ROC has issued a penalty order to Tilak Proficient Nidhi Limited, a company based in Khagaria, Bihar, for violating Section 118 of the Companies Act, 2013.

Nidhi | Jun 7, 2025 |

Company Penalised for Not Keeping Proper Meeting Records

The Registrar of Companies (ROC) has issued a penalty order to Tilak Proficient Nidhi Limited, a company based in Khagaria, Bihar, for violating Section 118 of the Companies Act, 2013.

Section 118 of the Companies Act, 2013 mandates that minutes be maintained for general meetings of shareholders or creditors, meetings of the Board of Directors, etc.

The company and its directors have failed to comply with the provisions of Section 118 of the Companies Act 2013. They did not maintain minutes of member meetings and other official meetings that were scheduled by the company from the date of its incorporation.

The Registrar of Companies (ROC) sent a notice to the company and its directors, outlining that they had violated Section 118 of the Companies Act, 2013. To which, one ex-director, Chittranjan Kumar, replied, asking the ROC to schedule a hearing.

The company and its directors were issued a Notice of Hearing where they were asked to appear personally or through a representative and submit a written response (if any). However, on the date of the hearing, two directors of the company appeared, but they did not submit anything about the non-compliance. Therefore, it is considered a violation, and the company was held liable to pay a penalty.

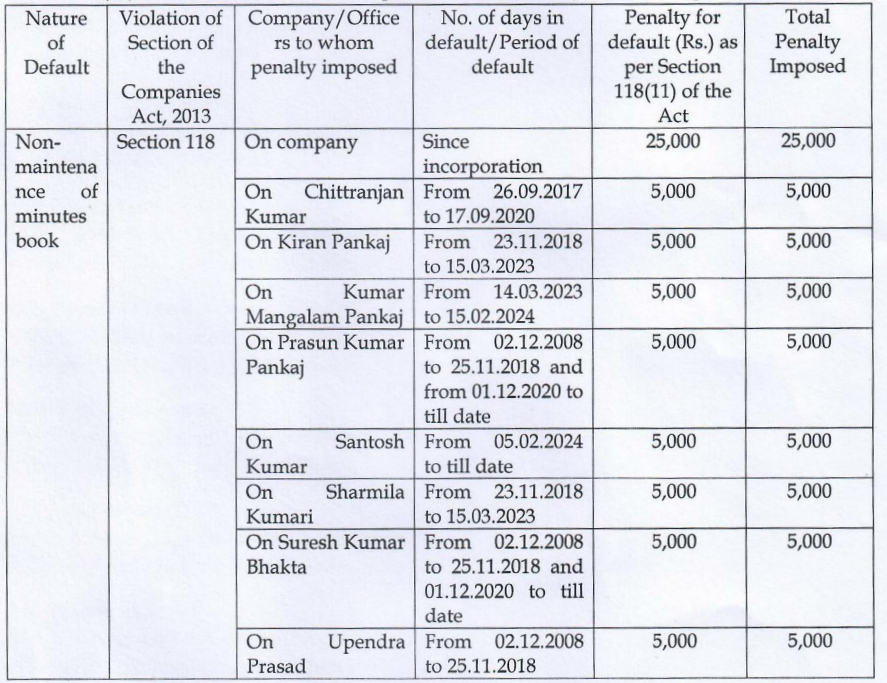

The company and its directors have been penalised as follows:

The company and its directors are required to pay the penalty within 90 days through the official MCA website. The company can also file an appeal within 60 days to the Regional Director (ER), Ministry of Corporate Affairs, Kolkata.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"