The Income Tax Department has announced the Common Offline Utility (COU) for filing Income Tax Returns (ITR-1 and ITR-4) for the assessment year 2025-26.

Saloni Kumari | Jun 12, 2025 |

Common Offline ITR Utility Released for Filing ITR 1 and ITR 4 for AY 2025-26

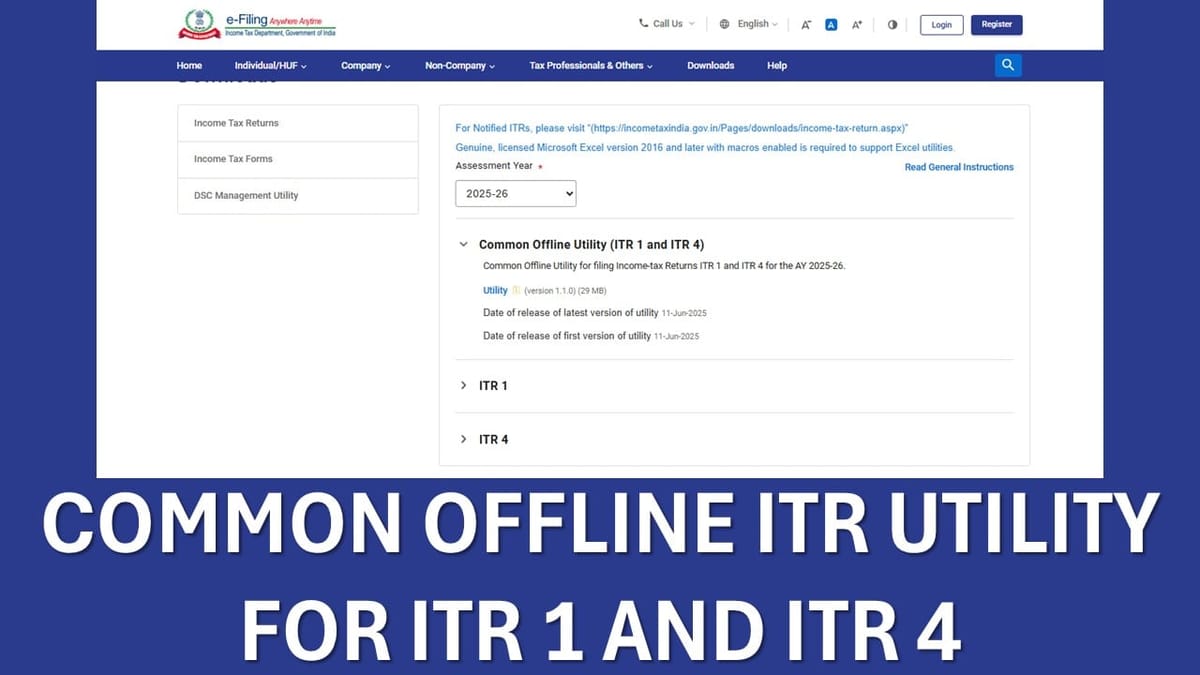

The Income Tax Department has announced the Common Offline Utility (COU) for filing Income Tax Returns (ITR-1 and ITR-4) for the assessment year 2025-26 (income earned in the financial year 2024-25). This has simplified the process of filing ITR for salaried taxpayers, individuals owning small businesses, and professionals. The first version (version 1.1.0) of offline utilities was released on June 11, 2025, and is available on the Income Tax e-filing Portal.

| ITR Form | Date of Notification | Offline | Online | |

| JSON Utility | Excel | |||

| 1 | 29.04.2025 | Common Offline Utility Released on 11.06.2025 for ITR-1 and ITR-4 | Released on 29.05.2025 | Released on 04.06.2025 |

| 2 | 03.05.2025 | Not released | Not released | |

| 3 | 30.04.2025 | Not released | Not released | |

| 4 | 29.04.2025 | Released on 29.05.2025 | Released on 04.06.2025 | |

| 5 | 01.05.2025 | Not released | Not released | Not released |

| 6 | 06.05.2025 | Not released | Not released | Not released |

| 7 | 09.05.2025 | Not released | Not released | Not released |

ITR-1

Income Tax Return (ITR-1) is filed by residents having total income upto Rs. 50 lakh and having income sources such as salaries, one house property, other sources (Interest, etc.), long-term capital gains under section 112A up to Rs. 1.25 lakh, and agricultural income up to Rs. 5000 (other than not ordinarily residents). The first version (Version 1.0) of offline utilities for ITR-1 was released on May 30, 2025. The first release of JSON Schema and Validation was released on May 30, 2025.

ITR-4

Income Tax Return (ITR-4) is filed by Individuals, HUFs and Firms (other than LLPs) who are residents and have a total income upto Rs. 50 lakh and generating income from business and profession, which is calculated under sections 44AD, 44ADA or 44AE, and having long-term capital gains under section 112A upto Rs. 1.25 lakh. The first version (Version 1.0) of offline utilities for ITR-4 was released on May 30, 2025. The first release of JSON Schema and Validation was released on May 30, 2025.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"