Union Government has released 3rd instalment of tax devolution to State Governments amounting to Rs.1,18,280 crore on 12th June, 2023, as against normal monthly devolution of Rs.59,140 crore.

Reetu | Jun 12, 2023 |

Central Government releases Rs.1,18,280 crore as 3rd Instalment of Tax Devolution to State Governments

The Union Government has released 3rd instalment of tax devolution to State Governments amounting to Rs.1,18,280 crore on 12th June, 2023, as against normal monthly devolution of Rs.59,140 crore.

States will receive one advance instalment in addition to the usual payment due in June 2023, allowing them to accelerate capital expenditures, fund development/welfare-related expenditure, and make resources available for priority projects/schemes.

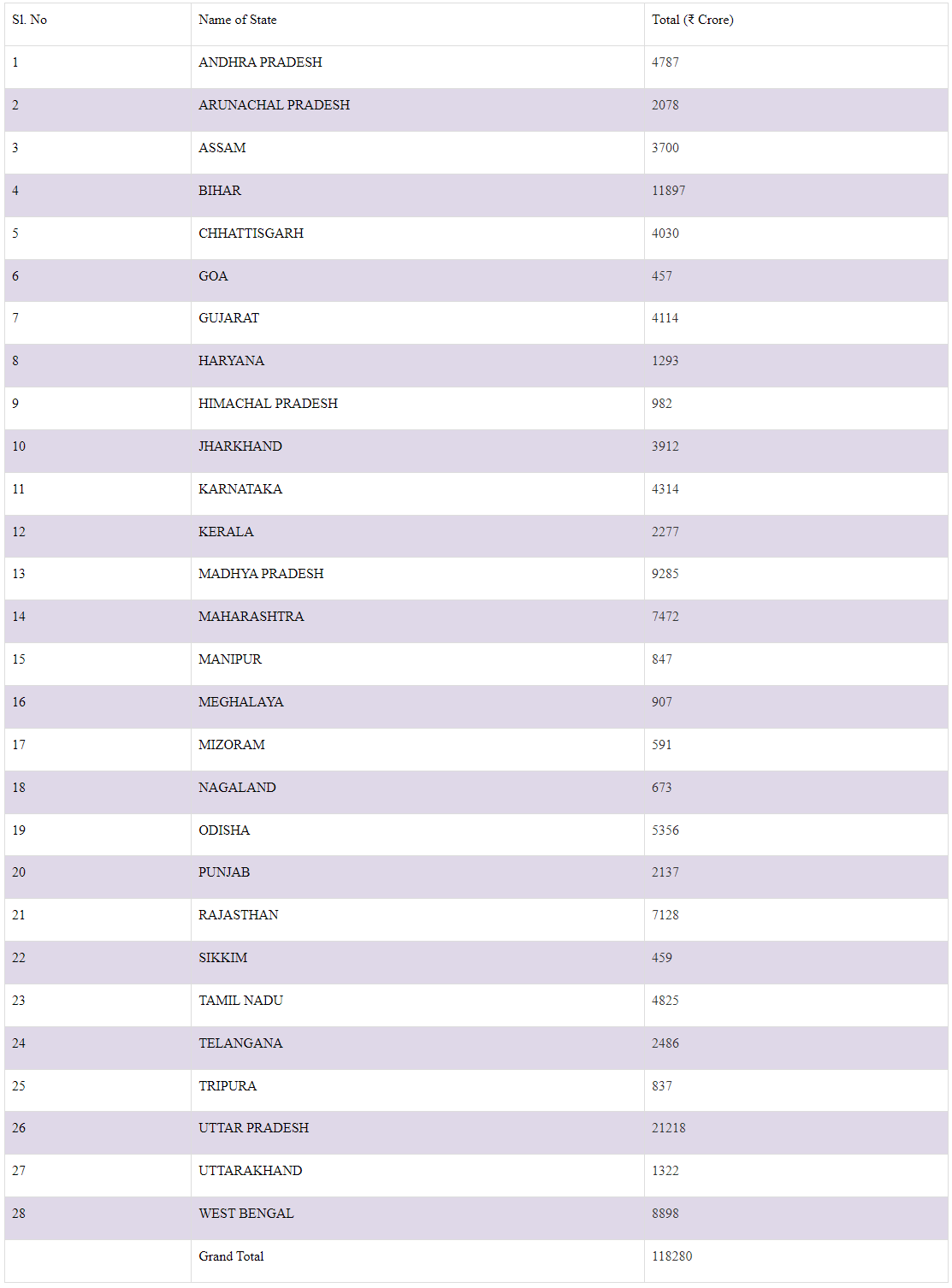

State-wise breakup of amounts released is given below in the table:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"