Reetu | Mar 26, 2022 |

Breaking: Upcoming New Changes in GSTR-3B

The GST Council in its 45th meeting held on 17th September, 2021 recommended to notify “Restaurant Service” under section 9(5) of the CGST Act, 2017 along with other services notified earlier such as motor cabs, accommodation and housekeeping services wherein the tax on such supplies would be paid by electronic commerce operator if such supplies made through it.

Notification No. 17/2021-Central Tax (Rate) and 17/2021-Integrated Tax (Rate) dated 18.11.2021 were issued in this regard for intra state and inter-state supply respectively.

Accordingly, the tax on supplies of restaurant service supplied through e-commerce operators, shall be paid by the e-commerce operator with effect from the 1st Janua1y, 2022.

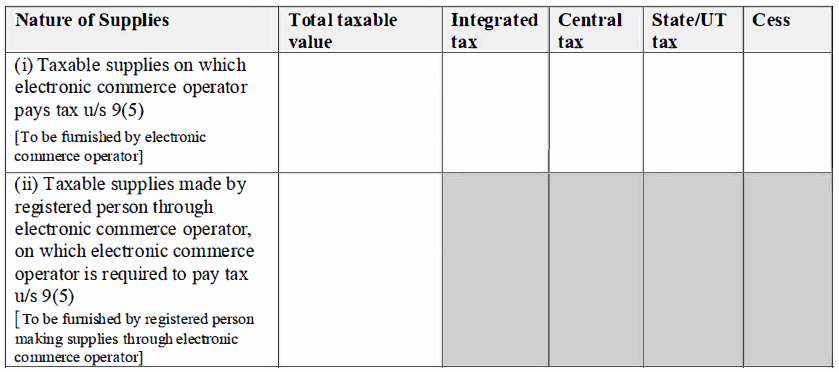

To comply with the notification issued, a new table 3.l(A) shall be added in Form GSTR-3B for reporting of supp lies made under section 9(5) of CGST Act and corresponding provisions in IGST /SGST /UTGST Acts.

The structure of table 3.1(A) shall be as follows:

In row (i), the electronic commerce operators shall be required to report the supplies on which they are liable to pay taxes.

The details so added, shall be added to the liability under other than reverse charge in Table 6.1.

The liabilities so reported will be required to be paid by cash only.

Out of the supplies reported in table 3.1(A)(i), the breakup of Inter-state supplies, POS wise on the supplies made to Unregistered persons, composition taxable persons and UIN holders, is required to be reported in table 3.2

In Row (ii), the registered persons making supplies through electronic commerce operators shall be required to report the supplies which are made by them through electronic commerce operators.

The values auto-drafted in table 3.1(a) and table 3.1(c) from GSTR-1 include the supplies which are made through electronic commerce operators.

Source: Twitter

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"