ITR Filing season is soon to end. Taxpayers have to report all of their income in the ITR form as many individuals generate income by buying and selling stocks.

Reetu | Jul 20, 2024 |

Reporting Stock Trading Income in ITR

ITR Filing season is soon to end. The last date to file an Income Tax Return is 31st July. Taxpayers have to report all of their income in the ITR form to have less complication after filing. We know that income from salary, rental income and business income is taxable.

But, many salaried Taxpayer, homemakers and retired individuals generate income by buying and selling stocks/ shares, but they are confused about how their earnings are taxed.

Income/loss from the selling of equity shares is reported under the heading ‘Capital Gains’.

Under the head ‘Capital Gains’, income is further classified into:

This classification is based on the holding period of the shares. The holding period is the time period during which an investment is held, beginning with its acquisition and ending with its sale or transfer.

It should be mentioned that the holding periods for shares and securities change depending on the class of capital asset. For income tax purposes, the holding periods of listed equity shares and equity mutual funds differ from those of debt mutual funds. Their tax rates are also different.

| Type | LTCG | STCG |

| Listed Shares | More than 12 months | Within 12 Months |

| Unlisted Shares | More than 24 months | Within 24 Months |

| Equity Orinted Mutual Funds | More than 12 months | Within 12 Months |

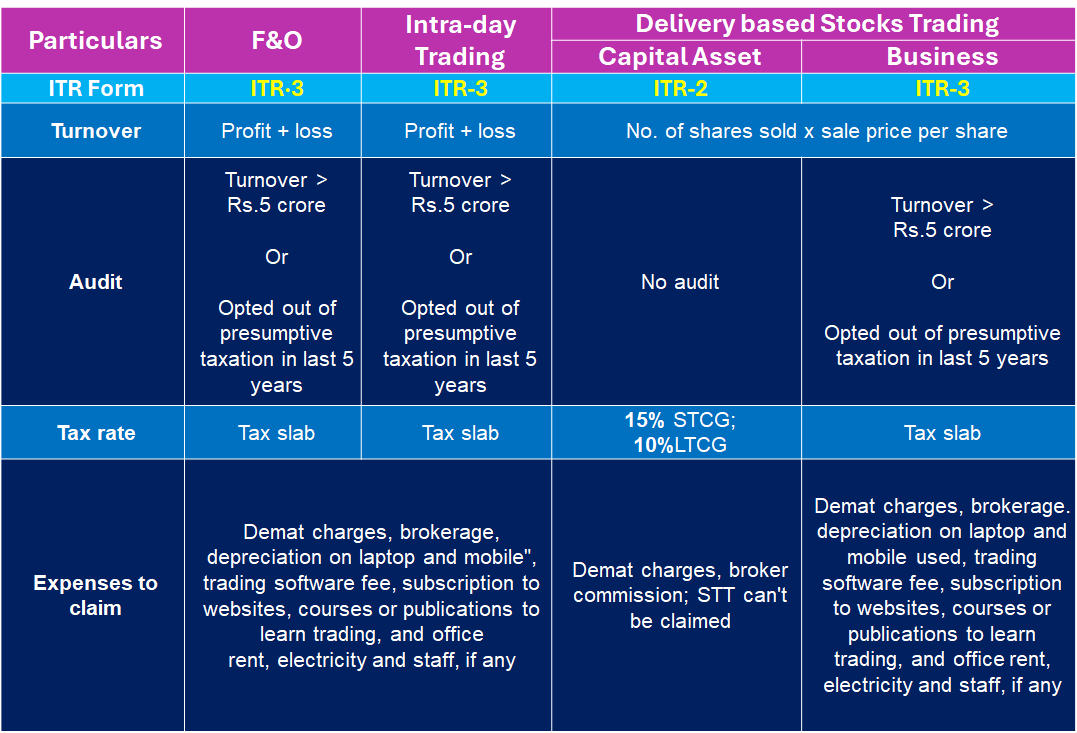

When a salaried individual starts investing a portion of their income in the stock market, they may be unclear whether to submit ITR 2 or ITR 3 to report their profits. This confusion arises because the type of ITR that salaried individuals submit is determined by the other income categories included in their total income. Let’s understand this in depth.

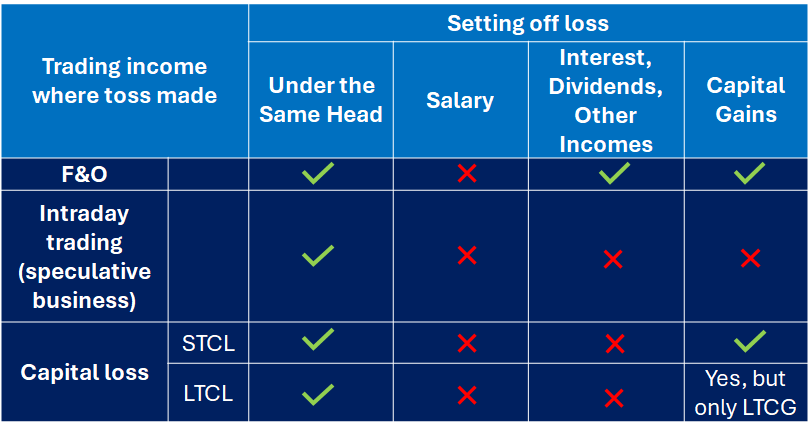

You can offset F&O losses with STCG or even interest. Intraday trading, in contrast, is regarded as speculative income and cannot be adjusted against other categories.

Stock trading is divided into two parts:-

Business – When multiple trades are done in a year and it’s your primary income. Trading in futures & options must be ideally reported as a business,

Capital Asset – When a few trades (<10) are done as an investment in a year.

Example: Let’s understand it with a hypothetical case. All calculations are based on assumption and are indicative.

For Example Mr A buys 1000 units of Futures of Company XYZ Ltd. @ Rs 210 and sells at Rs 200.

He also buys 2000 units of futures of Company ABC Ltd. @ Rs 200 and sells at Rs 290. This is how his turnover would be determined:

| Particulars | Calculation | Amount |

| Loss on sale of Futures | 1000 * 10 | 10000 (negative ignored) |

| Profit on sale of Futures | 2000*90 | 180000 |

| Total Turnover for Tax Audit | 190000 | |

In this case, turnover for checking Tax Audit Applicability is 190000, Net income is Rs. 1.7 Lakh.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"