Reetu | Jun 16, 2023 |

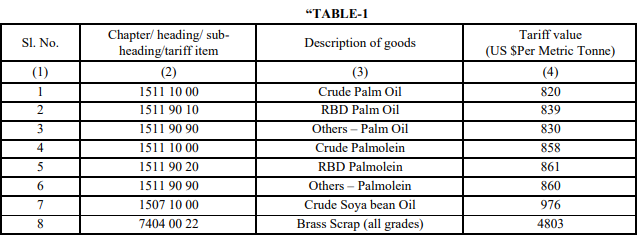

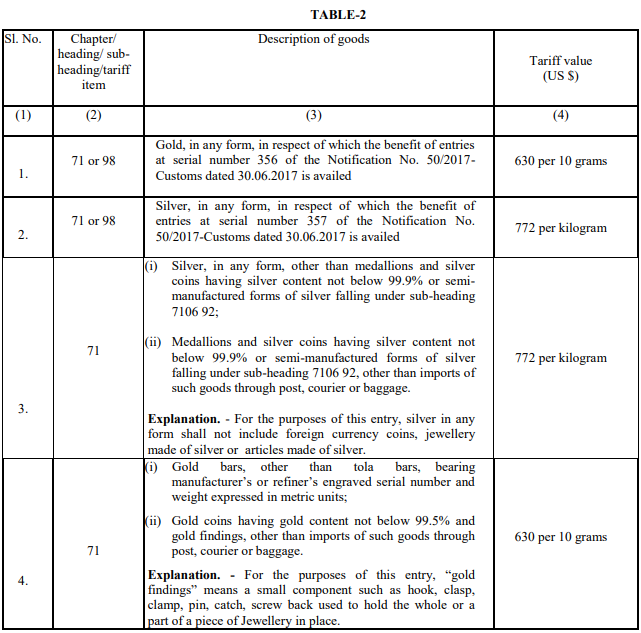

CBIC Customs notifies Tariff value for Crude Palm Oil, Gold, Silver etc.

The Central Board of Indirect Taxes and Custom(CBIC) has notifies Tariff value for Crude Palm Oil, Gold, Silver etc via issuing Notification.

The Notification Stated, “In exercise of the powers conferred by sub-section (2) of section 14 of the Customs Act, 1962 (52 of 1962), the Central Board of Indirect Taxes & Customs, being satisfied that it is necessary and expedient to do so, hereby makes the following amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 36/2001-Customs (N.T.), dated the 3rd August, 2001, published in the Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii), vide number S. O. 748 (E), dated the 3rd August, 2001.”

In the said notification, for TABLE-1, TABLE-2, and TABLE-3 the following Tables shall be substituted, namely:-

This notification shall come into force with effect from the 16th day of June, 2023.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"