MCA has issued an adjudication order against a company named Neptune Petrochemicals Limited for violating Section 29 of the Companies Act, 2013.

Nidhi | May 22, 2025 |

Delay in Dematerialising Shares: ROC Levies Penalty of Rs. 169000

The Ministry of Corporate Affairs (MCA) has issued an adjudication order against a company named Neptune Petrochemicals Limited for violating Section 29 of the Companies Act, 2013, and it has been penalised by the Registrar of Companies (ROC) for the same.

As per Section 29(1) of the Companies Act, some companies, including listed and unlisted companies, must issue their securities only in dematerialised form by complying with the provisions of the Depositories Act, 1996 (22 of 1996) and the regulations made thereunder. However, Neptune Petrochemicals issued shares in physical form, which violates the law. This non-compliance lasted for 109 days, from 29th July 2024 to 15th November 2024.

The delay occurred because the company was looking for a registrar and transfer agent (RTA) and getting an ISIN (International Securities Identification Number) from NSDL and CDSL.

As Section 29 of the Companies Act does not directly mention a penalty for such violations, Section 450 of the Companies Act is applicable, which is enforced when there is a violation, but no specific penalty is provided in the Act. As per Section 450, a Rs. 10,000 penalty is imposed on the officers of the company in default. In case of continued non-compliance, a further penalty of Rs. 1,000 per day. The maximum penalty is Rs. 2,00,000 for the company and Rs. 50,000 for each officer in default.

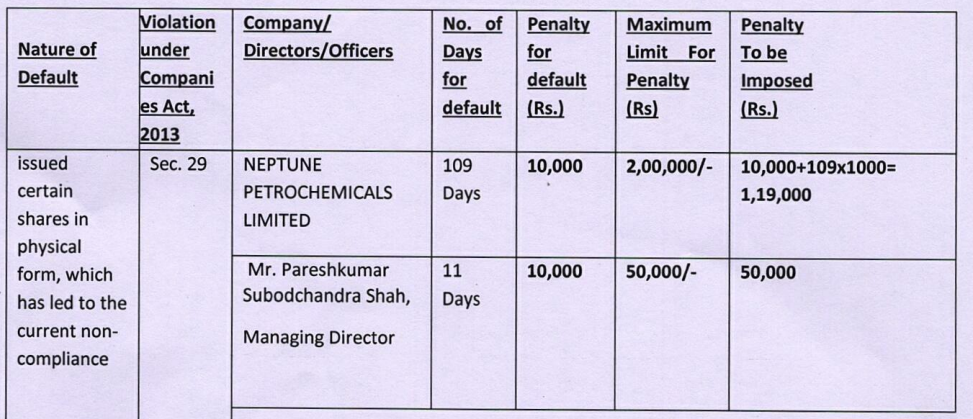

The following amount of penalty has been imposed on the company and its officers:

The company has been ordered to pay the penalty amount through the e-payment mode on the Ministry Website and within 60 days of receiving the order.

Refer to the official notification for more information.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"