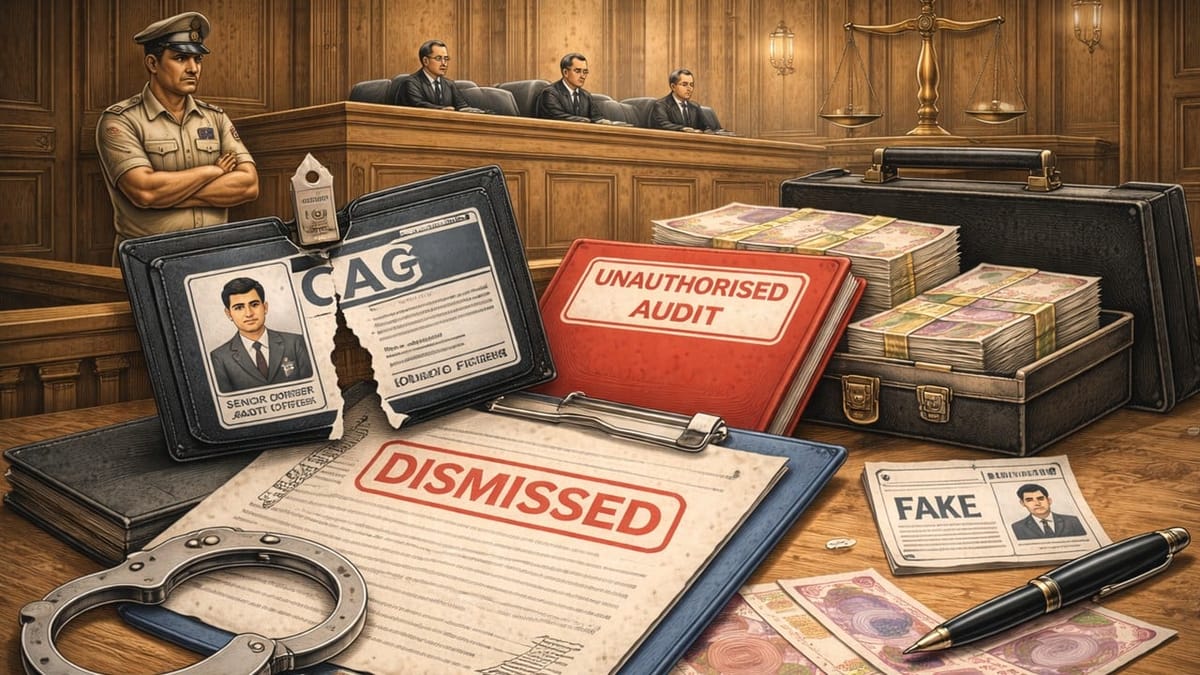

High Court dismisses writ petition challenging dismissal of Senior Auditor for unauthorised audits and impersonation

Meetu Kumari | Jan 31, 2026 |

Delhi High Court upholds dismissal of CAG official for unauthorised audits and impersonation

The petitioner, S.C. Vohra, joined the Indian Audit and Accounts Department in 1969 and rose to the post of Senior Auditor. Between 1996 and 1999, while posted in Audit Management Group–IV, allegations surfaced that he had unauthorisedly conducted Central Excise audits of industrial units in Okhla, issued audit completion certificates without authority, and impersonated an Assistant Audit Officer by misusing the official seal. A complaint from an industry association led to a fact-finding inquiry, followed by forensic examination of records by the CFSL. After investigation, a charge memorandum was issued in March 2004 under Rule 14 of the CCS (CCA) Rules. A full-fledged departmental inquiry was conducted, culminating in findings that the charges stood proved.

The Disciplinary Authority imposed the penalty of dismissal from service in May 2005, which was affirmed in appeal. The petitioner’s first OA before the CAT resulted in a limited remand on proportionality alone. Upon reconsideration, the Appellate Authority again upheld dismissal. The second OA was dismissed by the Tribunal, leading to the present writ petition.

Main Issue: Whether the disciplinary proceedings and penalty of dismissal were vitiated by delay, alleged procedural infirmities, lack of motive or loss, or disproportionate punishment, and whether the petitioner’s challenge was barred by res judicata.

HC’s Decision: The Hon’ble High Court held that the Tribunal was not entirely correct in applying res judicata as an absolute bar, since the earlier remand order had expressly kept other grounds open. However, this did not assist the petitioner, as his challenge failed on merits. The Court found that the delay in issuing the charge-sheet was satisfactorily explained by the time taken for investigation and forensic examination, and no real prejudice was shown. It held that proof of motive or personal gain was unnecessary once unauthorised audits and impersonation were established. The inquiry was found to be fair, evidence-based, and compliant with principles of natural justice.

The Court observed that impersonation and misuse of official position strike at the core of integrity expected from an officer of a constitutional authority, and long service could not dilute the gravity of such misconduct. The punishment of dismissal was not shockingly disproportionate. Consequently, the writ petition was dismissed and the Tribunal’s order was upheld.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"