ROC has issued an Adjudication order against Baby Memorial Hospital Limited for not dematerialising Securities held by promoters, directors, and key managerial personnel.

Nidhi | Jun 6, 2025 |

Company Penalised by ROC for Not Dematerialising Shares within due time

The Registrar of Companies (ROC) has issued an Adjudication order against Baby Memorial Hospital Limited, an unlisted public company, for violating the provisions of Section 29(1A) read with Rule 9A (2) and 9A(3)(b) of the Companies (Prospectus and Allotment of Securities) Rules, 2014.

As per Rule 9A(2), before offering any new shares, the company must ensure all shares held by promoters, directors, and key managerial staff are dematerialised. Meanwhile, Rule 9A(3)(b) states that any person subscribing to securities on or after October 2, 2018, must ensure their existing shares are dematerialised.

It was noted that the shares offered by the company between July 2021 and June 2023, the securities held by promoters, directors, and key managerial personnel as mandated by Rule 9A (2) were not dematerialised.

Additionally, in the third share issue made on June 5, 2023, to M/s. Trinity Finsec Private Limited, the offeree, was already holding 22,11,598 shares, which were not dematerialised at the time of the share issue. These were dematerialised only on December 27, 2023. The offeree did not dematerialise these existing shares before the new allotment, as required under Rule 9A(3)(b).

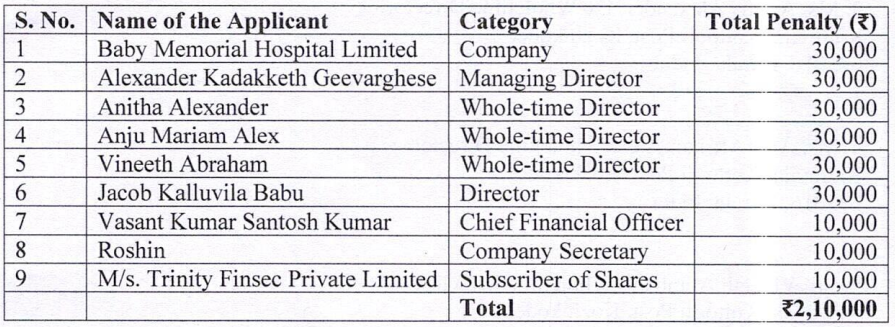

The following penalty has been imposed on the company and the responsible persons:

The total penalty amount must be paid within 90 days from the receipt of this order through the MCA portal under the “Pay Miscellaneous Fees” option. The company and its officers in default can appeal the order within 60 days in Form ADJ to the Regional Director, Ministry of Corporate Affairs, Chennai, along with a certified copy of the order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"