CA Pratibha Goyal | Jul 1, 2023 |

CA New Education Scheme: ICAI releases FAQs, Study Material, Syllabus, Transition Plan for New Education Scheme

The Institute of Chartered Accountants of India (ICAI) has finally notified Chartered Accountants (CA) New Education Scheme on 1st July 2023. The Inauguration of the CA New Education Scheme was done by Droupadi Murmu, the Honorable President of India.

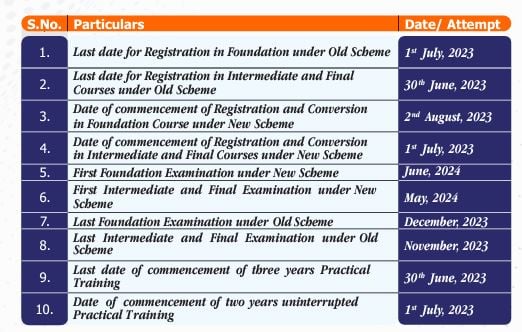

Important dates for the implementation of the New Scheme of Education and Training are given as under:

Transition for Existing Students:

Final Level and Inter Level: Students who will appear in November, 2023 and are unsuccessful in both the groups have to appear May 2024, under new Education Scheme.

All the new registration will be now under new Education Scheme.

Below is the link to read Prospectus, Syllabus, Frequently Asked Questions (FAQs), Study Material related to the Chartered Accountants New Education Scheme. It also has Transition Scheme related to the present students.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"