CBDT notifies Sections for Non-Deduction of TDS when payee is IFSC [Read Notification]

CA Pratibha Goyal | Mar 8, 2024 |

![CBDT notifies Sections for Non-Deduction of TDS when payee is IFSC [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2024/03/Non-Deduction-of-TDS.jpg)

CBDT notifies Sections for Non-Deduction of TDS when payee is IFSC [Read Notification]

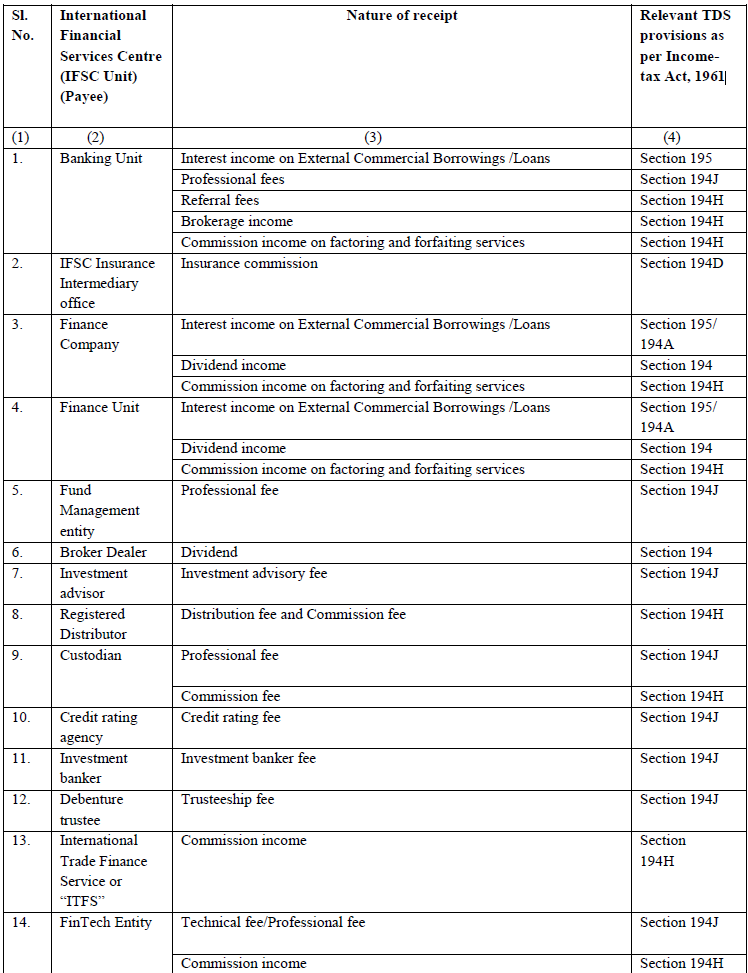

The Central Board of Direct Taxes (CBDT) has notified that no deduction of tax shall be made under the provisions of the Income-tax Act in respect of payment made to Unit of International Financial Services Centre, (hereinafter referred as ‘payee’). The Relevant TDS provisions as per Income tax Act, 1961 where no-TDS will be deducted are:

The Notification has been issued In exercise of the powers conferred by sub-section (1F) of section 197A read with subsection (1A) and sub-section (2) of section 80LA of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred as the Income-tax Act). This notification shall come into force on 1st day of April, 2024.

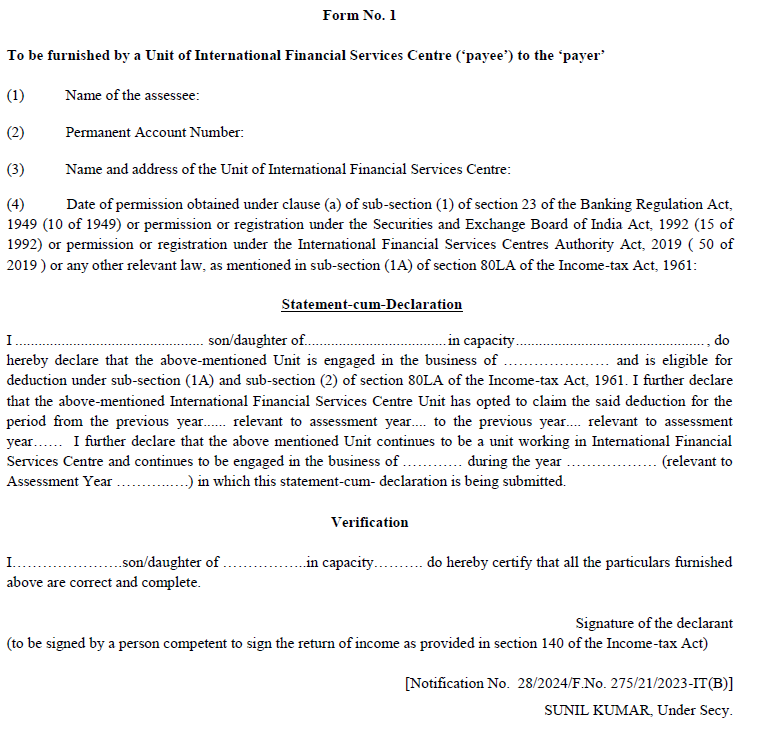

The unit of International Financial Services Centre (IFSC) is required to furnish Form No. 1 to obtain this benefit.

Click on the Link given below to Download the Notification.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"