Reetu | Aug 8, 2022 |

CBIC issued Advisory for Anonymised Escalation Mechanism for delayed Bill of Entry under Faceless Assessment

The Central Board of Indirect Taxes and Custom(CBIC) has issued Advisory for Anonymised Escalation Mechanism for delayed Bill of Entry under Faceless Assessment.

CBIC has endeavored to provide an Anonymized Escalation Mechanism for ICEGATE registered users where they submit their grievance for delay in Bill of Entry clearance under faceless assessment. The delay in clearance would subsequently be escalated to the concerned Faceless Assessment Officers.

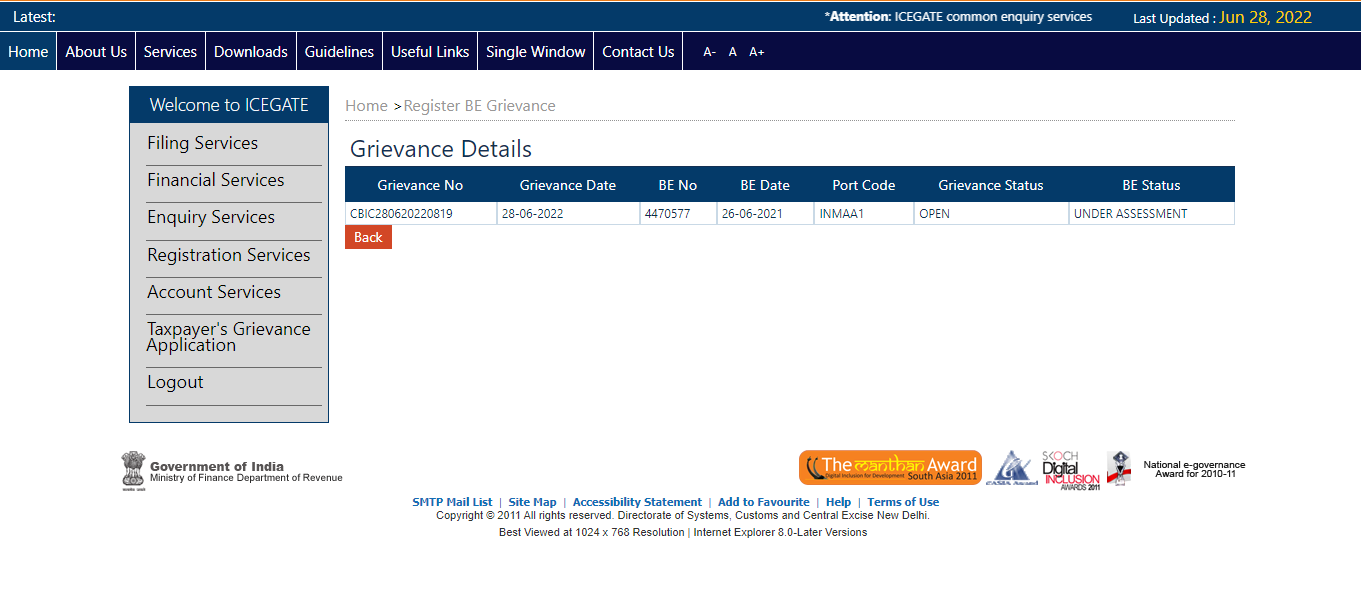

The Anonymised Escalation facility also enables users to monitor the progress of complaints they have filed up until a final conclusion.

Please take note that if the following conditions are met, a grievance may be filed regarding a delay in Bill of Entry clearance:

a. There should be a minimum 24 hours gap after filing of BE for the registration of grievance request

b. Grievance can be logged for Bill of Entries in which IGM number and date has been mentioned.

The following step-by-step instructions should be followed in order to submit a grievance and track one that has already been submitted through the anonymous escalation mechanism available after logging into ICEGATE.

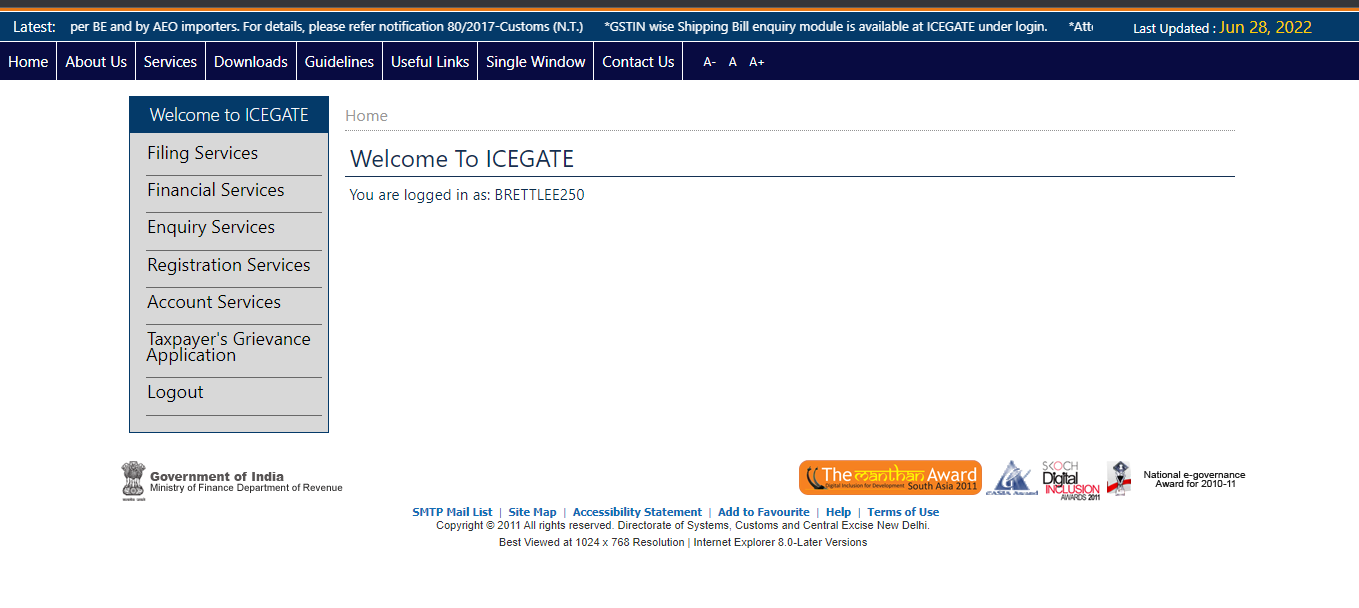

1. Login through ICEGATE user portal

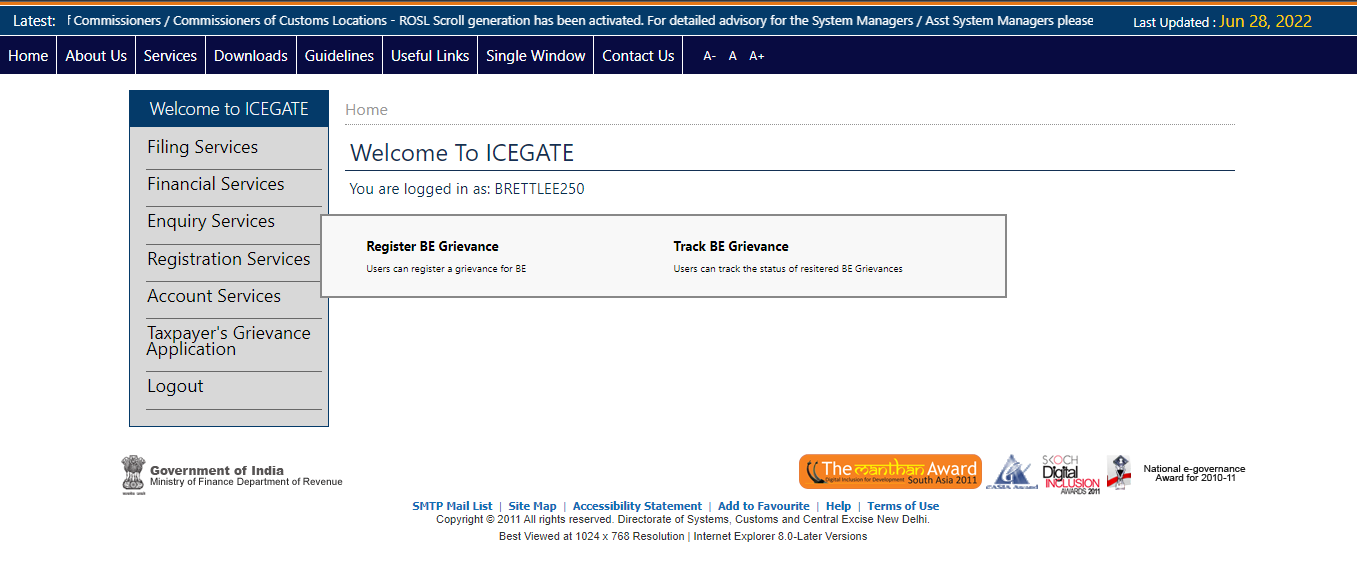

2. Select “Taxpayer’s Grievance Application” and then click on “Register BE (Bill of Entry) Grievance”

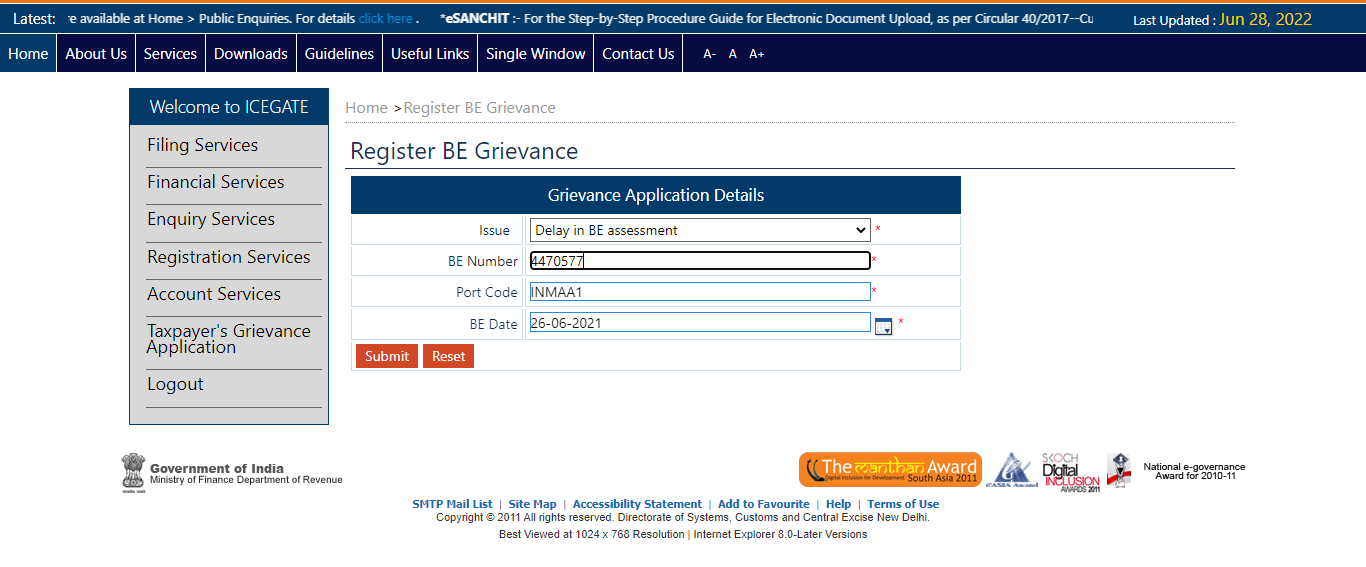

3. Enter Bill of Entry details and click on Submit button to create a grievance

4. If the details match the specified criterias for grievance creation, a new grievance will be created and a grievance number shall be provided for tracking purpose. Otherwise appropriate error message will be generated.

To Read Full Advisory Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"