CA Pratibha Goyal | Jul 5, 2023 |

CA Result May 2023 Declared: Know CA Exam Pass Percentage

The result of the Chartered Accountancy exams for the CA Final and CA Inter May Exam has been declared by the Institute of Chartered Accountants of India (ICAI). The pass percentage for CA Exam in May 2023 is as follows:

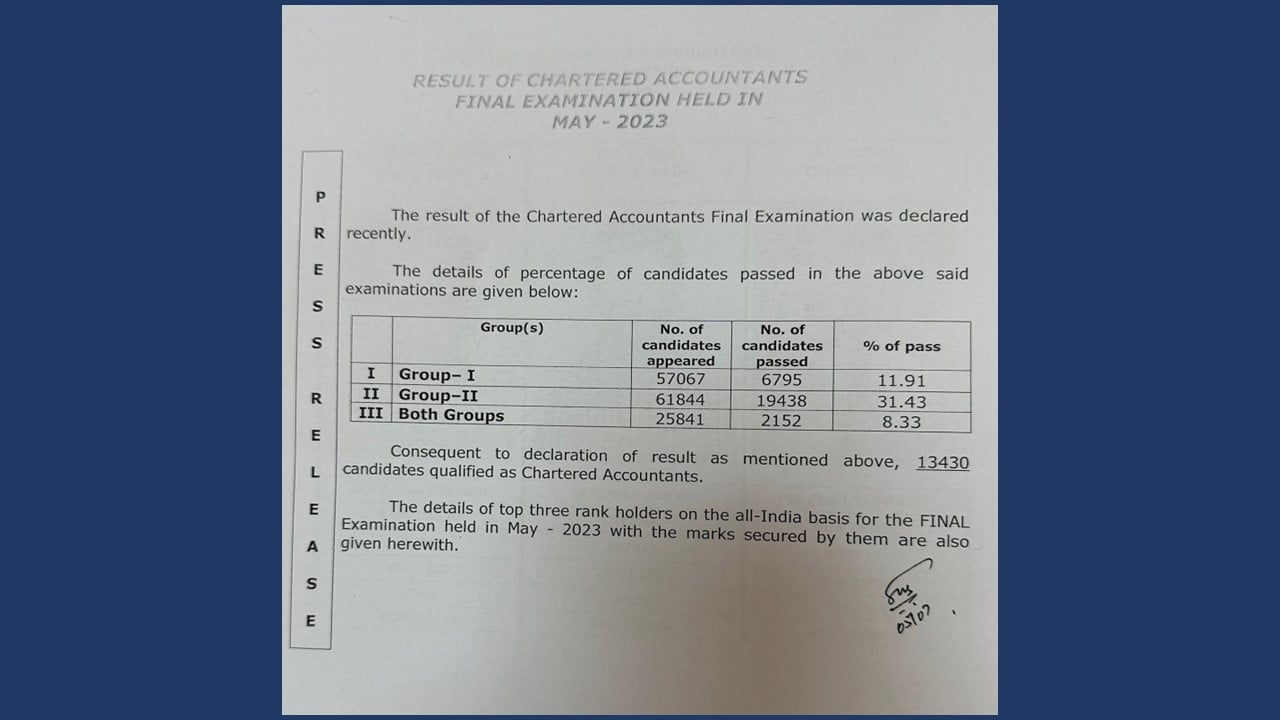

CA Final Pass Percentage May 2023

A total of 8.33% of Students passed both groups of CA Final May 2023. 11.91% of students passed Group-1 and 31.43% students passed Group-II.

13430 Students became Chartered Accountants today.

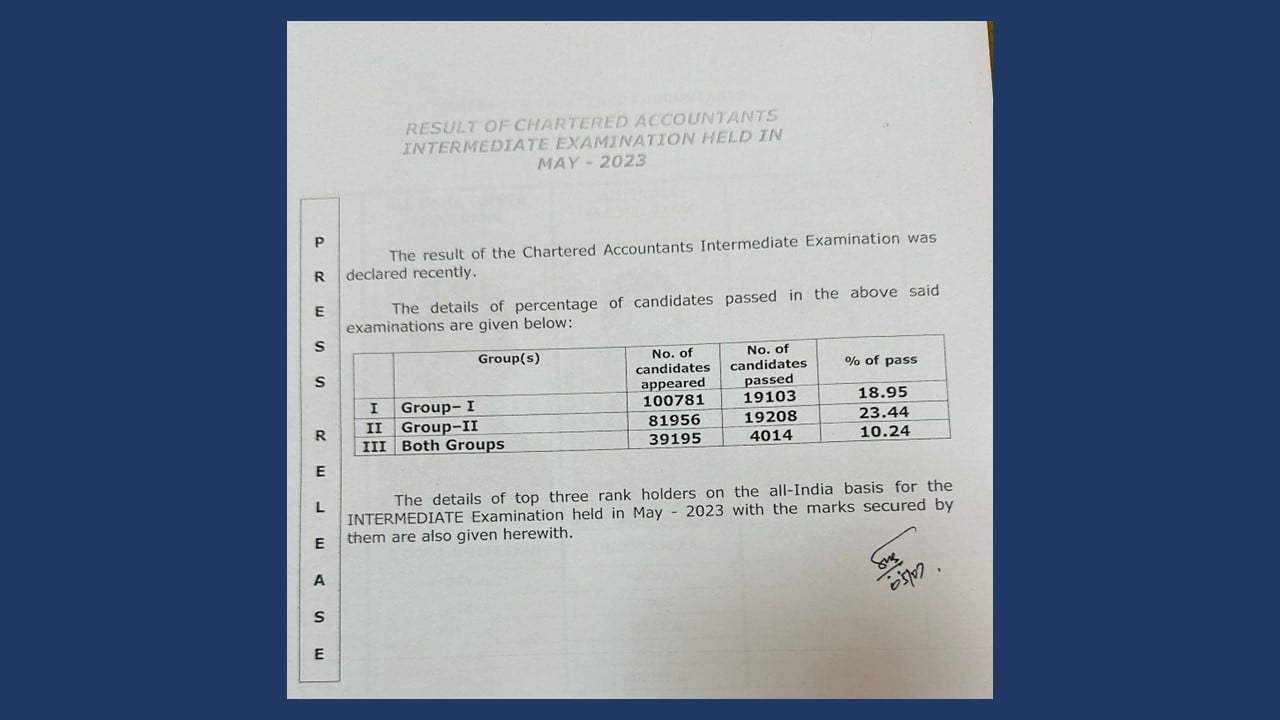

CA Inter Pass Percentage May 2023

A total of 10.24% of Students passed both groups of CA Inter in May 2023. 18.95% of students passed Group-1 and 23.44% of students passed Group II.

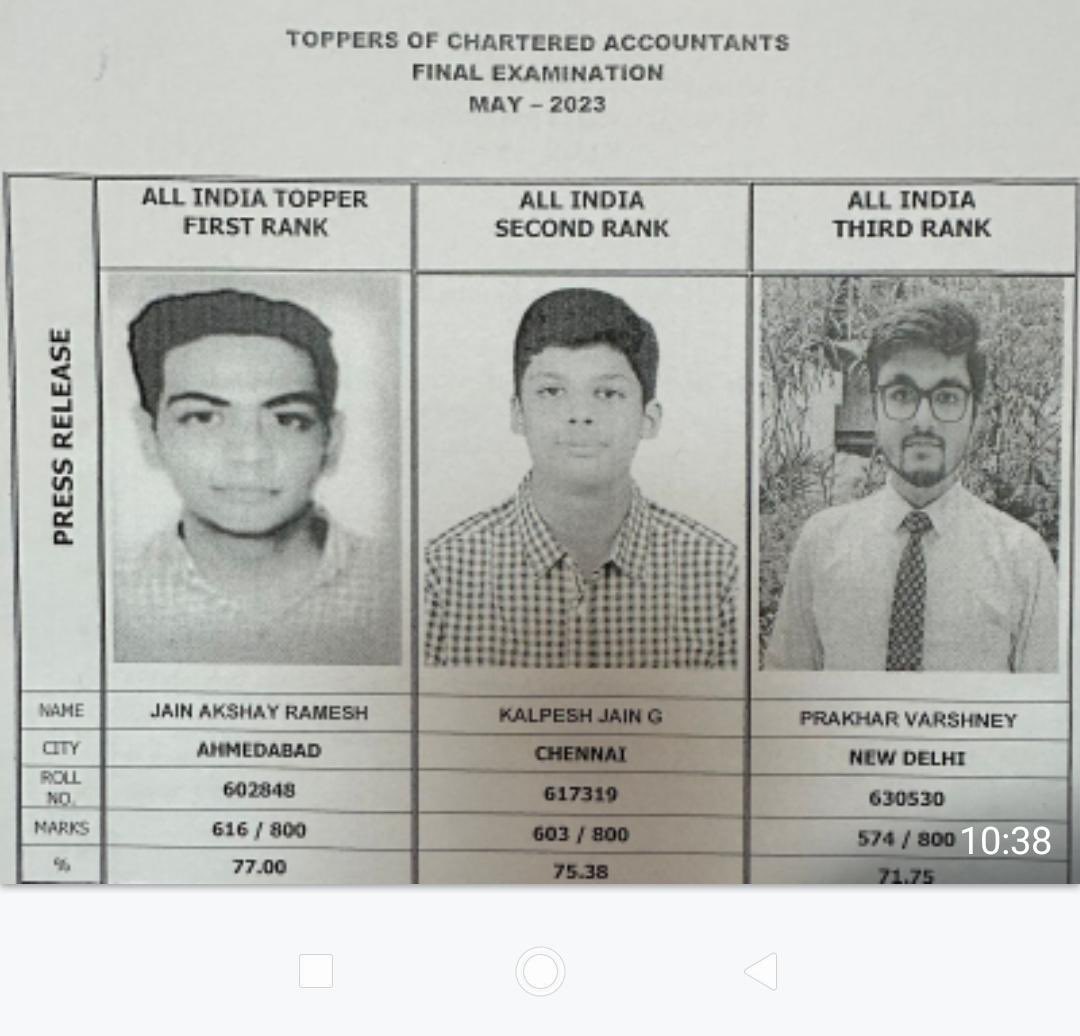

Jain Akshay Ramesh from Ahmedabad topped the CA Final Exam with 616 marks out of 800 and secured the first rank. Kalpesh Jain with 603 marks secured the 2nd rank and Prakhar Varshney with 574 marks secured the 3rd rank.

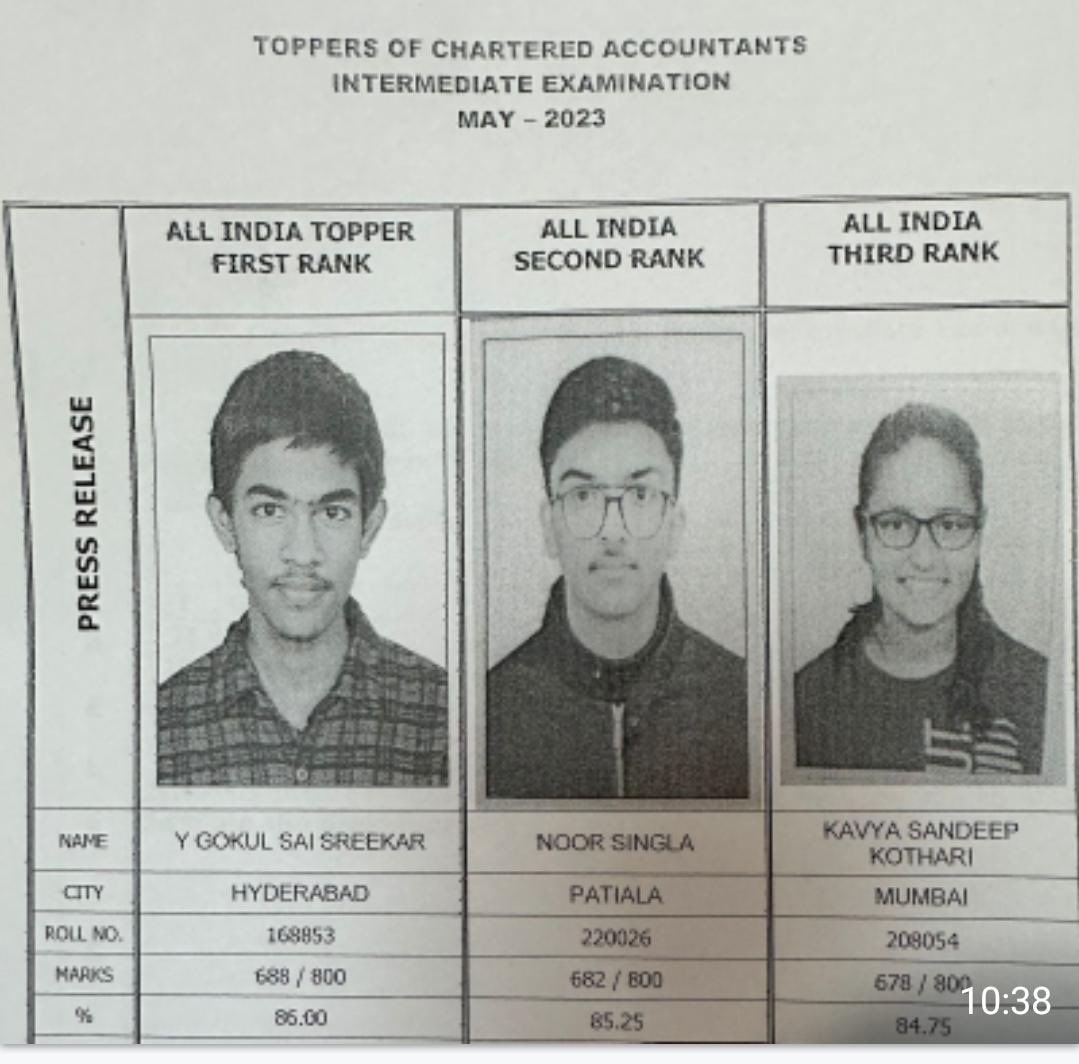

In CA Inter Examination, Gokul Sai Sreekar from Hyderabad secured first rank with 688 marks out of 800. Noor Singla from Patiala with 682 marks secured second rank. Kavya Sandeep Kothari from Mumbai secured third rank with 678 marks.

Students can follow the steps below to check the result:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"