Reetu | Jan 3, 2024 |

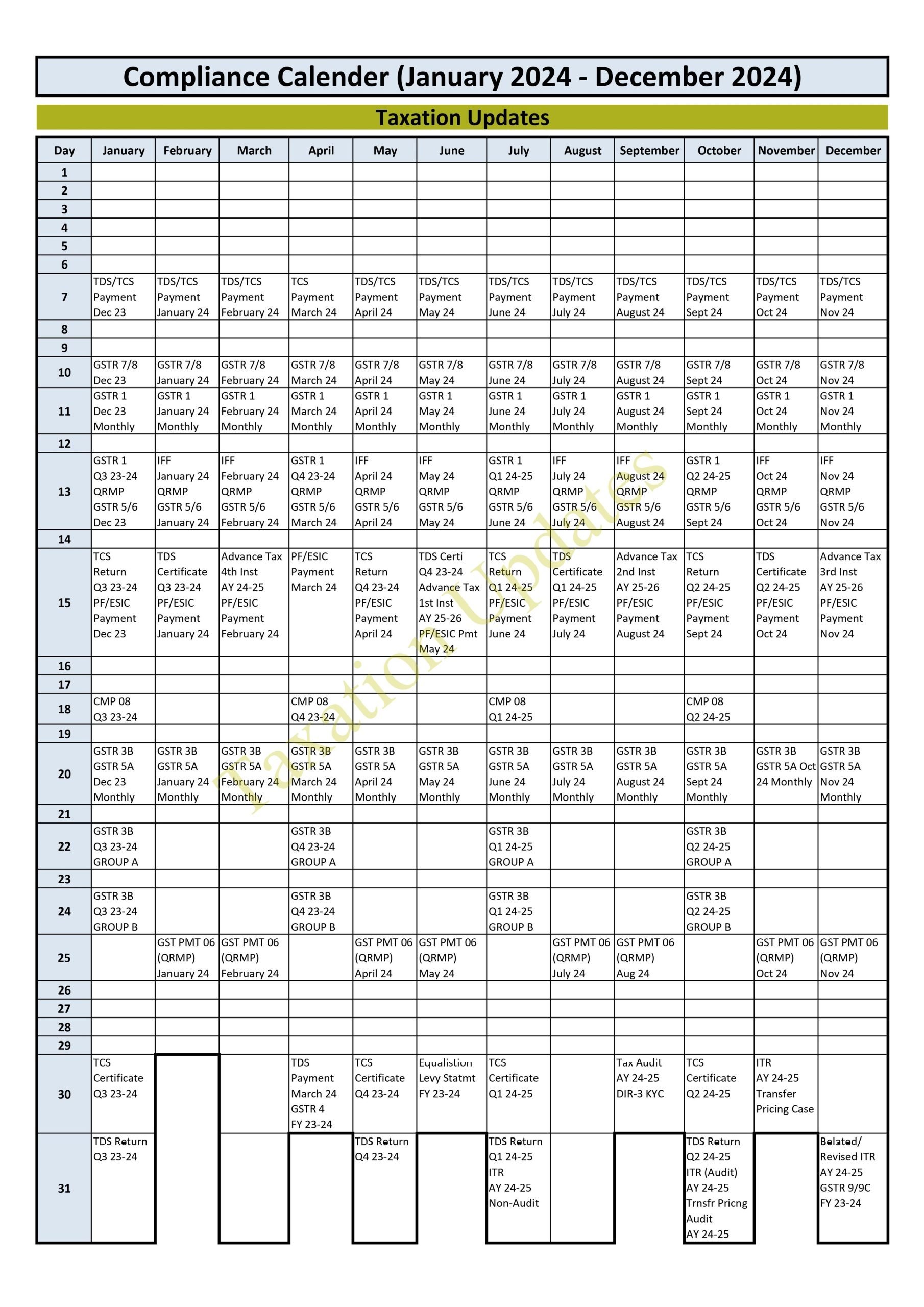

Compliance Calendar for Calendar Year 2024

The compliance Calendar for the Calendar year 2024 explains the Compliance requirement under the Income Tax Act 1961 and the Compliance Requirement under the GST Act 2017 for the Year 2024.

7th January 2024

TDS/TCS payment for the month of Dec 2023.

10th January 2024

Filing of Form GSTR 7/8 for the month of Dec 2023.

11th January 2024

Monthly Filing of Form GSTR-1 for Dec 2023.

13th January 2024

Furnishing of GSTR 1 by taxpayers who opted for QRMP Scheme for Q3 of 2023-24.

Filing of Form GSTR 5/6 for the month of Dec 2023.

15th January 2024

Filing of TCS Return for Q3 of 2023-24.

PF/ ESIC Payment for the month of Dec 2023.

18th January 2024

Filing of CMP-08 for Q3 of 2023-24.

20th January 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for the QRMP Scheme for the period of December 2023.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Provider for the period of December 2023.

22nd January 2024

Furnishing GSTR-3B for QRMP-1 by Taxpayers who have opted for QRMP Scheme for the period of Oct-Dec 2023.

24th January 2024

Furnishing GSTR-3B for QRMP-2 by Taxpayers who have opted for QRMP Scheme for the period of Oct-Dec 2023.

30th January 2024

Issue of TCS Certificate period of Oct-Dec 2023.

31st January 2024

Filing of TDS Return for the period of Oct-Dec 2023.

7th February 2024

TDS/TCS payment for the month of Jan 2024.

10th February 2024

Filing of Form GSTR 7/8 for the month of Jan 2024.

11th February 2024

Monthly Filing of Form GSTR-1 for the month of Jan 2024.

13th February 2024

Furnishing GSTR-1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of Jan 2024.

Filing of Form GSTR 5/6 for the month of Jan 2024.

15th February 2024

Issuing of TDS Certificate for Q3 of 2023-24.

PF/ ESIC Payment for the month of Jan 2024.

20th February 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of Jan 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of Jan 2024.

25th February 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of Jan 2024.

7th March 2024

TDS/TCS payment for the month of Feb 2024.

10th March 2024

Filing of Form GSTR 7/8 for the month of Feb 2024.

11th March 2024

Monthly Filing of Form GSTR-1 for Feb 2024.

13th March 2024

Furnishing of GSTR 1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of Feb 2024.

Filing of Form GSTR 5/6 for the month of Feb 2024.

15th March 2024

PF/ ESIC Payment for the month of Feb 2024.

4th Installment of Advance Tax (100%) for FY 2023-24.

20th March 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of Feb 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of Feb 2024.

25th February 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of Feb 2024.

7th April 2024

TDS/TCS payment for the month of March 2024.

10th April 2024

Filing of Form GSTR 7/8 for the month of March 2024.

11th April 2024

Monthly Filing of Form GSTR-1 for March 2024.

13th April 2024

Furnishing of GSTR 1 by taxpayers who opted for QRMP Scheme for Q4 of 2023-24.

Filing of Form GSTR 5/6 for the month of March 2024.

15th April 2024

PF/ ESIC Payment for the month of March 2024.

18th April 2024

Filing of CMP-08 for Q4 of 2023-24.

20th April 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of March 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of March 2024.

22nd April 2024

Furnishing GSTR-3B for QRMP-1 by Taxpayers who have opted for QRMP Scheme for Q4 2023-24.

24th April 2024

Furnishing GSTR-3B for QRMP-2 by Taxpayers who have opted for QRMP Scheme for Q4 2023-24.

30th April 2024

TDS payment for the month of March 2024.

Filing of Form GSTR-4 for FY 2023-24.

7th May 2024

TDS/TCS payment for the month of April 2024.

10th May 2024

Filing of Form GSTR 7/8 for the month of April 2024.

11th May 2024

Monthly Filing of Form GSTR-1 for April 2024.

13th May 2024

Furnishing of GSTR 1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of April 2024.

Filing of Form GSTR 5/6 for the month of April 2024.

15th May 2024

Filing of TCS Return for Q4 of 2023-24.

PF/ ESIC Payment for the month of April 2024.

20th May 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of April 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of April 2024.

25th May 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of April 2024.

30th May 2024

Issue of TCS Certificate period of Q4 of 2023-24.

31st May 2024

Filing of TDS Return for the period of Q4 of 2023-24.

7th June 2024

TDS/TCS payment for the month of May 2024.

10th June 2024

Filing of Form GSTR 7/8 for the month of May 2024.

11th June 2024

Monthly Filing of Form GSTR-1 for May 2024.

13th June 2024

Furnishing of GSTR 1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of May 2024.

Filing of Form GSTR 5/6 for the month of April 2024.

15th June 2024

Issuing of TDS Certificate for Q4 of 2023-24.

PF/ ESIC Payment for the month of May 2024.

Ist Installment of Advance Tax (15%) for FY 2024-25.

20th June 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of May 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of May 2024.

25th June 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of May 2024.

30th June 2024

Equalisation Levy Statement for FY 2023-24.

7th July 2024

TDS/TCS payment for the month of June 2024.

10th July 2024

Filing of Form GSTR 7/8 for the month of June 2024.

11th July 2024

Monthly Filing of Form GSTR-1 for June 2024.

13th July 2024

Furnishing of GSTR 1 by taxpayers who opted for QRMP Scheme for Q1 of 2024-25.

Filing of Form GSTR 5/6 for the month of June 2024.

15th July 2024

Filing of TDS Return for Q1 of 2024-25.

PF/ ESIC Payment for the month of June 2024.

18th July 2024

Filing of CMP-08 for Q1 of 2024-25.

20th July 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of June 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of June 2024.

22nd July 2024

Furnishing GSTR-3B for QRMP-1 by Taxpayers who have opted for QRMP Scheme for Q1 2024-25.

24th July 2024

Furnishing GSTR-3B for QRMP-2 by Taxpayers who have opted for QRMP Scheme for Q1 2024-25.

30th July 2024

Issuing of TCS Certificate for Q1 of 2024-25.

31st July 2024

Filing of TDS Return for Q1 of 2024-25.

Filing of Income Tax Return (Non-Audit) for AY 2024-25.

7th August 2024

TDS/TCS payment for the month of July 2024.

10th August 2024

Filing of Form GSTR 7/8 for the month of July 2024.

11th August 2024

Monthly Filing of Form GSTR-1 for July 2024.

13th August 2024

Furnishing of GSTR 1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of July 2024.

Filing of Form GSTR 5/6 for the month of July 2024.

15th August 2024

Issuing of TDS Certificate for Q1 of 2024-25.

PF/ ESIC Payment for the month of July 2024.

20th August 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of July 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of July 2024.

25th August 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of July 2024.

7th September 2024

TDS/TCS payment for the month of August 2024.

10th September 2024

Filing of Form GSTR 7/8 for the month of August 2024.

11th September 2024

Monthly Filing of Form GSTR-1 for August 2024.

13th September 2024

Furnishing GSTR-1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of August 2024.

Filing of Form GSTR 5/6 for the month of August 2024.

15th September 2024

PF/ ESIC Payment for the month of August 2024.

2nd Installment of Advance Tax (45%) for FY 2024-25.

20th September 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of August 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of August 2024.

25th September 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of August 2024.

30th September 2024

The Due date of Tax Audit for AY 2024-25.

Filing Form of DIR-3 KYC.

7th October 2024

TDS/TCS payment for the month of September 2024.

10th October 2024

Filing of Form GSTR 7/8 for the month of September 2024.

11th October 2024

Monthly Filing of Form GSTR-1 for September 2024.

13th October 2024

Furnishing of GSTR 1 by taxpayers who opted for QRMP Scheme for Q1 of 2024-25.

Filing of Form GSTR 5/6 for the month of September 2024.

15th October 2024

PF/ ESIC Payment for the month of September 2024.

Filing of TCS Return for Q2 of 2024-25.

18th October 2024

Filing of CMP-08 for Q2 of 2024-25.

20th October 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of September 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of September 2024.

22nd October 2024

Furnishing GSTR-3B for QRMP-1 by Taxpayers who have opted for QRMP Scheme for Q2 of 2024-25.

24th October 2024

Furnishing GSTR-3B for QRMP-2 by Taxpayers who have opted for QRMP Scheme for Q2 of 2024-25.

30th October 2024

Issuing of TCS Certificate for Q2 of 2024-25.

31st October 2024

Filing of TDS Return for Q2 of 2024-25.

Filing of ITR (Audit) for AY 2024-25.

Due Date of Transfer Pricing Audit for AY 2024-25.

7th November 2024

TDS/TCS payment for the month of Oct 2024.

10th November 2024

Filing of Form GSTR 7/8 for the month of Oct 2024.

11th November 2024

Monthly Filing of Form GSTR-1 for Oct 2024.

13th November 2024

Furnishing GSTR-1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of Oct 2024.

Filing of Form GSTR 5/6 for the month of Oct 2024.

15th November 2024

PF/ ESIC Payment for the month of Oct 2024.

Issuing of TDS Certificate for Q2 of 2024-25.

20th November 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of Oct 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of Oct 2024.

25th November 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of Oct 2024.

30th November 2024

Filing of ITR (Transfer Pricing Case) for AY 2024-25.

7th December 2024

TDS/TCS payment for the month of Nov 2024.

10th December 2024

Filing of Form GSTR 7/8 for the month of Nov 2024.

11th December 2024

Monthly Filing of Form GSTR-1 for Nov 2024.

13th December 2024

Furnishing GSTR-1 in Invoice Furnishing Facility by taxpayers who opted for QRMP Scheme for the month of Nov 2024.

Filing of Form GSTR 5/6 for the month of Nov 2024.

15th December 2024

PF/ ESIC Payment for the month of Nov 2024.

3rd Installment of Advance Tax (75%) for FY 2024-2025.

20th December 2024

Furnishing GSTR-3B (Monthly) by Taxpayers who have not opted for QRMP Scheme for the month of Nov 2024.

Furnishing GSTR-5A (Monthly) to be filed by a Non-Resident OIDAR Service Providers for the month of Nov 2024.

25th December 2024

Due Date for Payment of GST PMT 06 by Taxpayers who have opted for QRMP Scheme for the month of Nov 2024.

31st December 2024

Due Date Filing of Belated/ Revised ITR for AY 2024-25.

Due Date of Filing GSTR-9 and 9C for FY 2023-24.

The Reference of this above Article is taken from a tweet by Taxation Updates (Mayur J Sondagar).

Here is the Link to his tweet – Click Here

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"