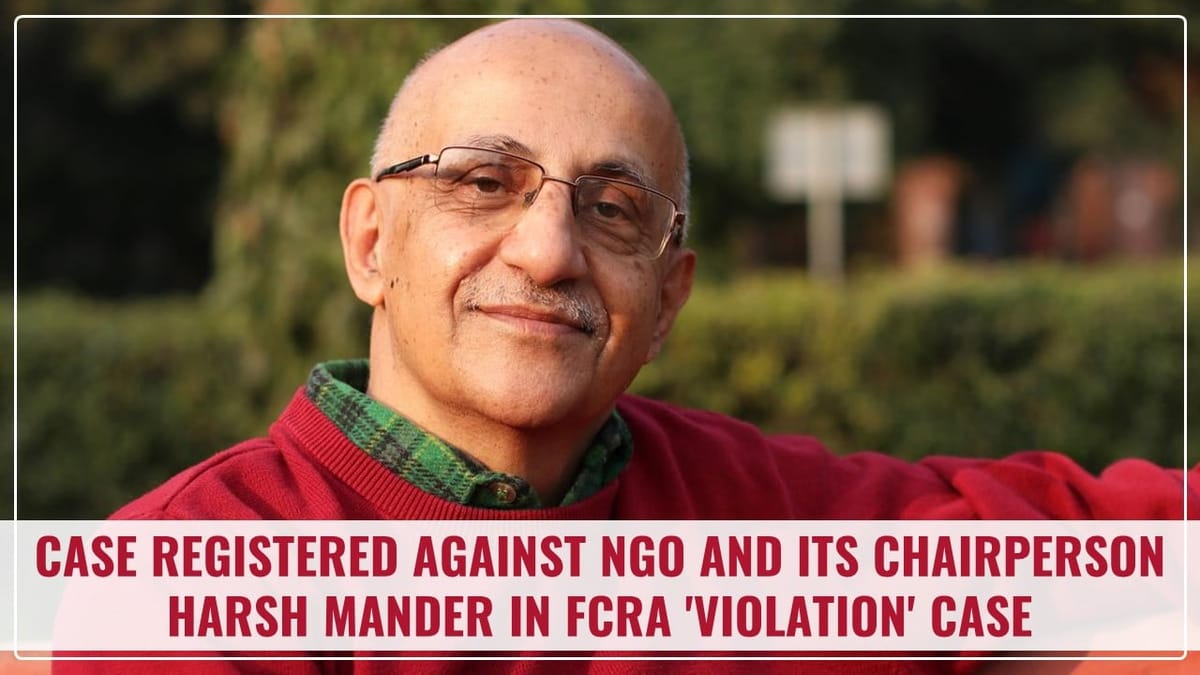

CBI has registered a case against a Delhi based NGO and its Chairperson on allegations of violations of the provisions of the FCRA,2010.

Reetu | Feb 3, 2024 |

CBI registers case against NGO and its Chairperson on Allegations of FCRA Violations; Conducts Searches

The Central Bureau of Investigation (CBI) has registered a case against an NGO based in Delhi and Chairperson-cum-Secretary of the said NGO, on allegations of violations of the provisions of the Foreign Contribution (Regulation) Act (FCRA) 2010.

Searches are being undertaken today at two locations in Delhi, including the accused’s official and home premises.

It has been alleged that the NGO transferred Rs. 32,71,915 (approx.), other than salary/ wages/ remuneration, from its FCRA account to the account of an individual(s) during 2020-21 in contravention of the terms of the FCRA, 2010.

It has also been charged that the NGO diverted funds from its FCRA account through the firm(s) in violation of the FCRA, 2010.

The investigation is ongoing in this case.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"