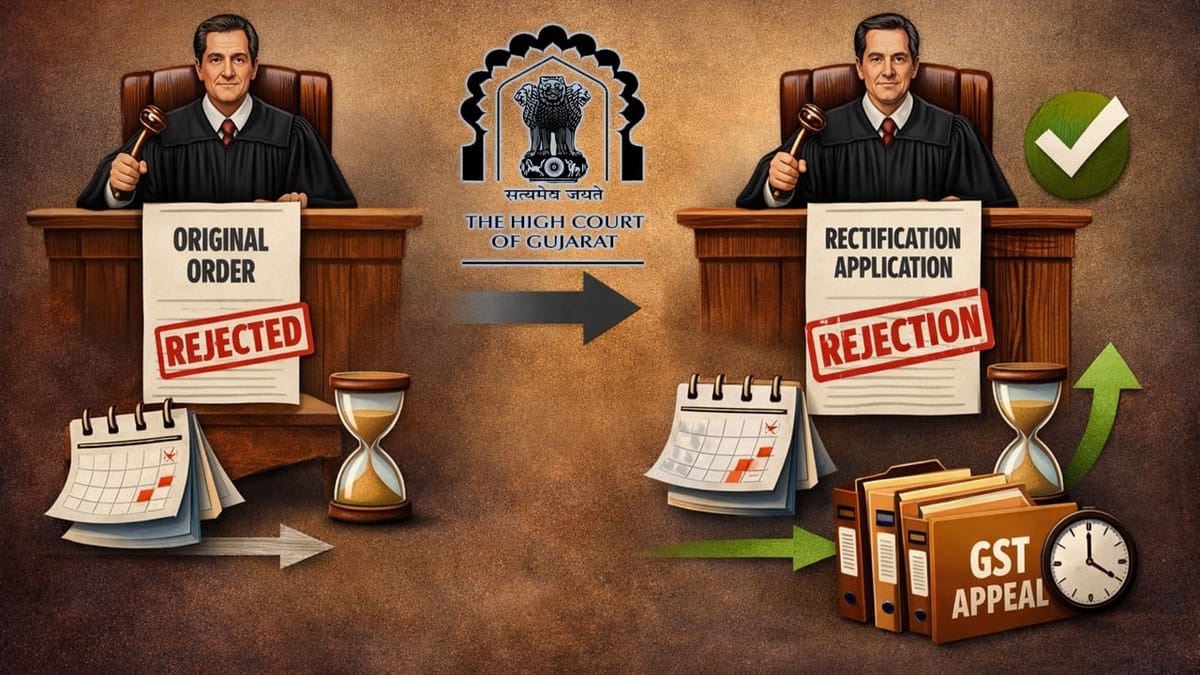

Gujarat High Court holds that the limitation period for filing a GST appeal begins from the rejection of the rectification application and not from the original order.

Saloni Kumari | Feb 9, 2026 |

GST Appeal Limitation Must Be Counted from Rectification Rejection, Holds Gujarat High Court

The Gujarat High Court held that the appeal limitation should be counted from the rejection of the rectification application, not the original order. Since the taxpayer filed an appeal within the statutory time limit after rejection, the court allowed the petitioner’s appeal.

The present writ petition has been filed in the Gujarat High Court by New Kailash Suppliers challenging an order dated April 25, 2025, where the GST authorities had rejected the appeal of the petitioner on the grounds of delayed filing.

The petitioner argued that the appellate authority had made a mistake in examining the facts of the rectification application dated November 05, 2024, passed by the petitioner. Since the said application was rejected on March 19, 2025, as per law, the petitioner was allowed to file an appeal after March 20, 2025, and the appeal was filed on March 25, 2025; therefore, it was within the statutory time limit. To support this argument, the petitioner also cited an earlier Madras High Court judgement titled M/s. SPK and Co. vs. The State Tax Officer.

However, the tax authorities argued that the petitioner had filed the appeal challenging the original order dated August 12, 2024, after a long delay of 225 days and also did not separately challenge the rectification order; therefore, the appellate authority was right in rejecting the appeal as time-barred.

When the court analysed the arguments from both sides, it noted that although appeals filed beyond 120 days cannot be condoned, the appellate authority failed to properly consider the effect of the rectification application and its rejection, which ultimately impacted the calculation of the limitation period.

The court held that, as per the law, the limitation period for filing the appeal should start from the date of rejection of the rectification application. Since the petitioner filed the appeal within a week of that date, the appellate authority should have examined the details before directly rejecting the appeal on the grounds of delay. Considering the aforesaid findings, the High Court set aside the appellate order dated April 25, 2025, and sent the case back to the appellate authority for fresh examination.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"