Reetu | Aug 30, 2022 |

CBIC Notifies Faceless Assessment Standard Examination Orders through RMS

The Central Board of Indirect Taxes & Customs(CBIC) has notified Faceless Assessment Standard Examination Orders through RMS.

The Notification Stated, “Reference is invited to para 3.6 of Circular No.14/2021-Customs dated 7th July 2021, wherein it has been informed that Board has decided to introduce RMS generated uniform examination orders at all Customs stations across the country. It may be recalled that, Board, vide Circular No. 45/2020-Customs dated 12th October 2020, had requested the National Assessment Centres (NACs) to review the examination orders given by different FAG officers in the same situation and streamline and standardise them, so as to avoid needless variations in practice and thereby obviate delays.”

Based on the inputs by NAC, National Customs Targeting Centre (NCTC) (former RMCC) has developed system generated centralized examination orders for Bills of Entry (BE), in coordination with DG Systems and National Assessment Centers (NACs), based on various parameters, which is now ready for rollout in phases. This functionality is expected to enhance the uniformity in examination, and lower the time taken in the process as well as reduce associated costs.

1. To harmonise the examination orders across FAGs, the Board has decided to implement system-generated centralized examination orders in a phased manner, in case of risk-based selection for examination after assessment.

2. To that end, NCTC, in consultation with DG Systems and the respective NACs, has developed a system wherein standardised examination orders will be centrally generated by RMS and populated on the corresponding Bill of Entry, based on a host of risk parameters concerning goods, entities, and countries, relating to that bill.

3. The standardized examination orders thus generated by RMS will be visible to Assessing Officers during the assessment. While these RMS-generated standardised examination orders will be the new norm, the Assessing officer will have the option of adding any additional examination instruction/order to the pre-populated RMS-generated examination order, if necessary.

4. According to the new procedure, after processing BE data, RMS will generate a consolidated examination order for each selected BE based on potential risks. An RMS-generated examination order would include the following main points: (i) % of containers to be examined, (ii) selected area/part (s) in a given container and % of goods in the selected area/part (s) to be examined, (iii) Item level instructions and (iv) additional examination instruction, if any.

1. While the BE is selected for examination depending on risk associated with various items in a BE, the examination will depend on the nature of the cargo and mode of packing. Hence, some standardization is adopted for different situations.

FCL Cargo :

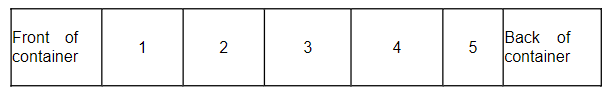

2. For FCL cargo, selection for the examination will be at two levels. First, the selection of the containers and then the area/part selected within those selected containers. For the sake of uniformity, the container has been divided into five areas/parts, for an easy identification and selection of areas for examination, as depicted below:

One area/part 1 (i.e. front) and other area/part (s) (i.e., 2,3,4 & 5), as may be applicable in each case based on potential risks, will be selected randomly by system. A specified % examination, based on potential risks, will be required to be done from these two or more areas/parts of the container. Only in the case of 100 % examination order, the whole container would be examined.

To illustrate, a typical system-generated examination order that will be displayed on BE will be as below:

“Check Seal No. of all containers and cut the seal of selected containers in your presence. Examine 10 % of the respective areas/parts indicated in respect of each selected container and follow CCRs, where necessary (other than ISO Liquid/Gas container and Dangerous cargo). Verify declared description, quantity and specification. Selected Container: KOCU4150113-Selected Area: 1 & 4”

In this example, one container i.e. KOCU4150113 has been selected for examination; two areas/parts within this container (i.e. 1 and 4) have been selected for 10% examination by shed/examining officers in each of the two areas/parts.

For LCL cargo, bulk cargo, and shipments through air and land, where container number is not available, only the percentage of goods to be examined will be communicated to shed/examining officers for physical examination, along with item specific examination order.

Furthermore, a container selected for scanning through CSM (Container Scanning Module) and marked suspicious by the Container Scanning Division (CSD) will have a separate related examination order as per the extant practice/order of the local customs station. CSM-related examination order will complement the RMS generated examination order for a consignment.

TO Read More Download Official PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"