Reetu | Oct 6, 2022 |

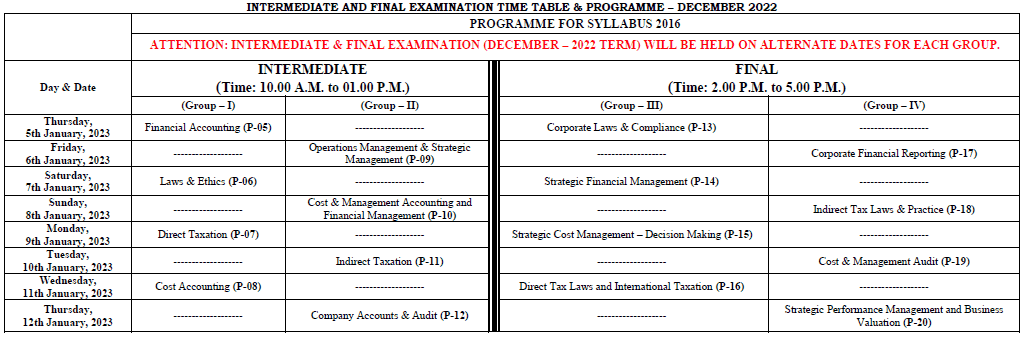

CMA Inter and Final Dec 2022 Exam Schedule Announced by ICMAI; Check Details Here

The Institute of Cost Accountants of India(ICMAI) has released the exam schedule for CMA Inter and Final Dec 2022 Examination.

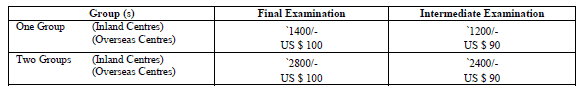

1. Application Forms for Intermediate and Final Examination has to be filled up through online only and fees will be accepted through online mode only (including Payfee Module of IDBI Bank). No Offline form and DD payment will be accepted for domestic candidate.

2. STUDENTS OPTING FOR OVERSEAS CENTRES HAVE TO APPLY OFFLINE AND SEND DD ALONGWITH THE FORM.

3. (a) Students can login to the website www.icmai.in and apply online through payment gateway by using Credit/Debit card or Net banking.

(b) Students can also pay their requisite fee through pay-fee module of IDBI Bank.

4. Last date for receipt of Examination Application Forms is 5th November, 2022.

5. The mode of examination will be offline-centre based.

6. The provisions of Direct Tax Laws and Indirect Tax Laws, as amended by the Finance Act, 2021, including notifications and circulars issued up to 31st May, 2022, are applicable for December, 2022 term of examination for the Subjects Direct Taxation, Indirect Taxation (Intermediate), Direct Tax laws and International Taxation and Indirect Tax Laws & Practice (Final) under Syllabus 2016. The relevant Assessment Year is 2022-23. For statutory updates and amendments please refer to the link:https://icmai.in/studentswebsite/Syl-2016.php

7. Companies (Cost Records and Audit) Rules, 2014 as amended up to 31st May, 2022 is applicable for December, 2022 term of examinations for Paper 12- Company Accounts and Audit (Intermediate) and Paper 19 – Cost and Management Audit (Final) under Syllabus 2016. For updates and amendments please refer to the link: https://icmai.in/studentswebsite/Syl-2016.php

8. The provisions of the Companies Act 2013 are applicable for Paper 6 – Laws and Ethics (Intermediate) and Paper 13 – Corporate Laws and Compliance (Final) under Syllabus 2016 to the extent notified by the Government of India up to 31st May, 2022 are applicable for December, 2022 term of examinations. For applicability of ICDR, 2018 for Paper 13 – Corporate Laws & Compliance (Final) under Syllabus 2016 please refer to the link:https://icmai.in/studentswebsite/Syl-2016.php

9. For amendments in IND AS and AS under Syllabus 2016 for Paper 5 – Financial Accounting, Paper 12 – Company Accounts and Audit (Intermediate) and Paper 17 – Corporate Financial Reporting (Final), applicable for December, 2022 term of examinations please refer to the link: https://icmai.in/studentswebsite/Syl-2016.php

10. Pension Fund Regulatory and Development Authority Act, 2013 already been included in Paper 6-Laws and Ethics (Intermediate) and Insolvency and Bankruptcy Code 2016 already included in Paper 13 – Corporate Laws and Compliance (Final) under Syllabus 2016 for December, 2022 term of examinations. Please refer to the link: https://icmai.in/studentswebsite/Syl-2016.php

11. Examination Centres: Adipur-Kachchh (Gujarat), Agartala, Agra, Ahmedabad, Akurdi, Allahabad, Angul Talcher, Asansol, Aurangabad, Bangalore, Bankura, Baroda, Berhampur – Ganjam (Odisha), Bharuch Ankleshwar, Bhilai, Bhilwara, Bhopal, Bewar City(Rajasthan), Bhubaneswar, Bilaspur, Bikaner (Rajasthan), Bokaro, Calicut, Chandigarh, Chennai, Coimbatore, Cuttack, Dindigul, Dehradun, Delhi, Dhanbad, Duliajan (Assam), Durgapur, Ernakulam, Erode, Faridabad, Ghaziabad, Guntur, Gurgaon, Guwahati, Haridwar, Hazaribagh, Hosur, Howrah, Hyderabad, Indore, Jaipur, Jabalpur, Jalandhar, Jammu, Jamshedpur, Jodhpur, Kalyan, Kannur, Kanpur, Kolhapur, Kolkata, Kollam, Kota, Kottakkal (Malappuram), Kottayam, Lucknow, Ludhiana, Madurai, Mangalore, Meerut, Mumbai, Mysore, Nagpur, Naihati, Nasik, Nellore, Neyveli, Noida, Palakkad, Panaji (Goa), Patiala, Patna, Pondicherry, Port Blair, Pune, Raipur, Rajahmundry, Ranchi, Rourkela, Salem, Sambalpur, Shillong, Shimla, Siliguri, Solapur, Srinagar, Surat, Thrissur, Tiruchirapalli, Tirunelveli, Tirupati, Trivandrum, Udaipur, Vapi, Vashi, Vellore, Vijayawada, Vindhyanagar, Waltair and Overseas Centres at Bahrain, Dubai and Muscat.

12. A candidate who is fulfilling all conditions specified for appearing in examination will only be allowed to appear for examination.

13. Probable date of publication of result: 17th March 2023.

* The candidates/students are advised to keep regularly in touch with the website of the Institute for further notifications and announcements relating to Examination of December 2022 and in case of any query or clarification can e-mail us only at exam.helpdesk@icmai.in

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"