Now relief is proposed to taxpayers to compute the capital gains tax under the new scheme at 12.5% and old scheme at 20% and pay the tax that is lower than the two.

Reetu | Aug 9, 2024 |

Capital Gain Taxation: Govt brings back indexation benefit on sale of property

House Property is considered as a capital asset for income tax purposes. As a result, any gain or loss incurred from the sale of a house property may be subject to taxation under the ‘Capital Gains’ head.

A capital gains tax is a tax on the profits earned from the sale of a non-inventory asset. The most common capital gains come from selling stocks, bonds, precious metals, real estate, and property.

In Budget 2024, the government removed the benefits of Indexation on the sale of the property. This means people can no longer claim indexation benefit on property purchase prices to reduce capital gains. Before this change, long-term capital gains from selling property were taxed at 20% with indexation. Now new tax rate is 12.5%, but without indexation benefit.

The Finance Minister clarified that properties bought before April 1, 2001, can use the higher actual purchase price or the fair market value as of April 1, 2001, to calculate gains. For properties bought after April 1, 2001, the actual purchase price will be used.

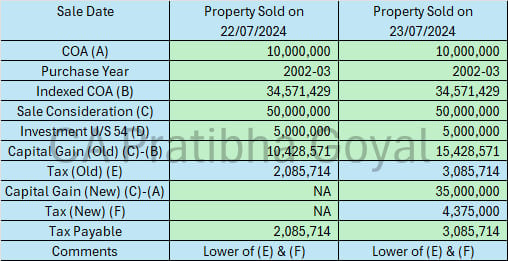

This change was applicable with effect from 23rd July 2024 and was resulting in Loss to many Taxpayers who sold the property after this date.

Now, the Finance Minister has given relief in the form of allowing taxpayers to compute the applicable tax on capital gains under the new scheme at 12.5% without indexation and the old scheme at 20% with indexation and pay the tax that is lower than the two.

This relief is for resident individuals/ HUF. Indexation Benefit restored for Property purchased before 23rd July.

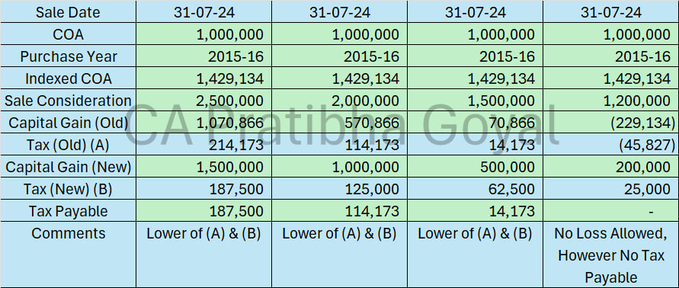

Let’s understand how it works –

Example:

Purchase cost – Rs.10L in FY 2015-16

Date of Sale – 31/07/24 for Rs.20,00,000

Index cost of Acquisition – Rs.14,29,134

Let’s do the Tax calculation:

Tax by the old way of Capital Gain Calculation [with Indexation]

CG = Rs.25,70,866

Tax = Rs.114,173

Tax by the new way of Capital Gain Calculation [Without Indexation]

CG = Rs.10,00,000

Tax = Rs.1,25,000

* You need to pay a Tax of Rs.114, 173 [Plus Cess].

The Benefits of Loss are not allowed. Let’s understand.

Loss as per Old Calculation: Rs.229,133 (With Indexation)

Gain as per New Calculation: Rs.200,000 (Without Indexation)

Tax: Rs.25000

A loss of Rs.229,133 is not allowed. But you don’t need to pay Tax.

Example:

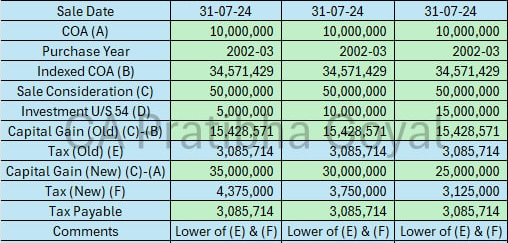

If the Tax Payable under the New Provisions (Without Indexation) exceeds the Tax Payable under the Old Provisions (With Indexation), and the property is purchased before July 24th, the excess Tax will be ignored.

Please keep in mind that capital gain deductions, such as Sections 54, 54F, 54EC, and so on, will be taken into account in capital gain calculations under the new provisions.

From the above example you can understand that in many of the cases investing to save capital gain as per Sections 54, 54F, 54EC, etc. would be of No use.

From the Above Example, you can see that the Taxpayer had no impact of investment u/s 54 and he paid an Extra tax of Rs. 10,00,000 due to the new provisions.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"