Reetu | Jan 19, 2022 |

CBIC Seeks to Exempt BCD and IGST on Goods Imported For AFC Womens Asian Cup 2022

The Central Board of Indirect Taxes and Customs vide Notification No. 1/2022-Customs dated 18th January 2022 to exempt BCD and IGST on goods imported for AFC Womens Asian Cup 2022.

The Notification is Given Below :

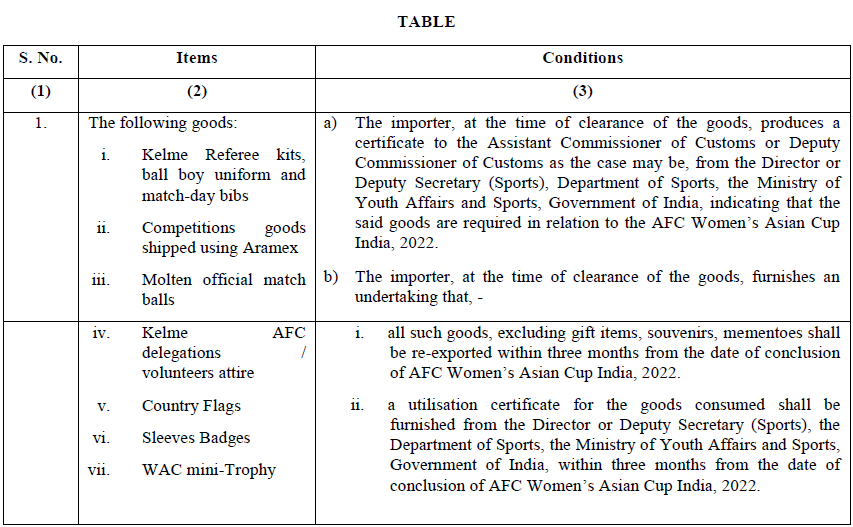

G.S.R. 26(E).—In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby exempts the goods of the description specified in column (2) of the Table below and falling under the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), when imported into India by All India Football Federation for the purpose of organising the AFC Women’s Asian Cup India, 2022, from the whole of the duty of customs leviable thereon which is specified in the said First Schedule and from the whole of the integrated tax leviable thereon under sub-section (7) of section 3 of the said Customs Tariff Act, subject to the conditions specified in the corresponding entry in column (3) of the said Table.

To Read Notification Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"