CA Bimal Jain | Apr 4, 2020 |

Recent Changes in GST vide Various Notification No. 30/2020 to 36/2020 dated 03.04.2020

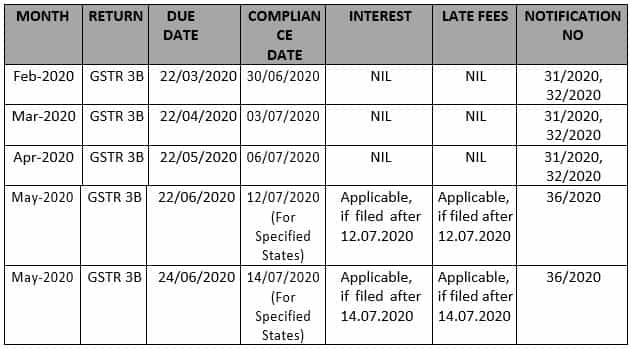

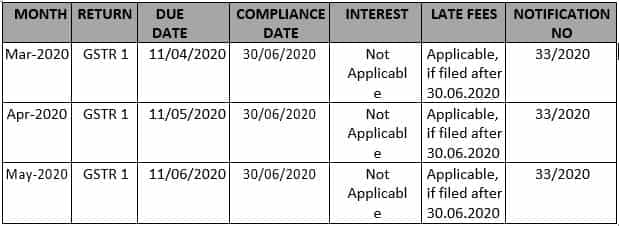

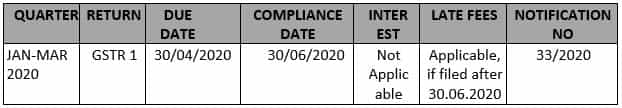

In view of the spread of pandemic COVID-19, the Hon’ble FM has announced various reliefs measures relating to statutory and regulatory compliance matters in GST. For ease of your convenience and reference, due date calendar for various returns in GST is given as under:

Taxpayers having Aggregate Turnover of More Than Rs. 5 Cr in the Preceding Financial Year

Â

Taxpayers having Aggregate Turnover of More Than Rs. 1.5 Cr but up to Rs. 5 Cr in the Preceding Financial Year

Taxpayers having Aggregate Turnover of up to Rs. 1.5 Cr in the Preceding Financial Year

Due Date for filing Form GSTR-1 for the Taxpayers having Aggregate Turnover of More Than Rs. 1.5 Cr

Due Date for filing Form GSTR-1 for the Taxpayers having Aggregate Turnover up to Rs. 1.5 Cr

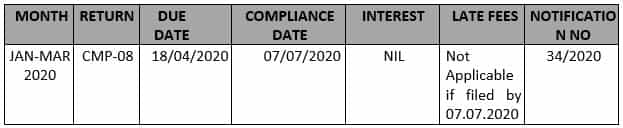

Due Date for filing Form CMP-08 i.e. Statement for payment of self-assessed tax by the Composition DealerÂ

Â

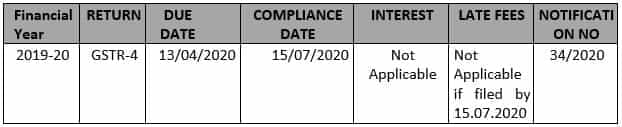

Due Date for filing Form GSTR- 04 for Composition Dealer for FY 2019-20

Miscellaneous Provisions: –

Condition under rule 36(4) prescribes the restriction for availment of Input Tax Credit (“ITC”) i.e. 10% of the eligible credit in respect of invoices or debit notes the details of which have not been uploaded by the suppliers under sub-section (1) of section 37 of the CGST Act, 2017.

(a) Chapter IVe. Time and Value of Supply.

(b) Sub-section (3) of section 10, Sections 25e. Procedure for Registration , Section 27 i.e. Special provisions relating to casual taxable person and non-resident taxable person, Section 31 i.e. Tax Invoice, Section 37 i.e. Furnishing of details of Outward Supplies, Section 47 i.e. Levy of Late Fees, Section 50 i.e. Interest on delayed payment of Tax, Section 69 i.e Power to Arrest, Section 90 i.e. Liability of partner of firm to pay tax, Section 122 i.e. Penalty of certain offences, Section 129 i.e. Detention, seizure and release of goods and conveyances in transit;

(c) Section 39 i.e Furnishing of Returns, except sub-section (3), (4) and (5)

(d) Section 68 i.e. Inspection of goods in movement, in so far as e-way bill is concerned; and,

(e) Rules made under the provisions specified at clause (a) to (d) above.

Further, the Government has issued following notifications in order to provide relief to the Taxpayers:

| Date | Source | Reference No. | Subject |

| April 03, 2020 | CBIC | Notification No. 30/2020 – Central Tax | Seeks to amend CGST Rules (Fourth Amendment) in order to allow opting Composition Scheme for FY 2020-21 till 30.06.2020 and to allow cumulative application of condition in rule 36(4). |

| April 03, 2020 | CBIC | Notification No. 31/2020 – Central Tax | Seeks to provide relief by conditional lowering of interest rate for tax periods of February, 2020 to April, 2020. |

| April 03, 2020 | CBIC | Notification No. 32/2020 – Central Tax | Seeks to provide relief by conditional waiver of late fee for delay in furnishing returns in FORM GSTR-3B for tax periods of February, 2020 to April, 2020. |

| April 03, 2020 | CBIC | Notification No. 33/2020 – Central Tax | Seeks to provide relief by conditional waiver of late fee for delay in furnishing outward statement in FORM GSTR-1 for tax periods of February, 2020 to April, 2020. |

| April 03, 2020 | CBIC | Notification No. 34/2020 – Central Tax | Seeks to extend due date of furnishing FORM GST CMP-08 for the quarter ending March, 2020 till 07.07.2020 and filing FORM GSTR-4 for FY 2020-21 till 15.07.2020. |

| April 03, 2020 | CBIC | Notification No. 35/2020 – Central Tax | Seeks to extend due date of compliance which falls during the period from “20.03.2020 to 29.06.2020” till 30.06.2020 and to extend validity of e-way bills. |

DISCLAIMER: The views expressed are strictly of the author and A2Z Taxcorp LLP. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"