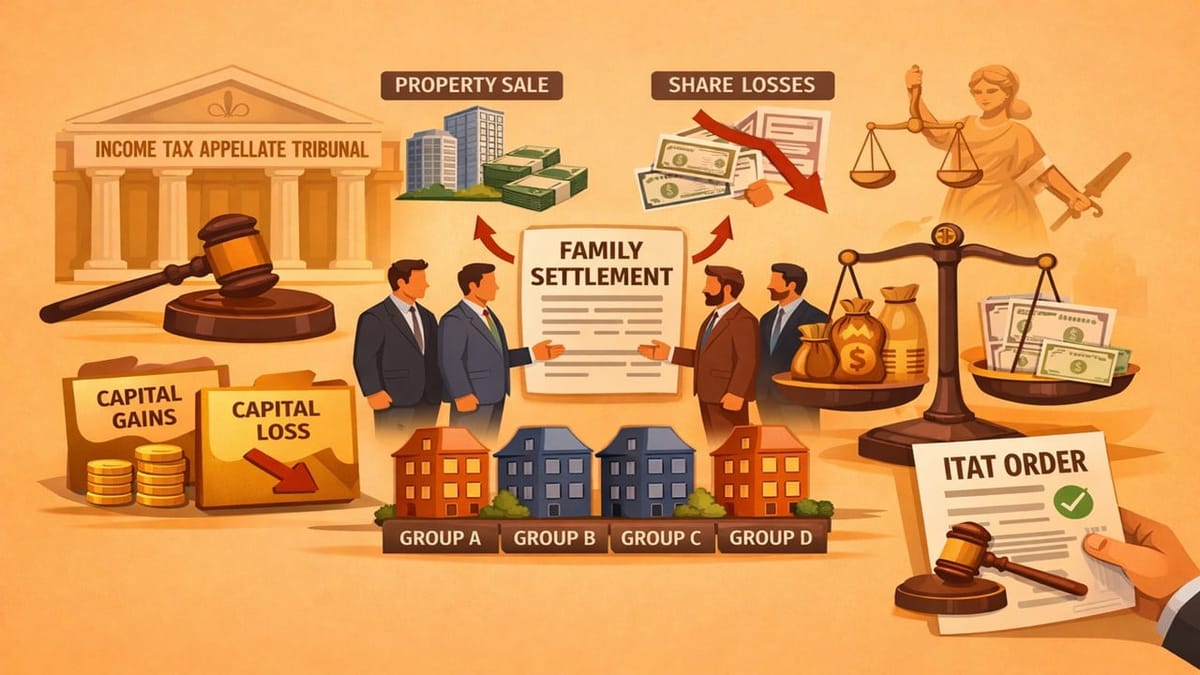

ITAT Rules in favour of assessee to claim long-term capital gains and losses after corporate restructuring under family settlement.

Vanshika verma | Dec 21, 2025 |

ITAT Upholds Capital Gains and Loss Claims in Family Settlement Restructuring

ACIT, Circle has filed the present appeal against M/s. KCT Papers Limited in the Income Tax Appellate Tribunal (ITAT) in Mumbai, challenging an order passed by the CIT(A) dated March 21, 2014, for the assessment year 2008-09.

The assessee company is part of the Thapar Group, originally established by the Late Lala Karam Chand Thapar. Over time, the family decided to reorganise their business holdings. On April 27, 2001, a family settlement was made, which split the group into four separate groups, each managed by one of Lala K.C. Thapar’s sons.

As part of this settlement, several companies were restructured or merged under different schemes. The assessee company is part of the BMT group, which includes Sh. B.M. Thapar and his sons, Sh. Gautam Thapar and Sh. Karan Thapar. The company had long-term capital gains from selling its rights to a commercial property. Originally, two companies, Modem Agencies Ltd and KCT Bros Ltd, had invested Rs. 4,10,00,000 in M/s Energetic Construction Pvt. Ltd to develop the World Trade Centre in Gurugram. In return, they were entitled to 24,261 sq ft of built-up area. After Modem Agencies merged with KCT Bros, all rights came under KCT Bros. Later, during a demerger, these rights were divided among four companies, including the assessee. The assessee sold its share of these rights to TCG Urban Infrastructure Holding Ltd for Rs. 5,19,65,736, while its cost was Rs. 1,83,39,832, resulting in long-term capital gains of Rs. 3,36,25,904.

Separately, the company also incurred losses from shares of Ballarpur Industries Ltd. (BILT) because of a buyback. Initially, BILT shares were split, and then the company bought back a portion of them, giving the assessee Rs. 49,40,64,800. These shares originally belonged to other group companies but came to the assessee through family settlement and mergers. The shares were transferred during these reorganisations at their original book value.

The assessee argued that the cost should be the original purchase price in the hands of the previous owner, adjusted for inflation, and for shares acquired before 1981, the Fair Market Value as of April 1, 1981, should be used. This would give a higher cost base and lower taxable capital gains.

The tax officer disagreed, saying the cost should be the book value of the shares on April 1, 2006, and the holding period should start from 2006. However, AO rejected the long-term capital gains of Rs 38,205,23,93 instead of the loss claimed by the assessee at Rs 23,385,80,71.

The assessee thereafter filed an appeal before the CIT(A). The CIT(A) allowed the appeal of the assessee based on family arrangements but did not adjudicate on the issue of whether the assessee is eligible to claim the benefit of previous ownership due to restructuring and provisions contained in the provisions of section 2(1B) and section 2(19AA) of the Act.

The assessee further approached ITAT; during the hearing, AR cited a similar case (B.A. Mohota Textiles Traders Vs DCIT) of the Hon’ble High Court of Bombay in which the court held that a company is a separate legal entity, independent of its shareholders and could not be part of a family settlement or arrangement among such shareholders.

Tribunal noted that the company went through some corporate changes, where some parts were amalgamated, and some parts were demerged. The company’s representative provided detailed explanations showing that they did follow the rules. They explained that in the demerger, the new entity took over all the assets and liabilities related to the paper division of KCTBL, and this was done according to the scheme approved by the Delhi High Court.

After considering the facts, the Tribunal allows the ground raised by the assessee on claiming long-term capital gain on the transfer of BITS shares and the claim of long-term capital loss by the assessee. As a result, the appeal filed by the revenue was dismissed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"