Reetu | Oct 20, 2022 |

CBIC amends Project Import Regulations 1986

The Central Board of Indirect Taxes and Custom (CBIC) has amended Project Import Regulations 1986 and notifies Project Imports (Amendment) Regulations, 2022.

The Notification stated, “In exercise of the powers conferred by section 157 of the Customs Act, 1962 (52 of 1962), the Central Board of Indirect Taxes and Customs hereby makes the following regulations further to amend the Project Imports Regulations, 1986, namely:-

(1) These regulations may be called the Project Imports (Amendment) Regulations, 2022.

(2) They shall come into force on the 20th day of October, 2022.”

In the Project Imports Regulations, 1986, in the Table, –

(i) against Sr. No. 2, in column 2, for the words “All Power Plants and Transmission Projects”, the words “All Power Plants and Transmission Projects, other than solar power plants or solar power projects,” shall be substituted;

(ii) against Sr. No. 3, in column 2, for the words, figures and symbols “Power Plants & Transmission Projects other than those mentioned at Sl. No. 2 above.”, the words, figures and symbols “Power Plants and Transmission Projects, other than solar power plants or solar power projects and other than those mentioned at Sr. No. 2 above.” shall be substituted;

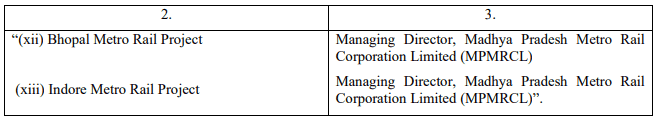

(iii) against Sr. No. 3FF, in columns 2 and 3, after item (xi) and the entries relating thereto, the following items and entries shall be inserted, namely: –

To Read Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"