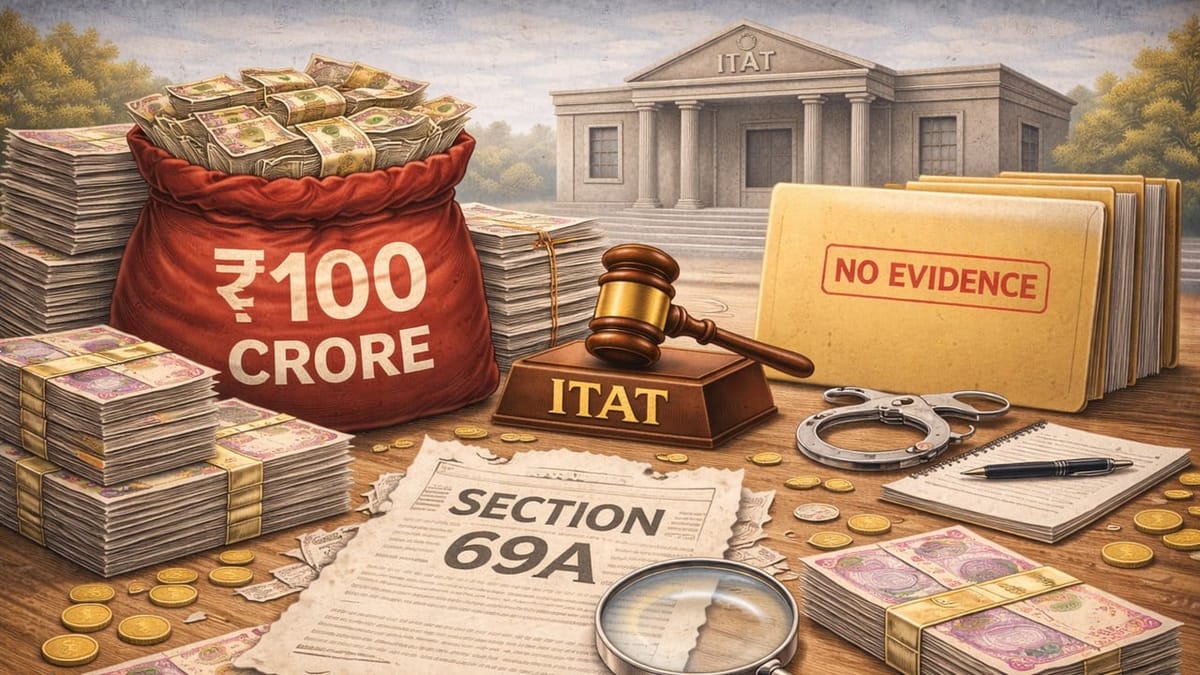

Delhi ITAT holds Section 153A assessment invalid for unabated AY 2016-17; Rs.100 crore addition deleted due to absence of incriminating material.

Meetu Kumari | Jan 31, 2026 |

ITAT Delhi quashes Rs.100 crore addition under Section 69A for lack of incriminating material in unabated year

The assessee filed his return for AY 2016-17 declaring income of about Rs.6.39 crore, which was accepted in scrutiny under Section 143(3) in December 2018. A search under Section 132 was later conducted in March 2021 in the Dalmia Group, including the assessee and certain employees. Based on a document seized from the residence of an employee, the Assessing Officer reopened the completed assessment under Section 153A and made an addition of Rs. 100 crore under Section 69A, alleging unaccounted cash received on sale of shares of Landmark Hi Tech Development Pvt. Ltd. The addition relied on the seized paper and statements recorded under Section 132(4).

On appeal, the CIT(A) deleted the addition on merits. The Revenue carried the matter to the ITAT, while the assessee, under Rule 27, raised a legal ground challenging the very validity of the Section 153A assessment for want of incriminating material.

Issue Raised: Whether, in an unabated assessment year, an addition of Rs.100 crore under Section 69A could be sustained under Section 153A on the basis of a seized document and statements, when the document was explained as a recorded investment and not shown to be incriminating.

Tribunal’s Rulling: The Tribunal held that AY 2016-17 was an unabated year and, following the Supreme Court’s ruling in Abhisar Buildwell, no addition could be made under Section 153A unless supported by incriminating material unearthed during search. Although documents seized from a third party could be considered as “found in the course of search”, the decisive question was whether such material was incriminating.

The seized paper relied upon by the Assessing Officer did not establish any undisclosed income: all other entries on the same sheet were accepted as recorded transactions, and the disputed Rs.100 crore entry was convincingly explained as an investment in JM Financial Mutual Funds, supported by bank statements and books of account, which the Revenue failed to rebut. The Tribunal also noted that statements recorded under Section 132(4) were only selectively relied upon by the Assessing Officer and were unsupported by independent corroboration, especially after retraction. In the absence of any incriminating material linking the assessee to unaccounted cash, the very foundation of the Section 153A assessment collapsed.

The Tribunal held the assessment to be bad in law, allowed the assessee’s legal ground under Rule 27, and dismissed the Revenue’s appeal as infructuous without examining the merits.

To Read Full Order, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"